The rule 115 for exchange rate: all you need to know

Understanding Rule 115: Exchange Rate Explained Introduction Exchange rates play a crucial role in the global economy. They determine the value of one …

Read Article

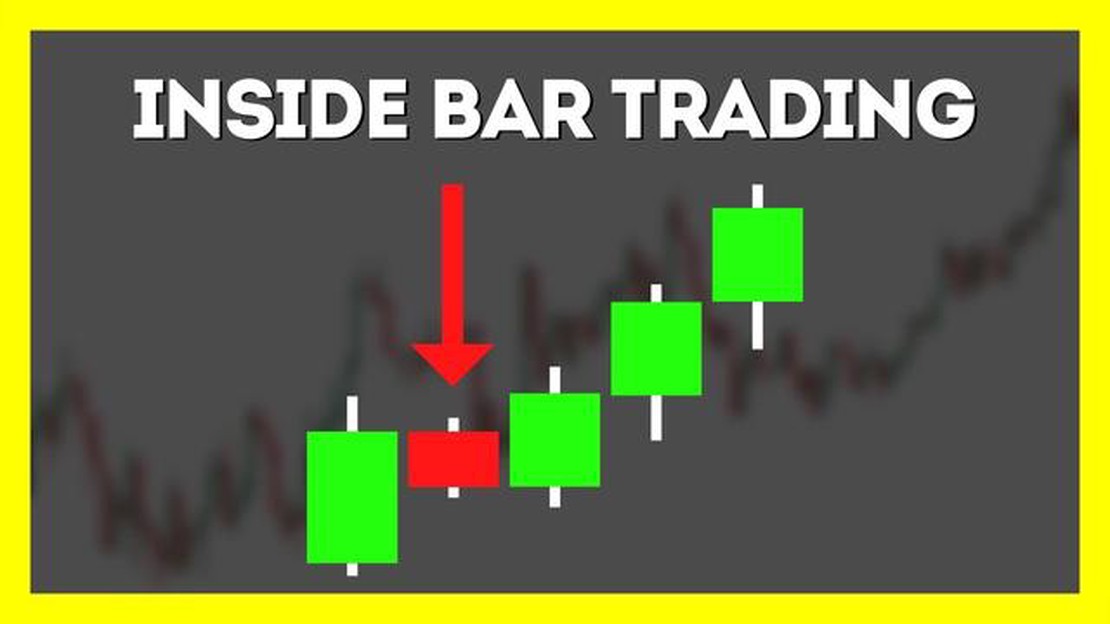

Inside bars are powerful candlestick patterns that can provide valuable insights into market trends and price action. This trading technique is widely used by both beginner and experienced traders to identify potential reversals or continuation patterns in the market.

An inside bar forms when the high and low of a candlestick are contained within the previous candlestick. In other words, the inside bar is completely engulfed by the previous bar. This pattern indicates a period of consolidation or indecision in the market as buyers and sellers are evenly matched.

Trading inside bars can be highly effective as it allows traders to time their entries and exits with greater precision. When an inside bar is followed by a breakout, it often signifies a strong trend reversal or continuation. By analyzing the location of the inside bar within the larger price structure and using additional technical indicators, traders can gain a clearer understanding of the market’s direction.

In this comprehensive guide, we will delve into the intricacies of inside bar trading. We will explore various strategies and techniques to effectively trade inside bars, including how to identify inside bars, set entry and exit points, manage risk, and interpret signals from other indicators.

Whether you are a beginner looking to learn the basics of inside bar trading or an experienced trader seeking to sharpen your skills, this guide will provide you with a complete roadmap to navigate the complexities of trading inside bars.

Inside bars are a commonly occurring candlestick pattern in technical analysis that can provide valuable insights into market trends and potential trading opportunities. They are characterized by a smaller bar or candlestick that is completely encompassed by the preceding larger bar, forming a “bar within a bar” pattern.

Inside bars typically indicate a period of consolidation or indecision in the market, as the trading range becomes narrower compared to previous bars. This consolidation phase can be seen as a pause in the market, where buyers and sellers are assessing the next direction of the price.

The significance of inside bars lies in their ability to act as a powerful signal for potential breakouts or reversals in the market. A breakout occurs when the price breaks above or below the high or low of the inside bar, indicating a potential continuation of the existing trend. On the other hand, a reversal occurs when the price breaks in the opposite direction of the existing trend, suggesting a possible trend reversal.

Inside bars can be particularly useful in identifying key levels of support and resistance, as they often form near these levels. When an inside bar forms near a support level, it can be a signal for a potential bounce off that level and the continuation of an uptrend. Similarly, when an inside bar forms near a resistance level, it can signal a potential reversal and the start of a downtrend.

Traders often use inside bars in conjunction with other technical indicators or patterns to confirm their trading decisions. For example, if an inside bar forms near a trendline or a moving average, it may provide a stronger indication of a potential breakout or reversal.

In conclusion, inside bars are a powerful tool in technical analysis that can provide valuable insights into market trends and potential trading opportunities. Understanding their significance and incorporating them into a trading strategy can help traders make more informed and successful trading decisions.

Read Also: Understanding Zig Zag Coding: Everything You Need to Know

An inside bar is a candlestick pattern that forms when the high and low of the current candle are within the high and low of the previous candle. This pattern indicates consolidation or indecision in the market, as the price is not making significant moves in either direction. Traders use inside bars to gain insight into potential future price movements and make informed trading decisions.

Identifying inside bars is relatively easy, as they have a distinct structure. Traders look for a candlestick that is completely engulfed by the previous candlestick, with its high and low contained within the range of the previous candle. The color of the candles does not matter; what matters is the positioning of the high and low relative to the previous candle. When an inside bar forms, it can be a signal that a breakout or reversal is imminent.

When analyzing inside bars, traders consider several factors to determine their potential significance. The first factor is the context in which the inside bar forms. Is it occurring at a key support or resistance level? Is there a trend in place that the inside bar could potentially reverse or continue? Understanding the broader market context is crucial in interpreting the potential outcomes of an inside bar pattern.

Traders also pay attention to the size of the inside bar compared to the previous bar. A smaller inside bar suggests that the consolidation or indecision is weaker, whereas a larger inside bar indicates stronger potential for a breakout or reversal. Additionally, traders look at the volume during the formation of the inside bar. Higher volume can indicate greater market participation and increase the likelihood of a significant price move.

Read Also: Understanding the Non-Zero Sum Game: Exploring the Dynamics of Stock Market

Another factor to consider is the length of time the inside bar pattern has been forming. The longer the consolidation, the stronger the potential breakout or reversal may be. Traders often use technical indicators or chart patterns in conjunction with inside bars to confirm their analysis and validate potential trading opportunities.

It’s essential to note that inside bars alone are not foolproof signals, and traders should use them in combination with other analysis techniques to make well-informed trading decisions. Risk management strategies are also crucial when trading inside bars, as breakouts can result in significant price movements in either direction.

In conclusion, identifying and analyzing inside bars can provide valuable insights into potential future price movements. By considering the context, size, volume, and formation time of inside bars, traders can make informed trading decisions and manage their risk effectively.

The inside bar trading technique is a popular trading strategy in which traders look for inside bars on a price chart to make trading decisions. An inside bar is a candlestick pattern where the high and low of a candle are completely inside the previous candle.

The inside bar trading technique works by identifying inside bars on a price chart and using them as signals for potential trading opportunities. Traders typically wait for the breakout of the inside bar’s range to determine the direction of the trade and set their entry and stop loss levels accordingly.

The inside bar trading technique has several advantages. First, it can be used in any market and timeframe, making it versatile for different trading styles. Second, it provides clear entry and stop loss levels, which can help traders manage risk. Finally, it often leads to high probability trades and can be used as part of a larger trading strategy.

While the inside bar trading technique can be effective, it is not foolproof and does have some limitations. One limitation is that it may result in false signals or whipsaws in choppy or ranging markets. Additionally, it requires patience and discipline to wait for high-quality inside bars and avoid overtrading.

To incorporate the inside bar trading technique into your trading strategy, you can start by learning to identify inside bars on price charts. Once you spot an inside bar, wait for the breakout of its range and use that as a signal to enter a trade. Make sure to set your entry, stop loss, and take profit levels based on the price action and market conditions.

An inside bar is a price bar on a chart that is completely contained within the price range of the previous bar. It represents a period of consolidation or indecision in the market.

To identify an inside bar pattern, you need to look for a price bar that has a lower high and a higher low than the previous bar. This indicates that the price has consolidated within the range of the previous bar.

Understanding Rule 115: Exchange Rate Explained Introduction Exchange rates play a crucial role in the global economy. They determine the value of one …

Read ArticleHow Does Xe com Make Money? Xe com is a popular online platform that provides currency exchange and international money transfer services. It offers …

Read ArticleUnderstanding the Fair Price of an Option Contract An option contract is a financial instrument that grants the holder the right, but not the …

Read ArticleUnderstanding the concept of a forex photo Forex photography is a specialized genre that captures the world of currency trading in beautiful and …

Read ArticleIs there a Forex.com app available for trading? When it comes to trading on the foreign exchange market, having access to a reliable and convenient …

Read ArticleConvert 100,000 USD to HKD Are you planning a trip to Hong Kong and wondering how much your 100,000 USD is worth in HKD? Look no further! We’ve got …

Read Article