Understanding the TMA Indicator in MQL4: Key Concepts and Application Techniques

Understanding the TMA Indicator in MQL4: A Comprehensive Guide The TMA (Triangular Moving Average) indicator is a popular tool used by traders to …

Read Article

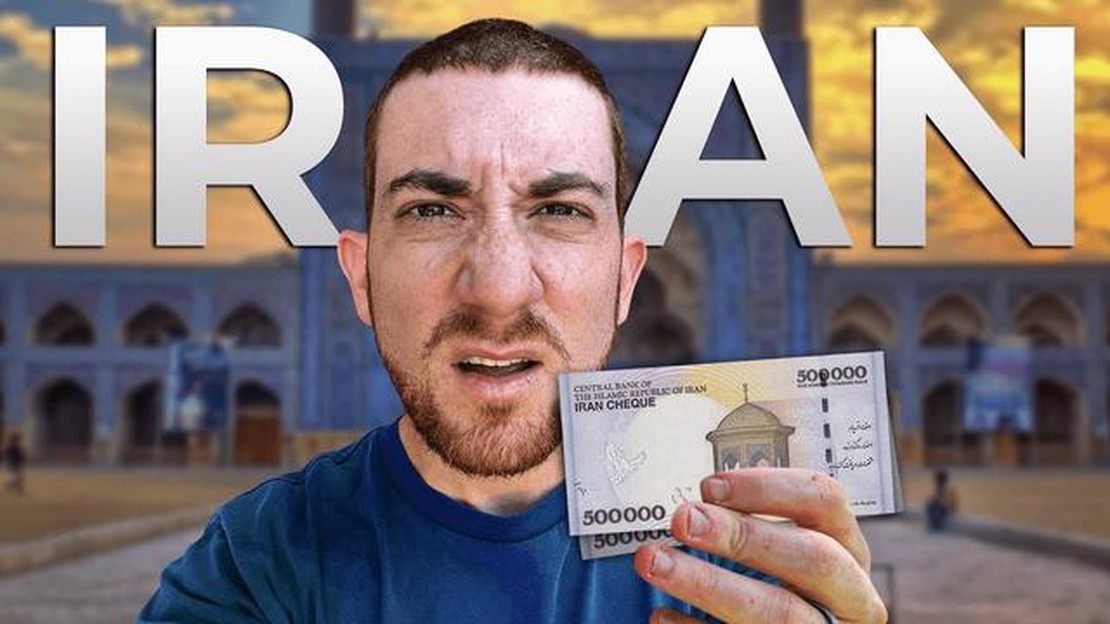

Iran, officially known as the Islamic Republic of Iran, is a country located in Western Asia. With a rich cultural heritage and a diverse economy, Iran has become an attractive destination for tourists and investors alike. One of the important aspects that every traveler and investor should be aware of is the currency used in Iran.

The official currency of Iran is the Iranian Rial (IRR). The rial is issued and regulated by the Central Bank of Iran. The currency is denoted by the symbol “IRR” and its ISO code is 4217. The rial is subdivided into units called “dinars,” with one rial being equal to 100 dinars.

It’s important to note that due to international sanctions and economic restrictions, the Iranian rial has experienced significant depreciation over the past years. This has led to a complex currency exchange system in Iran, with multiple exchange rates available. The official exchange rate is set by the Central Bank of Iran, but there are also other rates used in the market, such as the free market rate and the open market rate.

When traveling to Iran or conducting business in the country, it is recommended to exchange your currency to Iranian rial at official exchange offices or banks. It is also essential to stay updated on the current exchange rates to ensure you get the best value for your money.

In conclusion, the Iranian rial is the official currency of Iran, and it plays a crucial role in the country’s economy. Understanding the currency and its exchange rates is vital for anyone planning to travel or invest in Iran. By being aware of the currency used in Iran, individuals can make informed financial decisions and optimize their financial transactions.

Iran trades in the Iranian Rial (IRR), which is the official currency of the country. The currency can be denoted by the symbol “﷼” and is commonly referred to as “rial”. The rial is subdivided into smaller units called “dinars”. However, the dinar is no longer in circulation and is mainly used for accounting purposes.

The Iranian Rial has experienced significant fluctuations in its value over the years. It has faced depreciation due to several factors, including economic sanctions, inflation, and political instability. As a result, the government has implemented measures to manage the exchange rate and prevent further fluctuations.

In recent years, the Iranian government has introduced a dual exchange rate system. There is an official exchange rate, which is used for government transactions and essential imports. Additionally, there is a market exchange rate, which is used for most other transactions.

Read Also: Understanding the Concept of 0.1 Lot Size in Forex Trading

It is important to note that due to economic sanctions imposed by the United States and other countries, accessing and using Iranian currency can be challenging for foreign individuals and businesses. International banks and financial institutions are often restricted in their dealings with Iran, making it difficult to convert currencies and conduct transactions.

Overall, the Iranian Rial is the currency used in Iran, and its value is subject to various economic and political factors. Anyone traveling to Iran or conducting business with Iranian counterparts should be aware of the currency’s fluctuations and the challenges associated with accessing and using it.

Iran trades in the Iranian rial, which is the official currency of the country. The currency is commonly abbreviated as IRR. The rial is subdivided into smaller units called “rials” and “dinars”.

In addition to the rial, Iran also recognizes the “toman” as a common unit of currency. The toman is not an official currency, but it is widely used in daily transactions and is equivalent to 10 rials.

For international transactions, Iran uses foreign currencies such as the US dollar, euro, pound sterling, and the United Arab Emirates dirham. These currencies are accepted in certain establishments such as hotels and restaurants, but it is mostly recommended to exchange foreign currencies for the local rial when in Iran.

It is important to note that due to international sanctions, it can be challenging to exchange foreign currencies in Iran. Therefore, it is advisable to carry enough cash in the local currency or use local banking services such as ATMs and credit cards, if possible.

Read Also: Should You Sell Put Options? Pros and Cons of Selling Put Options

Iran has strict regulations regarding the import and export of currency. Travelers entering or leaving the country are required to declare any amount of currency exceeding $10,000 or its equivalent in other currencies.

When traveling to Iran, it is important to have a clear understanding of the foreign exchange system in the country. Here are some tips and guidelines to help you navigate the currency exchange process:

By following these tips and guidelines, you can ensure a smooth and hassle-free foreign exchange experience while visiting Iran. Remember to always stay informed and make informed decisions to get the best value for your money.

The currency in Iran is the Iranian Rial (IRR).

No, you cannot use US dollars directly in Iran. The official currency is the Iranian Rial, and you will need to exchange your dollars for Rials at local banks or exchange offices.

The exchange rate between US dollars and Iranian Rials fluctuates regularly. It is best to check for the current rate before exchanging your money. As of now, the approximate exchange rate is 1 US dollar to 42,000 Iranian Rials.

Credit cards are not widely accepted in Iran. It is recommended to carry sufficient cash in Iranian Rials for your expenses during your stay. Some upscale hotels and tourist shops may accept credit cards, but it is not common.

Understanding the TMA Indicator in MQL4: A Comprehensive Guide The TMA (Triangular Moving Average) indicator is a popular tool used by traders to …

Read ArticleTravel Currency Card: All You Need to Know A travel currency card is a type of prepaid card that allows you to load and store multiple currencies on a …

Read ArticleWhat is the risk margin on options? In the world of investment and financial markets, options play a crucial role in providing investors with …

Read ArticleUnderstanding Forex Options: What They are and How They Work Forex options are a popular derivative instrument in the foreign exchange market. They …

Read ArticleResetting the Moving Average Price in SAP: Step-by-Step Guide In SAP, the moving average price is a key factor in determining the valuation of …

Read ArticleIs Forex Trading Legal in India? Foreign Exchange or Forex trading is a popular form of investment across the globe. It involves buying, selling, and …

Read Article