Step-by-Step Guide: Buying Options on the Fidelity App

How to Buy Options on Fidelity App If you’re looking to trade options and have a Fidelity app on your phone, you’re in luck. Fidelity offers a …

Read Article

Forex trading is a complex and dynamic market where traders analyze various technical indicators to predict future price movements. One of the most commonly used indicators is the moving average, which helps to smooth out price data and identify trends. Understanding how to calculate and interpret moving averages is essential for successful forex trading.

A moving average is a statistical calculation that is used to analyze past price data and identify the average price over a specified period. It is called a “moving” average because it is constantly updated as new price data is added and old data is removed. Traders use moving averages to filter out noise and identify the direction of the market trend.

The calculation of a moving average involves adding up the closing prices of a currency pair over a certain number of periods and then dividing the sum by the number of periods. For example, a simple moving average of a currency pair’s closing prices over the past five days would be calculated by adding up the closing prices of the last five days and dividing the sum by five. This average can then be plotted on a chart to visualize the trend.

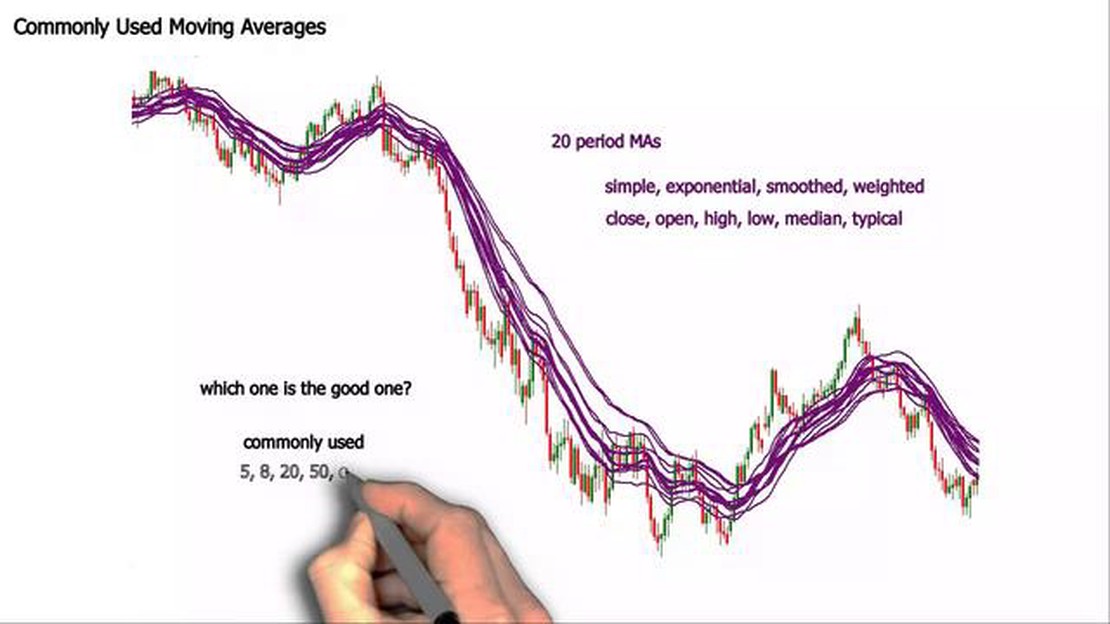

Moving averages can be calculated over different time periods, such as 10-day, 20-day, or 50-day moving averages. Traders often use multiple moving averages with different time periods to get a more comprehensive view of the market. When a shorter-term moving average crosses above a longer-term moving average, it is considered a bullish signal, indicating that the price is trending upward. Conversely, when a shorter-term moving average crosses below a longer-term moving average, it is considered a bearish signal, indicating that the price is trending downward.

Moving average is a widely used technical indicator in forex trading. It is a trend-following indicator that smooths out price data over a specified period of time, allowing traders to identify the overall direction of the market.

The moving average is calculated by adding up the closing prices of a currency pair over a specific time period and dividing the sum by the number of periods. For example, if a trader wants to calculate the 5-day moving average, they would add up the closing prices of the past 5 days and divide the sum by 5.

The purpose of using a moving average is to filter out short-term price fluctuations and focus on the underlying trend. By smoothing out the data, moving averages provide a clearer picture of the market’s direction, helping traders make informed trading decisions.

There are different types of moving averages, such as simple moving average (SMA), exponential moving average (EMA), and weighted moving average (WMA). SMA gives equal weight to all periods, while EMA and WMA assign more weight to recent price data. Each type of moving average has its own advantages and drawbacks, and traders choose the one that suits their trading strategy.

Moving averages are often used in conjunction with other indicators to confirm trading signals or identify potential reversals. For example, when the price crosses above the moving average, it may signal a buy opportunity, while a cross below the moving average may indicate a sell opportunity.

It is important for traders to understand that moving averages are lagging indicators, meaning they are based on past price data. As a result, they may not always provide accurate signals in real-time market conditions. Traders should use moving averages in combination with other indicators and price analysis to increase the accuracy of their trading decisions.

Read Also: Discover the Top 5 Financial Derivatives You Need to Know

In conclusion, moving average is a valuable tool in forex trading that helps traders identify trends and make informed trading decisions. By smoothing out price data, moving averages provide a clearer picture of the market’s direction, allowing traders to stay on the right side of the trend.

Moving average is a commonly used technical analysis tool in forex trading. It helps traders to identify trends, smooth out price fluctuations, and make more informed trading decisions.

The moving average is calculated by taking the average price of a currency pair over a certain period of time. This period can range from a few days to several weeks or months, depending on the trader’s preference and the timeframe they are analyzing.

To calculate the moving average, you add up the closing prices of the currency pair over the specified period and then divide that sum by the number of periods. This gives you the average price for that period. As new data becomes available, the oldest price is dropped from the calculation and the newest price is added.

The moving average is displayed as a line on a price chart, which helps to visually represent the trends in the market. Traders often use different types of moving averages, such as simple moving average (SMA) or exponential moving average (EMA), to provide different perspectives on the price movement.

The moving average can be used in various ways in forex trading. One common strategy is to look for the crossover of two moving averages. For example, when a shorter-term moving average crosses above a longer-term moving average, it is often considered a bullish signal, indicating that the price may continue to rise. On the other hand, when a shorter-term moving average crosses below a longer-term moving average, it is seen as a bearish signal, suggesting that the price may decline.

Read Also: How to effectively use Bollinger Bands

Traders can also use moving averages to determine support and resistance levels. When the price of a currency pair crosses above the moving average, it may indicate a support level, whereas a price crossing below the moving average may suggest a resistance level.

Overall, understanding the concept of moving average is essential for forex traders as it can help them analyze market trends, identify potential entry and exit points, and make more accurate trading decisions.

Disclaimer: Trading forex involves risk, and it is important to conduct proper research and utilize risk management strategies before participating in the market.

A moving average in forex trading is a commonly used technical indicator that helps traders analyze the overall trend of a currency pair. It calculates the average price over a specified period of time and displays it as a line on a chart. Traders use moving averages to identify potential entry and exit points, as well as to determine the strength and direction of the market trend.

To calculate a moving average in forex trading, you need to first decide the period you want to use. This can be a short-term average, such as a 10-day moving average, or a longer-term average, such as a 50-day moving average. Then, you need to add up the closing price of the currency pair for each day within the chosen period and divide it by the number of days. This will give you the moving average for that period, which you can plot on a chart.

The purpose of using a moving average in forex trading is to smooth out price fluctuations and help identify the overall trend of a currency pair. By calculating the average price over a specific period of time, traders can filter out temporary price movements and focus on the general direction of the market. This can assist in making more informed trading decisions and finding potential entry and exit points.

A moving average can help in determining market trends by showing whether the price of a currency pair is generally moving up or down. If the moving average line is sloping upwards, it indicates an uptrend, while a downward slope suggests a downtrend. The steeper the slope, the stronger the trend. By analyzing the slope and positioning of the moving average line, traders can get an idea of the market’s overall direction.

Yes, a moving average can be used as a standalone indicator in forex trading. Some traders rely solely on moving averages to make their trading decisions. They may use crossover signals, where a shorter-term moving average crosses above or below a longer-term moving average, as a trigger to buy or sell. However, it’s important to note that using other technical indicators and analyzing other aspects of the market can provide a more comprehensive trading strategy.

A moving average in forex trading is a technical indicator that helps smooth out price data over a specified period of time and identifies trends.

How to Buy Options on Fidelity App If you’re looking to trade options and have a Fidelity app on your phone, you’re in luck. Fidelity offers a …

Read ArticleIs AvaTrade a broker? When it comes to choosing a broker for your trading needs, it is crucial to ensure that you are dealing with a legitimate and …

Read ArticleInvesting in JPX: A Step-by-Step Guide Investing in the JPX (Japan Exchange Group) can be a rewarding venture for beginners looking to grow their …

Read ArticleCosting Methods in SAP B1: A Comprehensive Guide In the world of business and finance, cost plays a crucial role in determining the success and …

Read ArticleWhat happens if I exercise an option? Exercising an option is the process of utilizing your right to buy or sell the underlying asset at a specified …

Read ArticleIs Zig Zag a good indicator? The Zig Zag indicator is a popular technical analysis tool that helps traders identify significant price reversals in a …

Read Article