What is 162m compensation and how does it work?

What is 162 m compensation? 162m compensation refers to compensation packages or payouts that are valued at 162 million dollars or more. These …

Read Article

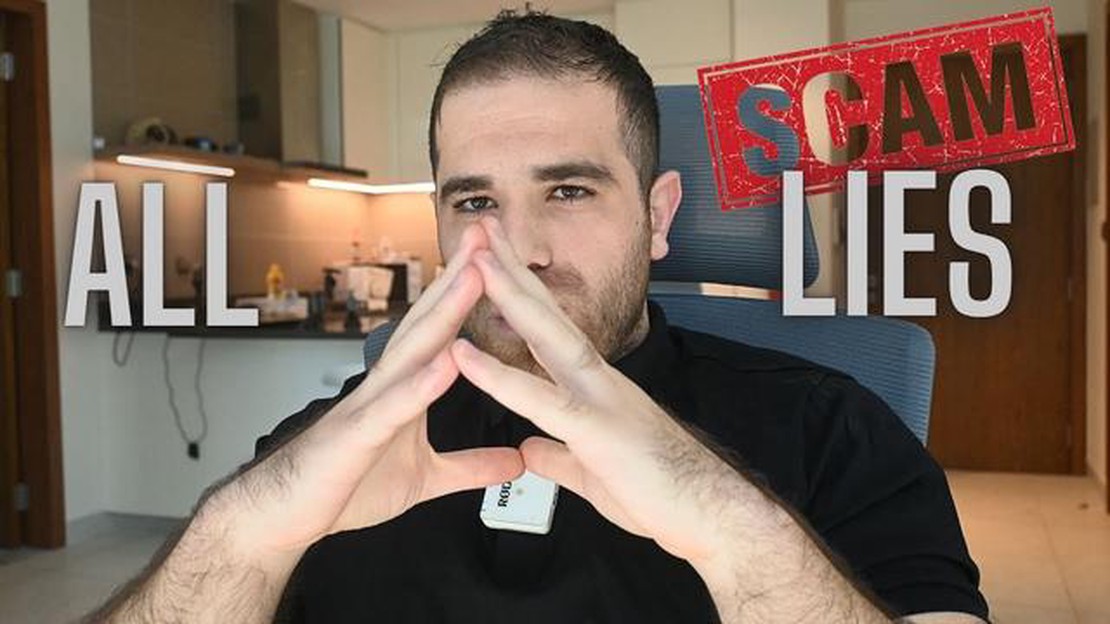

Forex trading has gained immense popularity in recent years, attracting individuals from all walks of life who are looking to earn a potentially substantial income. However, with the rise in popularity also comes an increase in the number of forex trading companies, some of which may not be entirely legitimate. This raises the important question: is forex trading company legit?

Uncovering the truth about forex trading requires a careful analysis of different aspects. One important factor to consider is the company’s regulatory status. Legitimate forex trading companies are typically regulated by reputable financial authorities, such as the Financial Conduct Authority (FCA) in the UK or the National Futures Association (NFA) in the United States.

Another key aspect to examine is the company’s reputation. Legitimate forex trading companies often have a strong track record and positive reviews from their clients. It is essential to conduct thorough research and read reviews from multiple sources to get a comprehensive understanding of the company’s reputation.

Additionally, it is important to consider the transparency and security measures implemented by the forex trading company. Legitimate companies provide clear information about their operations, including their trading platforms, fees, and customer support. They also prioritize the safety of their clients’ funds by implementing robust security measures, such as encryption protocols and segregated client accounts.

In conclusion, while there is a multitude of forex trading companies in the market, it is crucial to conduct thorough research and due diligence to determine whether a company is legitimate. Considering factors such as regulatory status, reputation, transparency, and security can help uncover the truth about a forex trading company and ensure a safe and rewarding trading experience.

With the increasing popularity of forex trading, it is important to ensure that you are dealing with a legitimate forex trading company.

Legitimacy is crucial when it comes to investing your hard-earned money. Unfortunately, there are many scams and fraudulent companies in the forex industry, so it is essential to do thorough research and due diligence before choosing a forex trading company.

Here are some factors to consider when determining the legitimacy of a forex trading company:

Remember, investing in forex trading involves risks, and there are no guarantees of profits. Be cautious of companies that promise high returns or use aggressive marketing tactics to lure investors. Legitimate forex trading companies educate their clients about the risks involved and focus on long-term investment strategies.

Read Also: 10 Tips for Journaling Your Forex Trading Journey

It is always recommended to consult with a financial advisor or seek professional advice before investing in forex trading.

By considering these factors and conducting thorough research, you can determine if a forex trading company is legit and make informed investment decisions.

Forex trading, short for foreign exchange trading, is a global marketplace where currencies are bought and sold. It has gained popularity in recent years due to its potential for high returns on investment. However, many people question the legitimacy of forex trading and wonder if it is a reliable and trustworthy industry.

Forex trading is a legitimate industry that operates within the financial markets. It is regulated by various financial authorities around the world, including the Securities and Exchange Commission (SEC) in the United States, the Financial Conduct Authority (FCA) in the United Kingdom, and the Australian Securities and Investments Commission (ASIC) in Australia.

Legitimate forex trading companies are registered with these regulatory bodies and must adhere to strict guidelines and regulations. They are required to provide transparent pricing, protect client funds, and maintain proper risk management procedures. These regulations help ensure that the market operates in a fair and orderly manner.

It is important to note that while forex trading is legitimate, there are scams and fraudulent companies in the industry. These companies often make false promises of quick and guaranteed profits, and they may engage in unethical practices to exploit inexperienced traders.

Read Also: What Does POA Stand for in Shipping? Unraveling the Mystery

To protect yourself from scams, it is crucial to conduct thorough research before engaging in forex trading. Look for reputable companies that are registered with regulatory authorities and have a track record of satisfied clients. Additionally, be cautious of any company that guarantees high profits or pressures you into making quick decisions.

Education is also key to navigating the forex trading industry. Take the time to learn about forex trading strategies, risk management techniques, and market analysis. This will enable you to make informed decisions and avoid falling victim to scams.

In conclusion, forex trading is a legitimate industry that operates within the financial markets. It is regulated by various financial authorities and provides potential opportunities for investors. However, it is important to be aware of scams and fraudulent companies in the industry. Conduct thorough research, choose reputable companies, and educate yourself to ensure a safe and legitimate forex trading experience.

Forex trading is a legitimate industry, but there are certainly scams and fraudulent companies operating in the market. It is important to research and choose a reputable forex trading company before investing any money.

To determine if a forex trading company is legitimate, you can research their background, read reviews and testimonials from other traders, and check if they are regulated by a recognized financial authority. Legitimate companies are transparent and have proper licensing and registration.

Some red flags to watch out for when choosing a forex trading company include promises of guaranteed profits, unrealistic returns, lack of regulation, and high-pressure sales tactics. It is important to trust your instincts and avoid companies that raise any suspicion.

Yes, there are many reliable forex trading companies in the market. Some well-known and reputable companies include Interactive Brokers, IG, OANDA, and Forex.com. It is important to do your own research and choose a company that aligns with your trading needs and preferences.

Forex trading involves significant risks, including the potential loss of your invested capital. The market is highly volatile and unpredictable, and there are various economic, political, and social factors that can impact currency prices. It is important to have a thorough understanding of the risks involved and to only invest money that you can afford to lose.

What is 162 m compensation? 162m compensation refers to compensation packages or payouts that are valued at 162 million dollars or more. These …

Read ArticleWhat is the best time frame for sniper entries? Time frames play a crucial role in the success of a trader’s sniper entries. Choosing the right time …

Read ArticleTrades Made by the Philadelphia Eagles The Philadelphia Eagles have been an active team in the NFL trade market, making several moves to improve their …

Read ArticleTypes of Swaptions: Exploring the Different Varieties A swaption, also known as a swap option, is a financial derivative that gives the holder the …

Read ArticleEUR USD Projection: Analysis and Predictions The EUR/USD currency pair is one of the most closely watched and volatile currency pairs in the world. As …

Read ArticleWhat is the Cost of 1 Lot of EUR USD? When it comes to trading in the foreign exchange market, it is important to understand the concept of a lot. A …

Read Article