Can I Start Forex Trading with $5000? - A Complete Guide

Is it possible to start forex trading with $5000? If you are interested in entering the world of forex trading, you may be wondering if it is possible …

Read Article

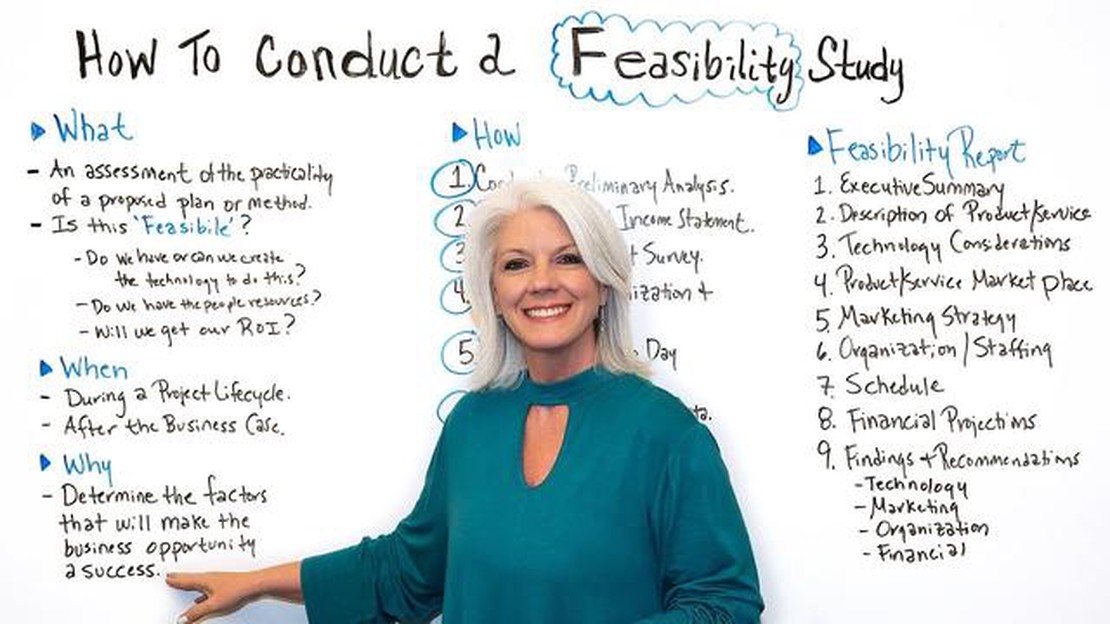

Feasibility assessment is an essential step in the decision-making process for any project or initiative. It involves evaluating the potential options or alternatives to determine their viability and profitability. By conducting a feasibility assessment, businesses can gain insight into the potential risks, benefits, and costs associated with each option, allowing them to make informed decisions.

During a feasibility assessment, various factors are taken into consideration, such as market demand, financial implications, technical feasibility, and environmental impact. By analyzing these factors, businesses can identify the most feasible option that aligns with their goals and objectives.

Options refer to the different alternatives or courses of action that can be pursued. These options may differ in terms of their scope, cost, timeline, and expected outcomes. By carefully considering and evaluating each option, businesses can assess their feasibility and determine which one is most likely to succeed.

A feasibility assessment with options allows businesses to compare and contrast different scenarios, identifying the strengths and weaknesses of each option. This analysis enables informed decision-making, minimizing risks and increasing the likelihood of success.

In this article, we will delve deeper into the concept of feasibility assessment with options, discussing its importance and providing practical guidance on how to conduct an effective assessment. We will explore various techniques and tools that can be used to evaluate and compare options, ultimately helping businesses make sound decisions that drive success and growth.

A feasibility assessment is a crucial step in any project or decision-making process. It helps evaluate the potential success and viability of a project or option before investing significant resources.

During a feasibility assessment, various factors are examined, including technical, financial, legal, and operational aspects. The goal is to determine whether a project can realistically be implemented and achieve its desired outcomes.

One key aspect of a feasibility assessment is to identify and analyze the potential risks and challenges associated with the project. By understanding the potential obstacles, project managers can develop strategies to mitigate or overcome them.

Another important element is assessing the available resources and capabilities. This includes evaluating the necessary skills, expertise, equipment, and financial means required to undertake the project successfully.

Additionally, a feasibility assessment considers the market demand for the project or option. It analyzes the target audience’s needs, preferences, and potential competition to ensure there is a viable market for the product or service being offered.

It’s important to note that a feasibility assessment is not just about determining whether a project is possible. It also helps determine whether it is practical and worth pursuing. This includes considering the economic, social, and environmental impacts of the project.

Overall, a feasibility assessment provides crucial information to decision-makers, enabling them to make informed choices and allocate resources effectively. By evaluating the potential benefits, risks, and requirements of a project, organizations can make better decisions and increase their chances of success.

Before diving into feasibility assessment with options, it’s important to understand some key concepts. Feasibility assessment involves evaluating the practicality and potential success of a project or idea. It is a crucial step in decision-making and can help identify potential risks and challenges.

Read Also: Beginner's guide: How to read currency charts and make accurate predictions

One key concept to understand is feasibility. Feasibility refers to the ability of a project to be successfully realized, taking into consideration various factors such as technical, economic, operational, legal, and scheduling constraints. Assessing feasibility involves analyzing these factors and determining whether the project is viable.

Another important concept is options. Options refer to different possibilities or alternatives that can be considered in a feasibility assessment. These options can include different approaches, technologies, resources, and strategies. Assessing options helps identify the most feasible and suitable path forward.

Feasibility assessment with options involves systematically evaluating and comparing different options to determine their viability and potential impact. This process includes gathering data, analyzing information, and making informed decisions based on the findings.

By understanding these key concepts, individuals and organizations can make more informed decisions and increase the chances of success for their projects. Feasibility assessment with options provides a structured framework for evaluating different possibilities and selecting the most feasible and effective option.

There are several types of feasibility assessment that can be conducted to evaluate the viability of a project or business idea. These assessments help in determining the likelihood of success and identifying potential risks or challenges that may arise during the implementation phase. The following are some common types of feasibility assessments:

1. Technical Feasibility: This assessment evaluates the technical aspects of the project, such as the availability of necessary resources and technology, the required skills and expertise, and the feasibility of implementing the proposed solution. It helps in determining if the project can be technically accomplished within the given constraints.

Read Also: How to Use the SMA Indicator: A Comprehensive Guide

2. Economic Feasibility: This assessment focuses on the financial aspects of the project, including the cost estimates, revenue projections, and potential return on investment (ROI). It helps in determining if the project is economically viable and if it can generate sufficient profits to justify the investment.

3. Market Feasibility: This assessment examines the market potential and demand for the proposed product or service. It involves analyzing the target market, competition, consumer behavior, and market trends. It helps in determining if there is a market for the product or service and if it can attract enough customers to sustain the business.

4. Legal and Regulatory Feasibility: This assessment evaluates the legal and regulatory requirements that may impact the project. It involves analyzing the laws, regulations, permits, licenses, and other compliance obligations that need to be fulfilled. It helps in determining if the project is feasible from a legal and regulatory standpoint.

5. Operational Feasibility: This assessment examines the operational aspects of the project, including the available resources, infrastructure, processes, and potential operational challenges. It helps in determining if the project can be successfully implemented and if it aligns with the existing operations of the organization.

By conducting these various types of feasibility assessments, organizations can have a comprehensive understanding of the potential risks, benefits, and challenges associated with a project or business idea. This information can then be used to make informed decisions and develop effective strategies for successful implementation.

Feasibility assessment is a process of evaluating the practicality and potential success of a proposed project or idea. It involves analyzing various factors such as economic, technical, operational, legal, and financial aspects to determine whether the project is viable.

Feasibility assessment is important because it helps in identifying the strengths and weaknesses of a proposed project and allows stakeholders to make informed decisions. It helps in avoiding risks and uncertainties by evaluating different options and selecting the most viable one.

The key elements of a feasibility assessment include market analysis, technical analysis, operational analysis, financial analysis, and legal analysis. Market analysis involves studying the demand, competition, and potential customers. Technical analysis focuses on the technical requirements and constraints. Operational analysis evaluates the resources and processes needed for the project. Financial analysis involves estimating the costs, revenues, and profitability. Legal analysis examines the legal and regulatory requirements.

Feasibility assessment is a preliminary evaluation of a project’s viability, whereas a business plan is a detailed document that outlines the goals, strategies, and financial projections for a specific business. Feasibility assessment helps in determining whether the project is worth pursuing, while a business plan provides a roadmap for executing the project.

Some common challenges in conducting a feasibility assessment include limited information or data, uncertainty about market conditions, inaccurate cost or revenue estimates, complexity of technical requirements, and legal or regulatory constraints. It is important to address these challenges by seeking expert advice, conducting thorough research, and reassessing the feasibility assessment as new information becomes available.

A feasibility assessment is a process of evaluating the practicality and potential success of a project or venture. It involves analyzing various factors such as cost, time, resources, and market demand to determine if the project is viable or not.

Is it possible to start forex trading with $5000? If you are interested in entering the world of forex trading, you may be wondering if it is possible …

Read ArticleStrategies for Protecting a Large Stock Position Investing in stocks can be a profitable venture, but it also comes with risks. If you have a large …

Read ArticleMoney Flow Index Indicator: How to Use It The Money Flow Index (MFI) is a popular technical indicator used by traders to analyze the momentum and …

Read ArticleTrading Crude Oil 24 Hours: What You Need to Know If you are interested in trading crude oil, it’s important to understand the trading hours for this …

Read ArticleIs Forex Trading Allowed in Finland? Forex trading, also known as foreign exchange trading, is a popular financial market activity that involves the …

Read ArticleHow long does it take to withdraw from LiteFinance? LiteFinance is a popular online financial platform that offers a wide range of services, including …

Read Article