Does Forex Have an App? Discover the Best Mobile Trading Platforms

Is there a forex app: finding the best options for trading on mobile In today’s fast-paced world, having access to trading platforms on the go is …

Read Article

A moving average and a convolution are two common techniques used in signal processing and time series analysis. Both methods involve applying a filter to a sequence of data points to extract certain information or patterns.

A moving average is a simple and intuitive method that calculates the average of a subset of adjacent data points within a specified window size. This window “slides” along the data sequence, and at each position, the average of the data points within the window is computed. The result is a smooth representation of the original data, with the noise and high-frequency components attenuated.

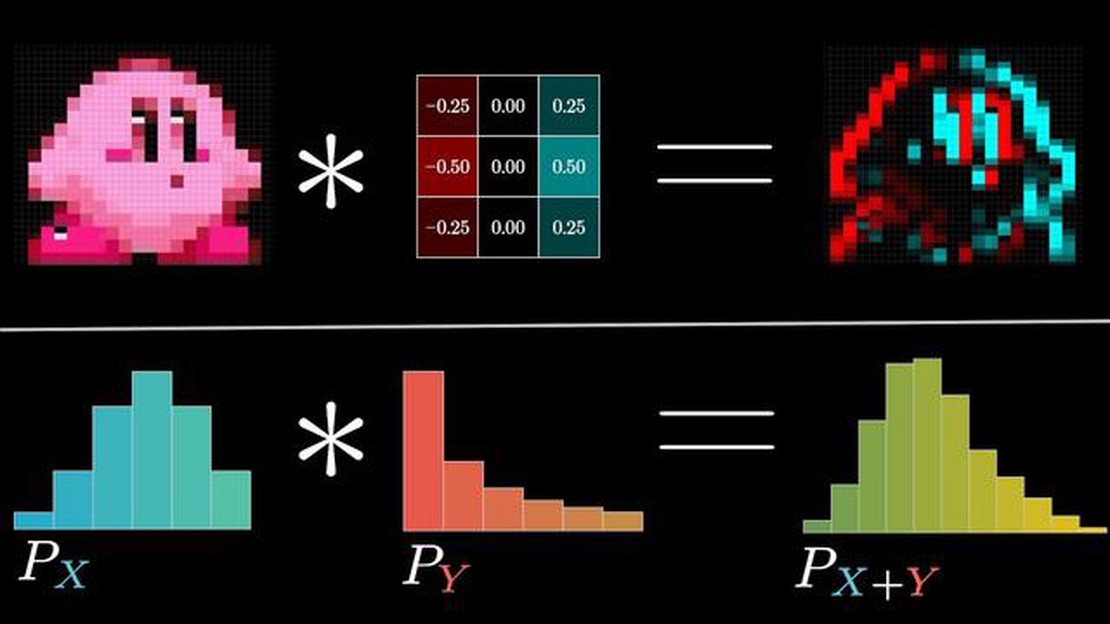

On the other hand, a convolution is a mathematical operation that combines two functions to produce a third function. In the context of signal processing, the two functions are typically the input data and a kernel function, which represents the desired filter response. The convolution operation involves sliding the kernel along the data sequence and calculating the sum of the element-wise product of the input data and the kernel at each position. The resulting output is a filtered version of the input data, with the characteristics determined by the shape and values of the kernel function.

While both a moving average and a convolution involve sliding a window along a data sequence, there is a subtle difference in the way they combine the data points. A moving average simply computes the arithmetic mean of the points within the window, whereas a convolution performs an element-wise multiplication of the kernel and the data points, followed by a summation. This gives the convolution operation more flexibility and allows for a wider range of filtering effects compared to a simple moving average.

When it comes to analyzing data and extracting meaningful information, moving averages and convolutions are two commonly used techniques. While they appear to be distinct concepts, there is a close relationship between them.

A moving average is a statistical calculation that is used to analyze time series data by smoothing out random fluctuations. It involves calculating the average of a specified number of data points within a given window and moving that window along the time series. This helps to identify trends and patterns in the data.

On the other hand, a convolution is a mathematical operation that combines two functions to produce a third one. In the context of signal processing and image analysis, convolutions are used to apply filters or masks to data. This can be useful for tasks such as noise reduction or edge detection.

So, what is the relationship between moving averages and convolutions? It turns out that a moving average can be viewed as a specific type of convolution. Specifically, it can be seen as a convolution with a rectangular function as the kernel.

When we calculate a moving average, we are essentially convolving the time series with a rectangular kernel that has equal weights within the window size and zero weights outside of it. This implies that moving averages are a special case of convolutions, tailored specifically for time series analysis.

This relationship between moving averages and convolutions has practical implications. It means that established algorithms and techniques for convolutions can be applied to moving averages, and vice versa. For example, techniques for fast convolutions, such as the fast Fourier transform (FFT), can be used to efficiently compute moving averages as well.

In conclusion, moving averages and convolutions are closely related concepts in data analysis. Understanding the relationship between them can help to deepen our understanding and improve our ability to analyze and extract meaningful information from data.

Both a moving average and a convolution are mathematical operations that involve the combination of a series of data points. While they may have slightly different applications and interpretations, at a fundamental level, they share many similarities.

Read Also: Understanding the Maximum Gain on a Long Put Option

A moving average is a calculation performed on a set of data to smooth out fluctuations and highlight trends. It involves taking the average of a specific number of consecutive data points, moving through the dataset one point at a time. The result is a new series of data points that represents the overall trend of the original data.

A convolution, on the other hand, is a mathematical operation that combines two sets of data to produce a third set. It involves multiplying corresponding data points from each set, summing the products, and placing the result in the appropriate position of the new dataset. The process is performed over a sliding window, which moves step by step through the original datasets.

Read Also: Understanding the Distinction: Smoothed Moving Average vs Simple Moving Average

When comparing the two operations, it becomes clear that they follow a similar pattern. In both cases, a sliding window is used to perform a calculation on a set of data points. The sliding window moves through the data one point at a time, combining the data within the window to produce a new result.

| Moving Average | Convolution |

|---|---|

| Averages consecutive data points | Multiplies and sums corresponding data points |

| Calculates new data points based on a window | Calculates new data points based on a window |

| Smoothes out fluctuations and highlights trends | Combines two datasets to produce a third |

Despite the differences in terminology and specific calculations, the foundational principles behind a moving average and a convolution are quite similar. They both involve the combination of data points within a sliding window to produce a new set of data that represents a trend or relationship. Understanding these similarities can help in better grasping the concepts and applications of both operations.

Moving averages and convolutions are widely used in various fields and applications due to their ability to extract important information from data sequences. Here are some practical applications where moving averages and convolutions are commonly used:

These are just a few examples of the practical applications of moving averages and convolutions. The versatility and effectiveness of these techniques make them invaluable in many scientific and technological fields.

Yes, a moving average can be considered a type of convolution. It involves taking the average of a sliding window of values, which is similar to convolving a filter with a signal.

A moving average differs from other types of convolutions in the sense that it uses a specific algorithm to calculate the average of the values within the sliding window, whereas other convolutions may use different algorithms or filters with different purposes.

Convolution is an operation that combines two functions (or signals) to produce a third function. It involves taking the integral of the product of the two functions as one of them is shifted. In simpler terms, convolution is a way to combine and transform signals or data.

A moving average function works by taking the average of a specified number of data points within a sliding window. The window moves along the data, and for each position, the average of the values within the window is calculated and used as the output value. This smoothing technique is commonly used for noise reduction or trend analysis.

Convolution and moving averages have various applications in signal processing, image processing, data analysis, and other fields. Some examples include noise reduction in audio signals, image blurring or sharpening, trend analysis in financial data, and recognizing patterns in time series data.

Yes, a moving average can be thought of as a convolution. It involves convolving a signal with a kernel that has equal weights for all samples within a specified window size.

Is there a forex app: finding the best options for trading on mobile In today’s fast-paced world, having access to trading platforms on the go is …

Read ArticleWho can trade in F&? If you are interested in trading, it is important to know who can participate in the F& market. The F& market is open to both …

Read ArticleWhat happens to ESOP after termination? Employee Stock Ownership Plans (ESOPs) have become increasingly popular as a way for companies to create a …

Read ArticleUnderstanding India’s Foreign Remittances India, with its enormous population and widespread diaspora, is one of the largest recipients of foreign …

Read ArticleWhat time does EU market open GMT? The EU market, also known as the European Union market, is a significant financial market that operates within the …

Read ArticleShares Owned by Apple CEO Apple Inc., one of the most valuable and influential companies in the world, is led by its CEO, currently Tim Cook. As the …

Read Article