Can VIX be traded directly? How to trade VIX futures and options

Trading VIX: Can It Be Done Directly? The VIX, also known as the “Fear Gauge,” is an index that measures the expected volatility in the stock market. …

Read Article

When it comes to financial markets, one of the key concepts to understand is the relationship between the spot price and the forward price. The spot price is the current price at which an asset can be bought or sold, while the forward price is the price at which an asset can be bought or sold at a future date. So, is the forward price higher than the spot price?

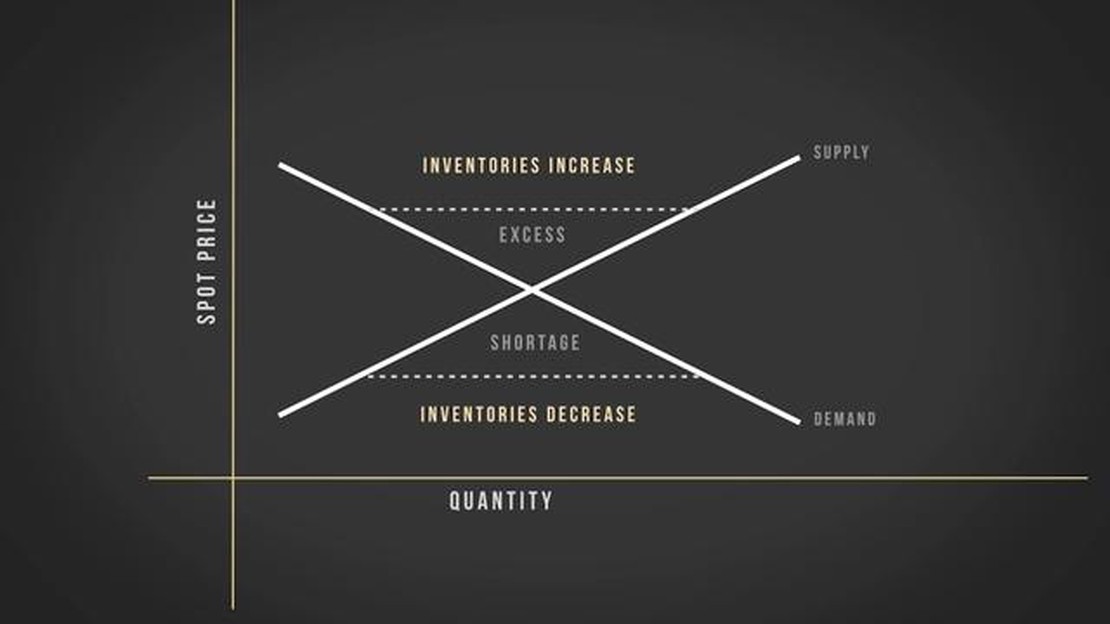

The answer to this question depends on various factors such as supply and demand, interest rates, and market expectations. In general, the forward price can be higher or lower than the spot price, depending on the circumstances. When the forward price is higher than the spot price, it is known as contango. On the other hand, when the forward price is lower than the spot price, it is known as backwardation.

In the case of contango, the higher forward price reflects the cost of holding the asset over time. This can be due to storage and insurance costs, financing costs, or simply the opportunity cost of not being able to use the funds tied up in the asset for other investments. Traders and investors may be willing to pay a premium for the convenience of buying or selling the asset at a future date.

Conversely, backwardation can occur when there is a perceived scarcity or increased demand for the asset in the future. In this case, the lower forward price reflects the expectation that the asset’s price will decrease in the future, making it more attractive to own now. Traders and investors may be willing to accept a lower price to secure the asset at a lower cost before its price potentially rises.

It is important to note that the relationship between spot and forward prices can change over time and can vary between different assets and markets. Factors such as market conditions, economic indicators, and geopolitical events can influence the expectations and sentiments of market participants, leading to shifts in the forward price relative to the spot price.

Ultimately, the relationship between the spot price and the forward price is complex and dynamic. It is influenced by a multitude of factors and can change based on market conditions and investor sentiment. Understanding these dynamics is crucial for participants in the financial markets, as it can provide insights and opportunities for informed decision-making.

In finance, forward and spot prices are terms that are commonly used in the context of securities, commodities, and currencies. Understanding the difference between these two prices is crucial for investors and traders.

The spot price refers to the current market price of an asset that can be instantly bought or sold. It is the price at which an asset is traded for immediate delivery. Spot prices can vary due to supply and demand dynamics, market conditions, and other factors. The spot price is usually quoted on financial platforms and exchanges.

On the other hand, the forward price refers to the price at which an asset can be bought or sold in the future, with the delivery and payment occurring at a predetermined date. Unlike the spot price, which reflects the current market conditions, the forward price takes into account factors such as interest rates, storage costs, and future expectations of the asset’s price.

So, is the forward price higher than the spot price? The answer depends on various factors such as the cost of carry, interest rates, and market expectations. If the cost of carry is positive, meaning that the expenses associated with holding an asset are higher than the interest earned, the forward price could be higher than the spot price. Conversely, if the cost of carry is negative, the forward price may be lower than the spot price.

It’s important to note that forward prices are determined through a process called forward pricing, which takes into account the various factors mentioned earlier. This process involves the use of financial models and calculations to derive the fair value of the asset for future delivery.

Investors and traders often use forward and spot prices to make investment decisions, hedge their positions, or speculate on future price movements. By understanding the relationship between these two prices and the factors that influence them, market participants can make informed decisions and manage their risk effectively.

| Spot Price | Forward Price |

|---|---|

| Current market price | Price for future delivery |

| Reflects current market conditions | Takes into account factors such as interest rates, storage costs, and future expectations |

| Can be instantly bought or sold | Settlement occurs at a predetermined date |

Read Also: Is forex trading allowed by RBC? - Find out all you need to know!

In conclusion, understanding the difference between forward and spot prices is essential for anyone involved in financial markets. By considering factors such as interest rates, storage costs, and future expectations, the forward price can differ from the spot price. Both prices play an important role in investment decision-making and risk management.

Forward and spot prices are two important concepts in the world of finance and commodities trading. Understanding the difference between these two prices is crucial for investors and traders.

Spot price refers to the current market price of a financial instrument or a commodity. It is the price at which a security, currency, or commodity can be bought or sold for immediate delivery and settlement. Spot prices are constantly changing due to supply and demand dynamics in the market.

Forward price is the price at which a financial instrument or a commodity can be bought or sold for delivery and settlement at a future date. Unlike spot prices, forward prices are determined in advance and are based on the current spot price plus the cost of carry, which includes interest rates, storage costs, and other factors.

Read Also: How Much USD Can I Carry to Pakistan? | A Guide for Travelers

The main difference between forward and spot prices is the timing of the transaction. Spot prices are for immediate delivery, while forward prices are for delivery at a future date. This difference in timing creates opportunities for arbitrage and speculation in the market.

Commonly, the forward price is not necessarily higher than the spot price. It can be either higher or lower depending on various factors such as interest rates, storage costs, and market expectations. If the cost of carry is greater than zero, the forward price is typically higher than the spot price. Conversely, if the cost of carry is negative, the forward price is usually lower than the spot price.

Traders and investors often use forward prices to hedge against price fluctuations or to speculate on future price movements. By entering into a forward contract, they can lock in a future price and minimize their exposure to market volatility.

In conclusion, forward and spot prices are important concepts in finance and commodities trading. While the spot price refers to the current market price for immediate delivery, the forward price is the price for future delivery. The difference between these two prices can provide opportunities for arbitrage and speculation in the market. It is important for traders and investors to understand the factors that influence forward prices and how they can be used to manage risk or profit from price movements.

The forward price is the price at which a financial instrument, such as a commodity or currency, can be bought or sold for delivery at a future date. It is determined by factors such as interest rates, time to expiration, and market expectations.

The spot price is the current market price at which a financial instrument, such as a commodity or currency, can be bought or sold for immediate delivery or settlement.

Yes, the forward price can be higher than the spot price. This situation is known as a contango market and occurs when there is an expectation of future price increases or when the cost of carry, including storage and financing costs, is higher than the spot price.

There are several reasons why the forward price can be higher than the spot price. These include expectations of future price increases, the cost of carry being higher than the spot price, and market demand and supply dynamics.

When the forward price is higher than the spot price, it may indicate that market participants expect future price increases. This can have implications for hedging strategies, investment decisions, and market dynamics. It can also create opportunities for arbitrage, where traders can take advantage of the price disparity between the forward and spot markets.

Yes, there is a difference between the forward price and spot price of a financial instrument. The spot price refers to the current price at which the instrument can be bought or sold immediately, while the forward price is the price at which the instrument can be bought or sold at a future date. The forward price takes into account factors such as interest rates and expected changes in the price of the instrument.

The forward price can be higher than the spot price due to various factors. One of the main reasons is the cost of carry, which includes interest rates, dividends, and storage costs. If the cost of carry is higher for a particular instrument, the forward price will be higher than the spot price. Additionally, market expectations and supply and demand conditions can also influence the relationship between the forward price and spot price.

Trading VIX: Can It Be Done Directly? The VIX, also known as the “Fear Gauge,” is an index that measures the expected volatility in the stock market. …

Read ArticleWhat is the limit of balikbayan box? The Balikbayan Box is an important part of Filipino culture. It is a package of goods sent by overseas Filipino …

Read ArticleThe Meaning of POA: Explained Power of Attorney (POA) is a legal document that grants someone else the authority to act on your behalf in specific …

Read ArticleMinimum Withdrawal on Axiory: Everything You Need to Know When it comes to withdrawing funds from your Axiory account, it is important to be aware of …

Read ArticleBest One-Minute Forex Indicator: A Comprehensive Analysis When it comes to forex trading, timing is everything. Being able to identify the right …

Read ArticleTrading US Stocks from Singapore: A Comprehensive Guide Interested in trading US stocks but not sure how to get started? Trading stocks from Singapore …

Read Article