Understanding the Work Cycle: How it Functions and What You Need to Know

Understanding the Work Cycle: How It Works and Why It Matters Work cycles are an essential part of our daily lives, whether we realize it or not. They …

Read Article

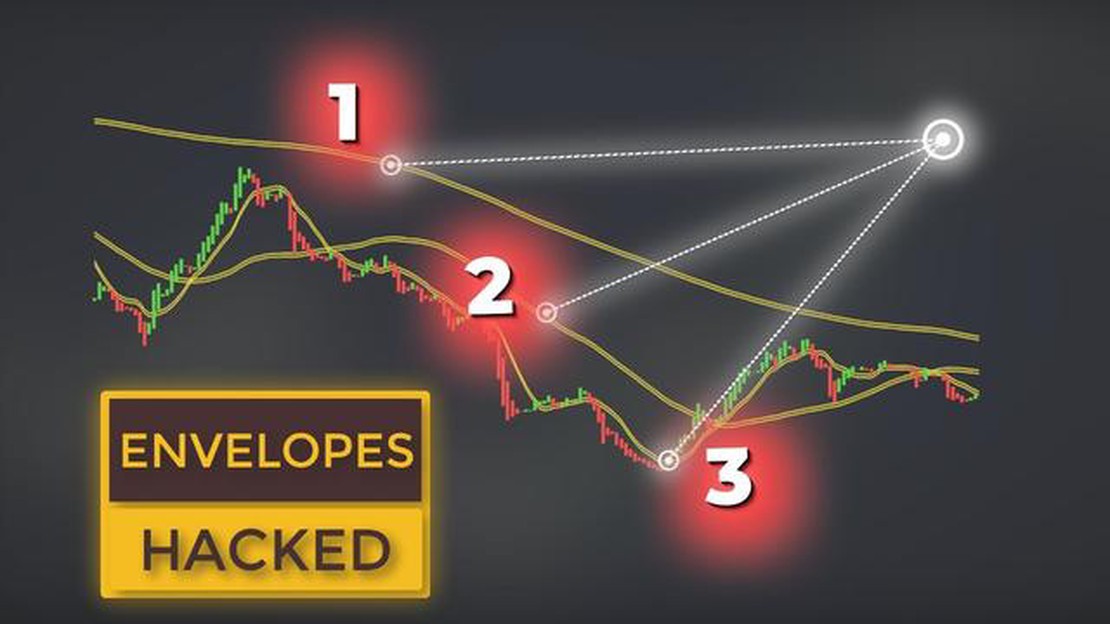

Trading in the financial markets can be a daunting task, especially for beginners. However, by using certain technical indicators, such as envelopes, traders can gain an edge and increase their chances of making profitable trades. Envelopes are a popular tool used in technical analysis to identify potential entry and exit points in the market. Understanding how to trade with envelopes can help you maximize your profits and minimize your losses.

Envelopes are a type of overlay indicator that consists of two lines plotted above and below a moving average. These lines are usually a fixed percentage, typically 1% or 2%, above and below the moving average. The upper line is referred to as the upper envelope, while the lower line is known as the lower envelope. Traders use these lines as a reference for potential buy and sell signals.

When the price of an asset reaches the upper envelope, it is considered overbought, indicating that it may be a good time to sell. Conversely, when the price touches the lower envelope, it is deemed oversold, suggesting a potential buying opportunity. By waiting for these signals, traders can enter and exit positions with more confidence, increasing their chances of making profitable trades.

It is important to note that envelopes are not foolproof and should be used in conjunction with other technical indicators and analysis methods. Additionally, it is essential to practice risk management and set stop-loss orders to protect against potential losses. Learning how to interpret and use envelopes effectively takes time and practice, but it can be a valuable tool in a trader’s arsenal.

In conclusion, learning how to trade with envelopes can help traders maximize their profits by providing potential entry and exit points in the market. By understanding how to interpret the upper and lower envelopes, traders can make more informed trading decisions. However, it is crucial to use envelopes in conjunction with other analysis methods and practice proper risk management. With time and practice, envelopes can become a valuable tool for traders looking to gain an edge in the financial markets.

Envelopes are a popular technical analysis tool used in trading. They are based on moving averages and can help traders identify potential trading opportunities.

An envelope is created by plotting a band or channel around a moving average. The upper band is plotted above the moving average line, while the lower band is plotted below it. The width of the band can be adjusted based on the trader’s preferences and the desired level of volatility.

Envelopes are commonly used to identify overbought and oversold conditions in a market. When the price of an asset reaches the upper band, it may be considered overbought and a potential reversal in price could occur. Conversely, when the price reaches the lower band, it may be considered oversold and a potential upward movement in price could occur.

Traders can also use envelopes to generate trading signals. For example, a buy signal may be generated when the price crosses above the lower band, indicating a potential upward trend. A sell signal may be generated when the price crosses below the upper band, indicating a potential downward trend.

It’s important to note that envelopes are not foolproof indicators and should be used in conjunction with other technical analysis tools and market indicators. They can provide valuable insights into potential trading opportunities, but traders should always consider other factors before making trading decisions.

Read Also: Forex Trading: How Much is Traded Annually in the Forex Market?

In conclusion, understanding envelopes in trading can help traders analyze market trends, identify potential reversals and generate trading signals. By incorporating envelopes into their trading strategy, traders can maximize their profits and make more informed trading decisions.

Trading with envelopes can be a powerful technique for maximizing your profits in the financial markets. Envelopes are a type of technical indicator that uses a set of moving averages to create upper and lower bands around a price chart. By using these bands as dynamic support and resistance levels, traders can identify potential buying and selling opportunities.

Here are some effective strategies for trading with envelopes:

1. Breakout Strategy: One popular approach is to wait for a breakout above the upper band or below the lower band. When the price successfully breaks above the upper band, it indicates a strong bullish signal. Conversely, when the price breaks below the lower band, it signals a potential bearish opportunity. Traders can then enter positions in the direction of the breakout.

2. Trend Reversal Strategy: Envelopes can also be used to identify trend reversals. When the price consistently trades above the upper band, it suggests that the market is overbought and due for a correction. Conversely, when the price consistently trades below the lower band, it indicates that the market is oversold and may be ready for a reversal. Traders can look for potential trend reversal signals when the price touches the upper or lower band.

3. Moving Average Crossover Strategy: Another common strategy involves using envelope bands in conjunction with moving average crossovers. Traders can add a shorter-term moving average to the price chart and use it to generate signals. When the shorter-term moving average crosses above the upper band, it suggests a potential buy signal. On the other hand, when the shorter-term moving average crosses below the lower band, it signals a potential sell opportunity.

Read Also: How to Communicate with Non-Binary Individuals: Essential Words and Phrases

4. Volatility Strategy: Envelopes can also be helpful in identifying periods of high or low volatility in the market. When the bands are narrow and close together, it suggests that the market is experiencing low volatility. Conversely, when the bands widen, it indicates increased volatility. Traders can adjust their trading strategies accordingly, for example, by increasing position sizes during volatile periods and decreasing them during low volatility.

In conclusion, trading with envelopes can provide valuable insights into market conditions and potential trading opportunities. By implementing these strategies, traders can improve their chances of success in the financial markets.

An envelope in trading is a technical analysis tool that is used to identify potential buying and selling points. It is created by plotting two moving averages around a central moving average. The upper band is created by adding a specified percentage or number of points to the central moving average, while the lower band is created by subtracting the same percentage or number of points. The resulting bands create a channel that can help traders identify overbought or oversold conditions in a market.

Trading with envelopes can help maximize profits by providing traders with clear signals for buying and selling. When the price of an asset touches or crosses the lower band of the envelope, it may indicate an oversold condition, signaling a potential buying opportunity. Conversely, when the price touches or crosses the upper band of the envelope, it may indicate an overbought condition, signaling a potential selling opportunity. By following these signals and placing trades accordingly, traders can potentially maximize their profits.

Trading with envelopes can be suitable for a variety of markets, including stocks, forex, commodities, and cryptocurrencies. However, it is important for traders to understand that no trading strategy is foolproof and that different market conditions can impact the effectiveness of envelope trading. Traders should use envelopes in conjunction with other technical analysis tools and indicators to confirm signals and make informed trading decisions.

When setting up envelopes for trading, several factors should be considered. Firstly, traders should consider the time frame they are trading on and adjust the parameters of the moving averages and percentage/points added or subtracted accordingly. Additionally, traders should consider the volatility of the market and adjust the parameters to account for this. It is also important to backtest envelope trading strategies on historical data to determine their effectiveness before using them in real-time trading.

Yes, trading with envelopes can be used for both short-term and long-term trading. Short-term traders can use envelopes to identify quick buying and selling opportunities based on overbought or oversold conditions within a shorter time frame. Long-term traders can also use envelopes to identify trends and longer-term buying and selling opportunities. By adjusting the parameters of the envelopes and using them in conjunction with other indicators, traders can tailor their envelope trading strategy to their desired time frame.

Envelopes in trading are technical indicators that are plotted on a price chart to help identify overbought and oversold levels. They are created by plotting two lines around a simple moving average, with one line above and one line below the moving average.

Understanding the Work Cycle: How It Works and Why It Matters Work cycles are an essential part of our daily lives, whether we realize it or not. They …

Read ArticleDo stock market simulators work? Stock market simulators have gained popularity in recent years as a way for investors to practice trading strategies …

Read ArticleHow Does SGX Generate Revenue? The Singapore Exchange (SGX) is the leading stock exchange in Singapore and one of the largest in Asia. As a publicly …

Read ArticleUnderstanding Long and Short Positions in Currency Trading When it comes to currency trading, there are two important concepts that every trader …

Read ArticleHow to Use Options on Fidelity App Investing in options can be a complex and risky venture, but with the right knowledge and tools, it can also be a …

Read ArticleShould SBC be Included in DCF Modeling? When it comes to valuing a company, the discounted cash flow (DCF) analysis is one of the most widely used …

Read Article