Who is the owner of KBC? Find out the answer here

Who is the owner of KBC? KBC, which stands for Kaun Banega Crorepati, is an Indian television game show based on the popular UK show, Who Wants to Be …

Read Article

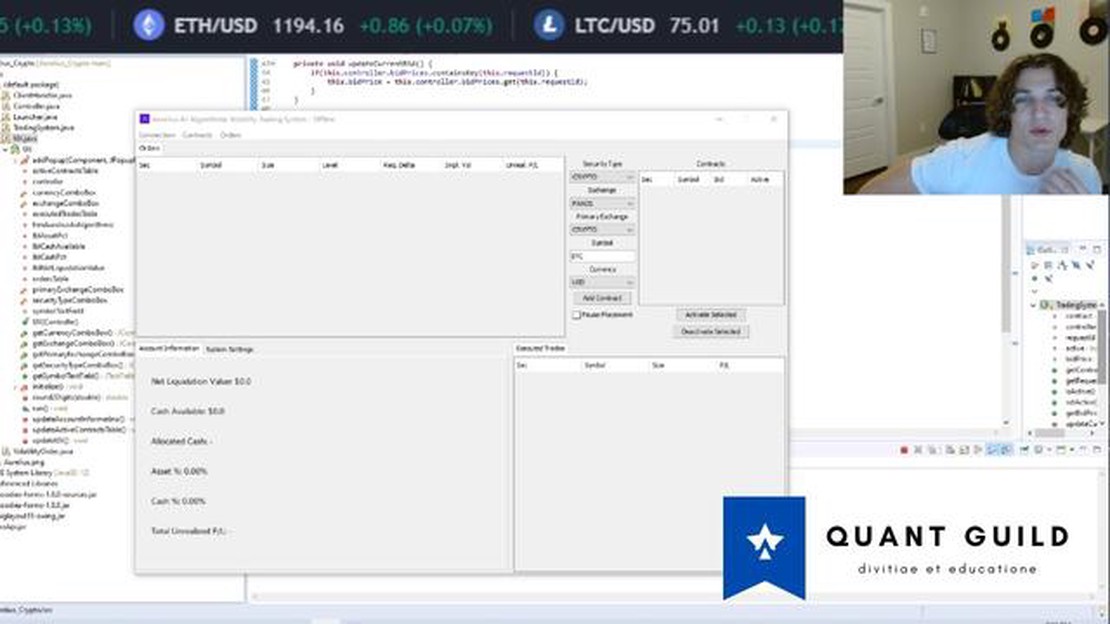

If you’re interested in trading and want to automate your trading strategy, creating a trading bot can be a great option. In this article, we’ll walk you through the process of creating a Java trading bot from scratch, providing you with step-by-step instructions to get you up and running.

A trading bot is a software program that executes trades automatically based on predefined strategies and parameters. By creating your own trading bot, you can take advantage of the speed and accuracy of computer algorithms to execute trades more efficiently and effectively.

Java is a popular programming language known for its versatility and cross-platform compatibility. It provides a robust set of libraries and tools that make it well-suited for creating trading bots. This tutorial assumes basic knowledge of Java programming, so if you’re new to Java, you may want to familiarize yourself with the language before diving into creating a trading bot.

In this tutorial, we’ll cover the fundamental steps required to create a trading bot in Java. We’ll start by setting up the development environment, including installing the necessary software and libraries. Then, we’ll move on to designing and implementing our trading strategy. Finally, we’ll test and launch our trading bot, ensuring that it works as expected.

By the end of this tutorial, you’ll have a fully functional Java trading bot that can execute trades automatically based on your predefined strategy. Whether you’re a beginner or an experienced trader, this tutorial will provide you with the knowledge and skills to create your own trading bot.

If you’re new to programming or looking to learn a new language, Java is a great choice. Java is a versatile and widely-used programming language that is used in a variety of applications, including trading bots.

Before diving into creating a trading bot, it’s important to have a solid understanding of the basics of Java programming. Here are some key concepts and features you should be familiar with:

| Concept | Description |

|---|---|

| Variables | In Java, variables are used to store values. They have a specific data type, such as int for integers or String for text. |

| Conditional Statements | Java uses if statements to perform different actions based on different conditions. The condition is evaluated as either true or false. |

| Loops | Loops allow you to repeat a block of code multiple times. Java has different types of loops, such as for loops and while loops. |

| Functions | Functions, also known as methods, are a way to group a set of instructions together so that they can be reused. Java has built-in functions, and you can also create your own. |

| Classes and Objects | Java is an object-oriented programming language, which means it uses classes and objects to represent and manipulate data. Classes are blueprints for creating objects. |

| Exception Handling | Java has built-in mechanisms for handling errors and exceptions. Exception handling allows you to gracefully handle and recover from errors in your code. |

Read Also: What is the Dow Jones Future Symbol? | Your Guide to Trading Dow Futures

It’s important to learn these basics before diving into creating a trading bot in Java. Once you have a solid understanding of the fundamentals, you’ll be better equipped to build more advanced projects like a trading bot.

A trading bot is a computer program designed to automatically execute trades on behalf of a trader. It uses predefined rules and algorithms to identify trading opportunities and execute trades in a timely manner. Understanding the functionality of a trading bot is crucial for effective usage and customization.

1. Data Analysis: Trading bots rely on historical and real-time data to identify patterns and trends in the market. They analyze various factors such as market prices, volume, and indicators to make informed trading decisions.

2. Trading Strategy: A trading bot operates based on a predefined trading strategy. The strategy defines when to enter or exit a trade, the type of order to place, and the risk management rules. It can be based on technical indicators, fundamental analysis, or a combination of both.

3. Order Execution: Once a trading signal is generated, the bot automatically places the trade based on the predefined strategy. It interacts with the trading platform’s API to execute the orders. The bot may also include features such as stop-loss and take-profit orders to manage risk and protect profits.

4. Risk Management: Risk management is a critical aspect of trading bot functionality. It involves setting parameters to control the amount of capital allocated to each trade, implementing stop-loss orders, and monitoring the overall portfolio risk. Effective risk management helps to minimize losses and protect the trader’s capital.

5. Backtesting and Optimization: Before deploying a trading bot, it is essential to backtest and optimize the trading strategy. Backtesting involves testing the strategy using historical data to evaluate its performance. Optimization aims to fine-tune the strategy parameters to maximize profitability and minimize risk.

6. Monitoring and Adjustments: Trading bots require ongoing monitoring to ensure they are functioning correctly. Traders need to regularly review the bot’s performance and make necessary adjustments to the strategy or risk management settings. This continuous monitoring helps to adapt to changing market conditions and improve the bot’s performance over time.

Read Also: Short Term vs Long Term Options: Which is the Better Investment?

In conclusion, understanding the functionality of a trading bot is essential for successful trading. It involves analyzing data, defining a trading strategy, executing trades, managing risk, and continuous monitoring. By understanding these aspects, traders can effectively utilize trading bots to automate their trading activities and potentially improve their trading results.

A trading bot is a software program that uses algorithms to automatically execute trades in financial markets.

Creating a trading bot allows individuals to automate their trading strategies, saving time and potentially maximizing profits.

Java is a popular programming language for creating trading bots due to its robustness and flexibility.

You can connect your trading bot to a cryptocurrency exchange by using the exchange’s API, which allows your bot to interact with the exchange’s trading platform.

A trading bot is a program that uses predefined algorithms and rules to execute trades automatically in the financial markets.

Who is the owner of KBC? KBC, which stands for Kaun Banega Crorepati, is an Indian television game show based on the popular UK show, Who Wants to Be …

Read ArticleWhat Happens to Your Stock Options When Your Company Goes Private? Stock options can be a valuable asset for employees, as they give them the …

Read ArticleTransfer money from GCM Investment: A step-by-step guide Transferring money from your GCM Investment account can be a simple and straightforward …

Read ArticleUnderstanding the Inverted H& An inverted H-bridge, also known as an H-bridge, is a crucial component in electronic circuits. Its purpose is to …

Read ArticleUnderstanding UTP in Trading When it comes to trading, having a comprehensive understanding of UTP (Unlisted Trading Privileges) is essential. UTP is …

Read ArticleWhat does the word UYU mean? The word UYU may seem unfamiliar to many, but it actually has a specific meaning and origin. In this article, we will …

Read Article