Comparing TMGM and IC Markets: Which is the Better Option?

TMGM vs IC Markets: Which Broker is Better? When it comes to forex trading, choosing the right broker is essential for success. Two popular options in …

Read Article

Understanding the true value of a stock option is crucial for investors looking to make informed decisions and maximize their returns. Stock options represent the right to purchase or sell a specific amount of a company’s stock at a predetermined price and within a specified time frame. However, accurately determining the value of a stock option can be a complex and challenging process.

In this article, we will delve into expert tips and strategies that can help you determine the value of a stock option. We will explore the key factors that influence option valuation, such as the current stock price, exercise price, time to expiration, volatility, and interest rates. By examining these variables and employing proven methodologies, you can gain a better understanding of the true worth of an option.

One critical aspect of valuing stock options is considering the underlying company’s financial performance and market outlook. The company’s financial health, growth prospects, and industry trends can significantly impact the value of its stock options. Additionally, factors like dividends, stock splits, and mergers/acquisitions must also be accounted for when determining option value.

Furthermore, various mathematical models, such as the Black-Scholes model, are commonly used to estimate option value. These models take into account the aforementioned variables and generate a fair value for the option. It is essential to understand and apply these valuation models carefully, as they can provide valuable insights into the potential profitability and risk associated with a stock option.

By mastering the art of determining the value of a stock option, investors can make more informed investment decisions and potentially increase their profitability. Armed with expert tips and strategies, you can confidently navigate the world of options trading and unlock the full potential of your investments.

When it comes to investing in the stock market, understanding the value of a stock option is essential. Stock options provide the holder with the right, but not the obligation, to buy or sell a specific number of shares at a predetermined price, known as the strike price, within a certain time frame.

There are several key factors to consider when determining the value of a stock option:

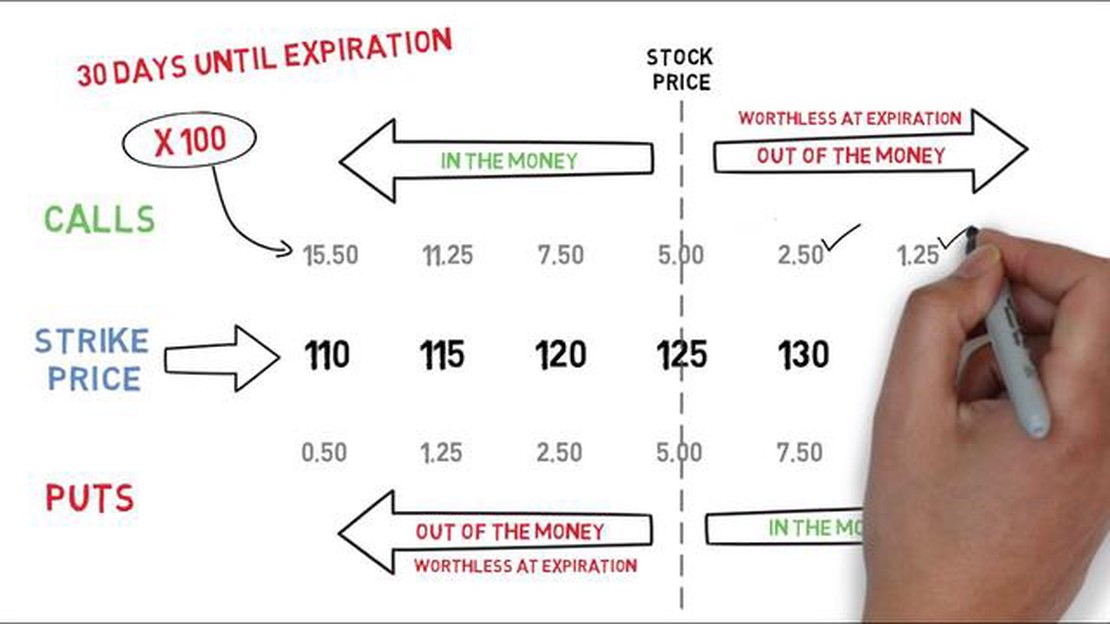

1. Intrinsic Value: The intrinsic value of a stock option is the difference between the current stock price and the strike price. If the stock option is “in the money” (the stock price is above the strike price for a call option or below the strike price for a put option), the intrinsic value will be positive. If the stock option is “out of the money”, the intrinsic value will be zero.

2. Time Value: The time value of a stock option represents the potential for the option to increase in value over time. Time value is influenced by factors such as the time remaining until expiration, market volatility, and interest rates. As the expiration date approaches, the time value of an option tends to decrease.

3. Volatility: Volatility measures the degree of price fluctuations in the underlying stock. Higher volatility generally leads to higher option prices, as there is a greater potential for the stock price to move significantly before the option expires. Low volatility tends to decrease option prices.

4. Interest Rates: Interest rates can impact the value of a stock option, as higher interest rates increase the present value of the option’s potential future cash flows. Conversely, lower interest rates decrease the present value.

5. Stock Price: The current stock price is a significant determinant of the value of a stock option. As the stock price moves closer to the strike price, the option becomes more valuable due to its increased intrinsic value.

By considering these factors and using valuation models such as the Black-Scholes model, investors can estimate the fair value of a stock option. However, it’s important to note that the value of a stock option is not static and can change due to market conditions and other variables.

Understanding how to determine the value of a stock option is crucial for investors looking to make informed decisions. By considering the intrinsic value, time value, volatility, interest rates, and stock price, investors can better evaluate the potential gains and risks associated with stock options.

Read Also: Does the Trader Have to Pay Taxes? Tax Obligations Explained

Stock options are financial derivatives that give individuals the right, but not the obligation, to buy or sell shares of a company’s stock at a specified price within a certain timeframe. They are often used as a form of compensation for employees or as investment instruments for traders and investors.

There are two types of stock options: call options and put options.

A call option gives the holder the right to buy a specific number of shares at a predetermined price, known as the strike price. This option is typically used when the investor believes that the price of the underlying stock will rise.

A put option gives the holder the right to sell a specific number of shares at a predetermined price. This option is used when the investor believes that the price of the underlying stock will decrease.

Read Also: Is there a monthly fee for E-Trade? | Find out the cost of using E-Trade services

When trading stock options, it’s important to understand some key terms:

Expiration date: This is the date on which the option contract expires.

Exercise price: Also known as the strike price, it is the price at which the underlying stock can be bought or sold.

Underlying stock: This refers to the actual shares of the company that the option is based on.

Premium: The price paid to purchase an option contract.

Stock options can be a valuable tool for investors and traders, as they allow for potential profits through price movements in the underlying stock without having to own the actual shares. However, it’s important to thoroughly understand the risks and dynamics of options trading before engaging in it.

Disclaimer: The information provided here is for informational purposes only and should not be considered as financial advice. Always consult with a qualified financial advisor or professional before making investment decisions.

A stock option is a contract that gives an individual the right to buy or sell shares of a company’s stock at a predetermined price within a specific time period.

The value of a stock option can be determined using various pricing models such as the Black-Scholes model. Factors that affect the value of a stock option include the current price of the underlying stock, the strike price, the time to expiration, interest rates, and volatility.

Some expert tips for valuing stock options include understanding the factors that affect the value of an option, conducting thorough research on the company and industry, staying updated on market trends, and seeking professional advice if needed.

Yes, the value of a stock option can change over time. As the price of the underlying stock, market conditions, and other factors fluctuate, the value of the option may increase or decrease.

Yes, there are strategies that can help maximize the value of stock options. Some common strategies include exercising options when the stock price is high, selling options at a profit, and using options as part of a larger investment strategy.

TMGM vs IC Markets: Which Broker is Better? When it comes to forex trading, choosing the right broker is essential for success. Two popular options in …

Read ArticleCalculate Your Forex Position Size Trading in the foreign exchange market, or forex, requires precise calculation and risk management. One crucial …

Read ArticleWhere to Buy Foreign Currency in South Africa: A Comprehensive Guide Planning a trip abroad can be an exciting and thrilling experience. However, one …

Read ArticleWhat is the promo code for Icici Bank money to World? Are you planning to send money abroad? Look no further! Icici Bank has the perfect solution for …

Read ArticleExceptions to 409A for Compensation Plans and Arrangements 409A is a section of the Internal Revenue Code that governs the tax treatment of …

Read ArticleIs SEBI going to ban options trading? The Securities and Exchange Board of India (SEBI) has recently been considering a potential ban on options …

Read Article