What is the Success Rate of the Bollinger Squeeze? Explained and Analyzed

What is the success rate of Bollinger squeeze? The Bollinger Squeeze is a popular technical indicator used in financial markets to identify periods of …

Read Article

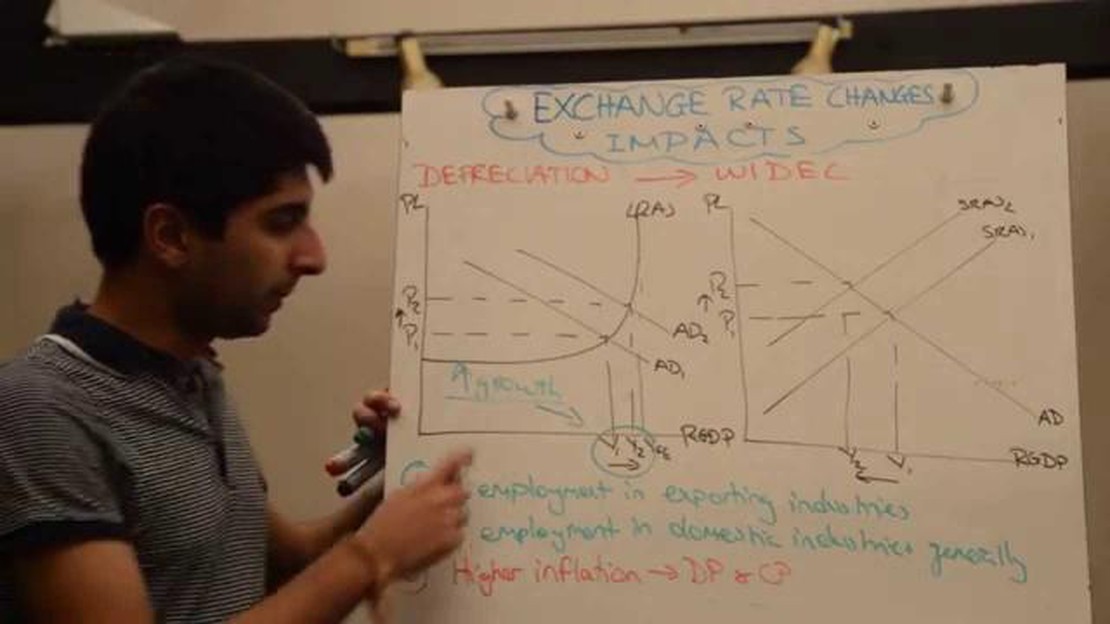

The exchange rate of a country’s currency plays a crucial role in its economy and international trade. When the value of a currency is high, it means that it can buy more goods and services from other countries. This is because a higher exchange rate makes imports cheaper and exports more expensive, thereby reducing the trade deficit and increasing the purchasing power of the country.

A higher exchange rate can also attract foreign investment as it offers better returns for investors. Foreign investors are more likely to invest in a country with a strong currency as it provides stability and higher returns on investment. This influx of foreign capital can boost the country’s economic growth and create job opportunities.

However, a higher exchange rate can have negative effects as well. It can make a country’s exports more expensive, making them less competitive in the global market. This can lead to a decrease in export revenues and job losses in export-dependent industries. Additionally, a higher exchange rate can also increase the cost of imported goods, negatively affecting domestic consumers.

It is important to note that the impact of an exchange rate on an economy is not black and white. It depends on various factors such as the country’s economic structure, its trade patterns, and its monetary policies. Governments and central banks often intervene in the foreign exchange market to manage currency valuations and ensure a balance between the benefits and challenges posed by a high exchange rate.

Currency valuation refers to the determination of the worth of one currency in relation to another. It is a crucial factor in international trade and affects various aspects of the economy. The impact of currency valuation can be significant and far-reaching, influencing areas such as exports, imports, inflation, investment, and economic growth.

Exchange rates play a key role in currency valuation. When a country’s currency appreciates, or strengthens, its exchange rate increases relative to other currencies. Conversely, when a currency depreciates, or weakens, its exchange rate decreases. The impact of currency valuation varies based on whether the currency is appreciated or depreciated.

Benefits of a higher exchange rate:

A higher exchange rate can have several benefits for an economy:

Drawbacks of a higher exchange rate:

However, a higher exchange rate can also have negative consequences:

Read Also: Understanding the Distinctions between an FX Forward and an FX Futures Contract

It is important for policymakers and economists to carefully monitor and manage currency valuation to ensure a balance between the benefits and drawbacks. They may intervene in the foreign exchange market to influence the exchange rate and maintain stability in the economy.

In conclusion, currency valuation has a profound impact on the economy. A higher exchange rate can bring benefits such as increased exports and foreign investment, but it can also have drawbacks such as reduced competitiveness and adverse effects on tourism and domestic consumption. Understanding and managing currency valuation is crucial for promoting economic growth and stability.

A higher exchange rate can have several benefits for a country’s economy. While it may initially seem counterintuitive, a stronger currency can provide various advantages in the long run. Here are some of the key benefits of a higher exchange rate:

1. Increased Purchasing Power: A higher exchange rate means that the local currency is worth more in relation to foreign currency. This can result in lower import prices, allowing consumers and businesses to purchase goods and services from abroad at a lower cost. Increased purchasing power can improve living standards and drive economic growth.

2. Attracting Foreign Investment: A higher exchange rate can make a country’s assets and investments more attractive to foreign investors. With a stronger currency, foreign investors can get more value for their money when investing in the country. This can lead to an increase in foreign direct investment (FDI), which can stimulate economic development and create job opportunities.

3. Boost to Domestic Industries: When the local currency is stronger, it becomes relatively more expensive for foreign consumers to purchase goods and services produced within the country. This can give a competitive advantage to domestic industries, as their products will be more affordable compared to imported alternatives. A higher exchange rate can thus promote domestic production and support local businesses.

Read Also: Understanding the Illegality of Backdating Stock Options

4. Reduced Inflation: A higher exchange rate can help to lower inflationary pressures. When a currency is stronger, the cost of imported raw materials and components used in production decreases, leading to lower production costs. This can prevent excessive price increases and help maintain price stability, benefiting both businesses and consumers alike.

5. Improved Terms of Trade: A stronger currency can improve a country’s terms of trade, which is the ratio of export prices to import prices. As the local currency appreciates, exports become relatively more expensive, while imports become cheaper. This can lead to an improvement in the trade balance, as exports may decrease slightly but imports are likely to decrease even more. A positive change in the terms of trade can contribute to a more favorable economic position for the country.

It is important to note that a higher exchange rate is not always beneficial for all sectors of the economy. Certain industries, such as export-oriented sectors, may face challenges as their products become less competitive in international markets. Additionally, a sudden and sharp appreciation of the currency can have negative consequences, such as hurting tourism or increasing the burden of foreign debt.

In conclusion, while there may be some disadvantages, a higher exchange rate can bring several benefits to an economy. Increased purchasing power, attraction of foreign investment, support for domestic industries, reduced inflation, and improved terms of trade are among the advantages. Careful management and consideration of potential challenges are essential to ensuring that the benefits of a higher exchange rate are maximized.

Exchange rate is the value at which one currency can be exchanged for another currency. It determines the ratio at which two currencies can be traded for each other.

A higher exchange rate can benefit a country in several ways. Firstly, it can make imports cheaper, as the domestic currency can buy more of a foreign currency. This can lead to lower prices for imported goods and services, resulting in increased purchasing power for consumers. Secondly, a higher exchange rate can make exports more expensive, which can help boost domestic industries by encouraging consumption of domestically-produced goods. Lastly, a higher exchange rate can attract foreign investors by making their investments more valuable in domestic currency terms, which can contribute to economic growth.

Yes, there can be disadvantages of a higher exchange rate as well. One possible disadvantage is that it can make exports more expensive, which can lead to lower demand for domestically-produced goods and services in foreign markets. This can negatively impact industries that rely heavily on exports. Additionally, a higher exchange rate can make it more expensive for domestic businesses to repay foreign debt, as the cost of repaying debt denominated in a foreign currency increases. Furthermore, a higher exchange rate can make it more difficult for domestic businesses to compete with foreign companies that have a lower exchange rate, making them less competitive in the global market.

A higher exchange rate can potentially lead to inflation, although it is not always the case. If a country has a higher exchange rate, it makes imports cheaper, which can lead to an increase in imports. If the demand for imports exceeds the domestic supply, it can lead to increased prices of imported goods, contributing to inflation. However, the impact of exchange rate on inflation depends on various factors, such as the level of domestic production and inflation expectations.

What is the success rate of Bollinger squeeze? The Bollinger Squeeze is a popular technical indicator used in financial markets to identify periods of …

Read ArticleTrading in MTrading: A Comprehensive Guide If you’ve ever wanted to enter the world of trading, but don’t know where to start, this step-by-step guide …

Read ArticleWhat time of day is SPY highest at? When it comes to trading stocks, timing is everything. Whether you’re a seasoned investor or just starting out, …

Read ArticleTrading Options with Penny Stocks: What You Need to Know If you’re a trader or investor looking to capitalize on the volatility of penny stocks, you …

Read ArticleBank Transfer Fee: How Much Does It Cost? Bank transfers are a common method of sending money from one bank account to another. They can be used for …

Read ArticleAre WP plugins free? When it comes to building and customizing websites, WordPress is a popular choice for many users. Its versatility and …

Read Article