What is a travel currency card? Learn all about it!

Travel Currency Card: All You Need to Know A travel currency card is a type of prepaid card that allows you to load and store multiple currencies on a …

Read Article

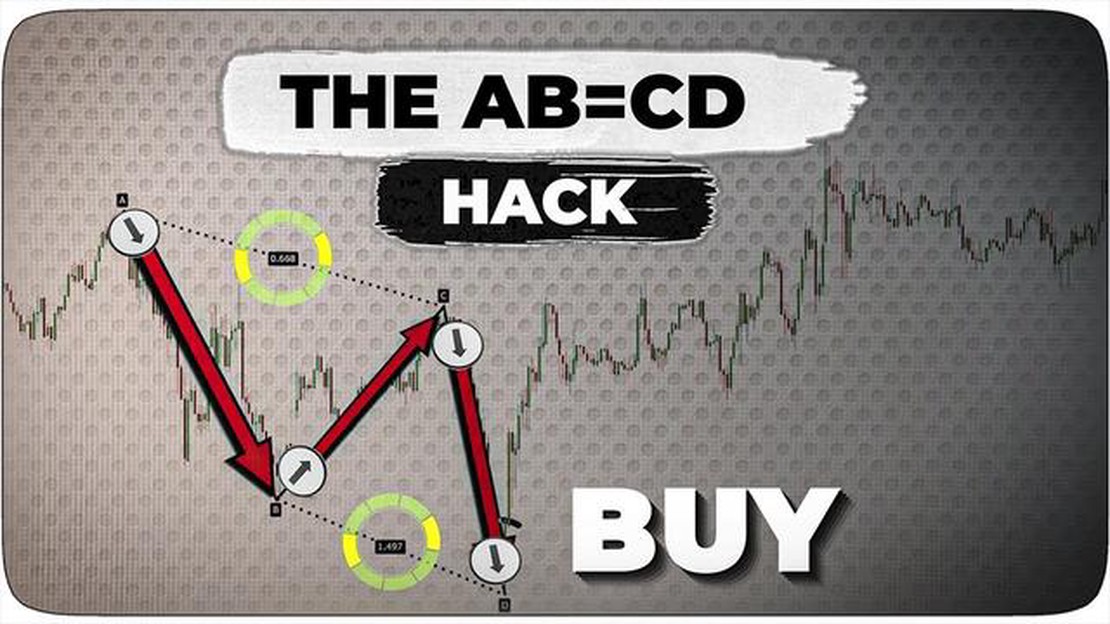

The ABCD pattern is a commonly discussed concept in technical analysis and is often used by traders to predict potential price reversals in financial markets. This pattern is based on the idea that markets move in a series of waves, with each wave creating a recognizable pattern that can be interpreted to forecast future price movements.

The ABCD pattern is named after the four points that form its structure - point A, point B, point C, and point D. These points are identified by analyzing the price chart and looking for specific price behavior and market conditions. Once the pattern is identified, traders can use it to estimate potential price targets and time their entry and exit points.

It is important to note that the ABCD pattern is not foolproof and should be used in conjunction with other technical analysis tools and indicators. While it can be a helpful tool in forecasting price reversals, it is not a guarantee of future market movements. Traders should always conduct thorough analysis and consider multiple factors before making trading decisions.

Implications of the ABCD pattern:

The ABCD pattern can be used by traders to identify potential reversal points in the market, which can be valuable information for determining entry and exit points. By recognizing the pattern’s structure, traders can set price targets and stop-loss orders, allowing for more effective risk management. Additionally, the ABCD pattern can be used in combination with other technical analysis methods, such as trendlines and Fibonacci retracement levels, to increase the accuracy of predictions.

In conclusion, the ABCD pattern is a commonly used tool in technical analysis for predicting potential price reversals in financial markets. However, it should be used in conjunction with other analysis techniques and indicators, and traders should always exercise caution and conduct thorough research before making any trading decisions.

The ABCD pattern is a popular technical analysis tool used by traders to identify potential trend reversals in financial markets, particularly in the forex market. It is a geometric pattern that is formed by consecutive price swings and is based on the Fibonacci ratio.

The ABCD pattern consists of four price swings - two upswings and two downswings – labeled as A, B, C, and D. The pattern is formed when the price moves in a distinct pattern, with point C retracing a certain percentage of the distance covered by the price from point A to B. The point D marks the potential reversal point, where the price is expected to reverse and start a new trend.

Traders use the ABCD pattern to identify potential entry and exit points in the market. When the pattern is complete, traders will look for other technical indicators or patterns to confirm the potential reversal. They may also use Fibonacci retracement levels to determine potential support or resistance levels.

It is important to note that while the ABCD pattern can be a powerful tool in technical analysis, it is not infallible. Like any other pattern, it is subject to false signals and market volatility. Traders should always use other technical indicators and analysis tools to confirm the signals provided by the ABCD pattern.

In conclusion, the ABCD pattern is a widely used tool in technical analysis to identify potential trend reversals. However, it is not a guaranteed reversal pattern and should be used in conjunction with other analysis tools for more accurate results.

The ABCD pattern is a chart pattern used in technical analysis to identify potential reversal areas in financial markets. It is based on Fibonacci ratios and consists of four key points: A, B, C, and D.

Point A is the starting point of the pattern and represents an important low or high in the price movement. Point B is a retracement of the initial price movement from A, often towards a Fibonacci level. Point C is another retracement from B, and it also tends to be around a Fibonacci level. Finally, point D completes the pattern, and it is an extension of the price movement from A to B, with the same Fibonacci ratio as the distance between A and B.

When the ABCD pattern is complete, it suggests that the price may reverse direction. Traders can use this pattern to identify potential entry or exit points for their trades. For example, if the pattern is bullish, traders may look to enter long positions near point D, expecting the price to rise. On the other hand, if the pattern is bearish, traders may look to enter short positions near point D, expecting the price to decline.

Read Also: Do Forex Indicators Really Work? The Truth Revealed

It’s important to note that the ABCD pattern is not a guarantee of a price reversal. It is just a tool that helps traders identify potential areas of market consolidation or reversal. Therefore, it should be used in conjunction with other technical analysis tools and indicators to make informed trading decisions.

| Point | Description |

|---|---|

| A | The starting point and an important low or high in the price movement. |

| B | A retracement of the initial price movement from A, often towards a Fibonacci level. |

| C | Another retracement from B, often around a Fibonacci level. |

| D | The completion of the pattern, an extension of the price movement from A to B with the same Fibonacci ratio. |

Read Also: Is Bet365 Arbitrage Friendly? Find Out Here

The ABCD pattern is a technical analysis tool used by traders to identify potential price reversals or continuation patterns in the market. This pattern is formed by four distinct price points, labeled as points A, B, C, and D.

When the ABCD pattern is fully formed, it consists of two legs: the AB leg and the CD leg. The AB leg represents the initial price move, while the CD leg represents the corrective move. The pattern is considered complete when the CD leg extends beyond the starting point of the AB leg.

Traders who identify the ABCD pattern believe that it provides insights into future price movement and can be used to predict potential reversals or continuations in the market. However, it is important to note that the ABCD pattern is not 100% accurate and should be used in conjunction with other technical indicators and analysis tools.

When the ABCD pattern is identified, traders can use it to determine entry and exit points for their trades. For example, if a trader believes that a pattern is indicating a potential reversal, they may look to enter a short position at point D and place a stop loss above point B. On the other hand, if the pattern suggests a continuation, a trader may consider entering a long position at point D and placing a stop loss below point B.

It is also worth noting that the ABCD pattern can be used in conjunction with other chart patterns and technical indicators to increase the probability of a successful trade. Traders may look for additional confirmation signals, such as bullish or bearish candlestick patterns or support and resistance levels, to strengthen their decision-making process.

In conclusion, the ABCD pattern is a widely recognized technical analysis tool that can assist traders in identifying potential price reversals or continuations. However, it is important to use this pattern in conjunction with other analysis tools and indicators to increase the probability of successful trades. It is also important to remember that no trading strategy or pattern is foolproof, and risk management should always be a top priority.

The ABCD pattern is a technical analysis pattern that is used to identify potential reversal points in the price of a security. It is formed by four key points: A, B, C, and D. A is the starting point of the pattern, B is the retracement from A, C is the extension from B, and D is the retracement from C. The pattern is considered to be complete when the price moves from point D and reverses back towards point A.

Traders can use the ABCD pattern to identify potential reversal points in the price of a security. When the ABCD pattern is complete, it suggests that the price may reverse and move in the opposite direction. Traders can use this information to make trading decisions, such as entering a short position when the pattern completes and the price starts to move downwards.

The implications of the ABCD pattern are that it can provide traders with potential trade setups and entry points. When the pattern is complete, it suggests that there may be a reversal in the price of the security. Traders can use this information to identify potential areas of support and resistance, and make trading decisions based on these levels.

The reliability of the ABCD pattern in predicting reversals depends on several factors, including the accuracy of the identification of the key points (A, B, C, and D), the strength of the price movement, and the confirmation from other technical indicators or patterns. While the ABCD pattern can be a useful tool for identifying potential reversals, traders should always use it in conjunction with other technical analysis tools and strategies to increase their probability of success.

Yes, there are variations of the ABCD pattern, such as the ABCD extension pattern and the ABCD butterfly pattern. These variations have similar characteristics to the original ABCD pattern, but may have slightly different formations or implications. Traders can study these variations to expand their knowledge and understanding of the ABCD pattern and its applications in trading.

The ABCD pattern in trading is a chart pattern that is often considered as a reversal pattern. It is named after the letters A, B, C, and D, which represent specific points on the chart. The pattern consists of two legs or swings, AB and CD, with AB being the initial trend and CD being the reversal trend. Traders use the ABCD pattern as a way to identify potential entry and exit points in the market.

To identify the ABCD pattern in a chart, you need to look for specific price movements. The pattern starts with the point A, which represents the beginning of a trend. From point A, the price moves up or down to point B, creating the first leg of the pattern. Then, the price retraces back to point C, forming the second leg. Finally, the price continues in the direction of the initial trend from point C to point D. The length and symmetry of the AB and CD legs are important factors to consider when confirming the presence of the ABCD pattern.

Travel Currency Card: All You Need to Know A travel currency card is a type of prepaid card that allows you to load and store multiple currencies on a …

Read ArticleDiscovering the Vanna-Volga Option Pricing Model When it comes to pricing options, accuracy is key. Traders and investors rely on various models to …

Read ArticleIs Xoom and PayPal the Same? When it comes to online payment services, PayPal is undoubtedly one of the most popular and widely accepted options …

Read ArticleCalculating Moving Weighted Average Inventory Inventory management is a crucial aspect of running a successful business. One important metric to track …

Read ArticleDoes Metatrader work on PC? If you are interested in trading on the forex market or other financial markets, you have probably heard of Metatrader. …

Read ArticleHow much does 1000Pip builder cost? If you are a forex trader looking for reliable and accurate trading signals, you may have come across 1000Pip …

Read Article