How long does a forex course last?

Durations of Forex Courses When it comes to learning about forex trading, many aspiring traders wonder how long it takes to complete a forex course. …

Read Article

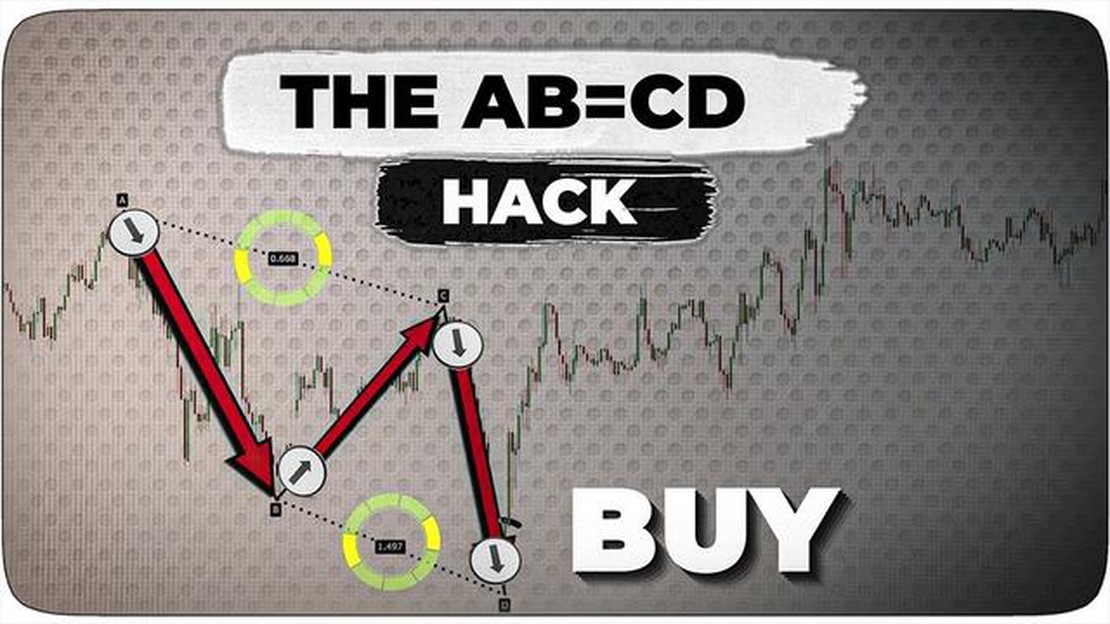

The ABCD pattern is a popular technical analysis tool used by traders to identify potential price reversals and continuation patterns in the financial markets. It is based on the idea that markets move in predictable waves and that these waves can be identified and used to make profitable trading decisions.

The pattern is formed by four price points, labeled as A, B, C, and D. The pattern starts with a strong price move, represented by the line AB. This move is followed by a retracement, represented by the line BC. The next move, from point C to point D, is a continuation of the initial trend. Traders who can accurately identify and trade these patterns can potentially profit from the subsequent price movements.

However, like any technical analysis tool, the ABCD pattern is not foolproof. It requires skill, experience, and a thorough understanding of market dynamics to effectively trade the pattern. Traders must also be aware of the limitations and potential pitfalls of relying solely on the ABCD pattern. The pattern is subjective and can vary in terms of size, duration, and reliability. It is important for traders to use other indicators and tools to confirm their analysis and make informed trading decisions.

Some tips and strategies for trading the ABCD pattern include:

In conclusion, the ABCD pattern can be an effective tool for traders when used in conjunction with other technical indicators and proper risk management techniques. It is not a standalone strategy and should be used as part of a comprehensive trading plan. By understanding the nuances and limitations of the pattern, traders can increase their chances of success in the markets.

The ABCD pattern is a popular technical analysis tool used by traders to identify potential reversals or continuation patterns in the financial markets. The pattern consists of four price points, denoted as A, B, C, and D, and is based on the Fibonacci sequence and ratios.

Traders analyze the ABCD pattern to determine potential entry and exit points for trades. When the pattern is complete, traders can anticipate a reversal or continuation of the current trend.

While the ABCD pattern can be effective in identifying potential trading opportunities, it is not a foolproof strategy. Like any technical analysis tool, it is important to use the ABCD pattern in conjunction with other indicators and analysis methods to confirm the likelihood of a reversal or continuation.

Read Also: Is it possible to make forex trading a full-time career?

Traders should also consider the current market conditions, such as liquidity, volume, and overall market sentiment, when using the ABCD pattern. A strong trend or significant news event can override the pattern’s signals and create false trading signals.

Furthermore, it is essential to practice proper risk management techniques when trading with the ABCD pattern. Traders should set appropriate stop loss levels and take profit targets to protect their capital and minimize losses.

Lastly, traders should be aware of the limitations of the ABCD pattern. It is a subjective analysis tool, and different traders may interpret the pattern differently. It is important to gain experience and develop a solid understanding of the pattern before relying solely on it for trading decisions.

In conclusion, the ABCD pattern can be an effective tool for traders when used in conjunction with other analysis methods and indicators. However, it is not a guaranteed strategy and should be used with caution. Traders should continue to educate themselves and refine their trading strategies to maximize their chances of success.

Read Also: Which is the Better Trade: SPX or SPY?

Here are some valuable tips and strategies for traders looking to effectively use the ABCD pattern in their trading:

| 1. Understand the ABCD pattern: | Before incorporating the ABCD pattern into your trading strategy, it is essential to have a clear understanding of how the pattern works. Study its structure, its potential entry and exit points, and the rules for identifying a valid ABCD pattern. |

| 2. Combine with other indicators: | While the ABCD pattern can be a powerful tool on its own, it is often more effective when combined with other technical indicators. Look for confluence with indicators such as moving averages, trend lines, or oscillators to increase the probability of successful trades. |

| 3. Confirm with price action: | To filter out false signals, it is important to confirm the ABCD pattern with price action. Look for additional signs of price reversal or continuation, such as candlestick patterns, support and resistance levels, or volume confirmation. |

| 4. Use proper risk management: | Like any trading strategy, it is crucial to implement proper risk management when trading the ABCD pattern. Set realistic profit targets and stop-loss levels, and always adhere to your risk management plan to protect your capital. |

| 5. Practice and backtest: | Before using the ABCD pattern in live trading, it is recommended to practice and backtest the strategy on historical data. This will help you gain confidence in the pattern and identify any weaknesses or areas for improvement. |

| 6. Keep a trading journal: | Keeping a trading journal can be beneficial when trading the ABCD pattern. Take note of each trade, including entry and exit points, reasons for taking the trade, and any lessons learned. This will help you analyze your trading performance and make necessary adjustments. |

| 7. Stay disciplined: | Finally, it is important to stay disciplined and stick to your trading plan when utilizing the ABCD pattern. Avoid making impulsive decisions based on emotions and always trust the signals generated by the pattern and your analysis. |

The ABCD pattern is a chart pattern that traders use to identify potential price reversal points. It consists of three legs or waves, labeled A, B, and C, and represents a pullback in a trend. The pattern is formed by using Fibonacci retracement and extension levels.

The effectiveness of the ABCD pattern depends on various factors such as the market conditions, the accuracy of the Fibonacci levels, and the trader’s ability to identify and execute trades based on the pattern. While it can be a reliable tool for some traders, it is important to combine it with other technical analysis tools and strategies to increase the probability of success.

Yes, the ABCD pattern can be used in any financial market that exhibits trends. It is commonly used in forex trading, stocks, commodities, and other markets. However, it is important to adapt the pattern to the specific characteristics and volatility of each market.

The ABCD pattern is a technical analysis pattern formed by four key price points that create a shape similar to a “W” or “M” on a chart. It is used by traders to identify potential market reversals or continuation patterns.

Durations of Forex Courses When it comes to learning about forex trading, many aspiring traders wonder how long it takes to complete a forex course. …

Read ArticleReasons for the Weakness of NOK in 2023 The Norwegian krone (NOK) has experienced a significant weakening in the year 2023, attracting considerable …

Read ArticleWhat Sets European Options Apart? European options are a type of financial derivative that are widely traded in the global markets. They are named …

Read ArticleCHF JPY exchange rate forecast The CHF JPY prediction is a topic of great interest for currency investors and traders. Both the Swiss franc (CHF) and …

Read ArticleCommon Reasons Why Traders Lose Money in Options Trading Options trading can be a highly lucrative venture, offering traders the potential to earn …

Read ArticleUnderstanding Oil Trading in the Forex Market Forex oil trading is a complex and dynamic market that involves the buying and selling of oil contracts. …

Read Article