Beginner's Guide: How to Start Forex Trading

Beginner’s Guide: How to Start in the Forex Market Forex trading, also known as foreign exchange trading, is a decentralized market where currencies …

Read Article

The foreign exchange market, also known as Forex, is a global decentralized market where currencies are traded. It operates 24 hours a day, five days a week, and is the largest financial market in the world. Accurate and timely forex quotes are crucial for traders to make informed decisions, analyze market trends, and execute trades effectively.

Quoting forex is the process of providing the current exchange rate for a currency pair. It involves two prices: the bid price, which represents the price at which traders are willing to sell a currency, and the ask price, which represents the price at which traders are willing to buy a currency. The difference between the bid and ask prices is known as the spread.

In order to properly quote forex, market participants rely on various sources. These sources include global banks, financial institutions, electronic brokerage platforms, and forex market makers. These entities use sophisticated technology and algorithms to aggregate and disseminate real-time forex quotes to traders and other market participants.

It is important for traders to have access to reliable and accurate forex quotes. Any discrepancies or delays in the quoted prices can lead to significant losses or missed trading opportunities. Therefore, it is crucial for traders to choose a reputable forex broker or platform that provides reliable and up-to-date market quotes.

Additionally, traders should be aware of the factors that can influence forex quotes. Economic indicators, such as interest rates, inflation, and geopolitical events, can have a significant impact on currency values. Traders should stay informed about these factors and regularly monitor the market to adjust their trading strategies accordingly.

In conclusion, properly quoting forex is essential for traders to make informed decisions and execute successful trades. Reliable and accurate forex quotes are necessary to analyze market trends, identify trading opportunities, and manage risk effectively. Traders should choose a reputable forex broker or platform and stay informed about the factors that can influence currency values.

When it comes to trading in the foreign exchange market, understanding forex quotes is essential. Forex quotes provide vital information for traders to make informed decisions and execute trades. In this guide, we will break down the basics of forex quotes and how they are used in currency trading.

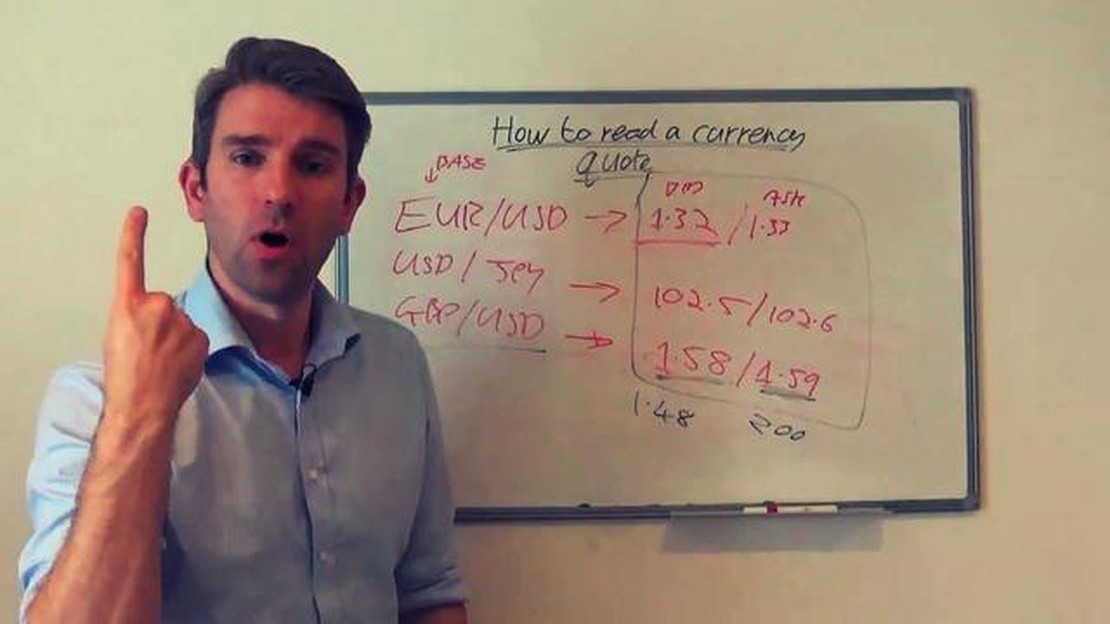

A forex quote consists of two parts: the currency pair and the exchange rate. The currency pair represents the two currencies involved in the trade, and the exchange rate shows the value of one currency relative to the other.

For example, in the currency pair EUR/USD, the base currency is the Euro (EUR), and the quote currency is the US Dollar (USD). The exchange rate indicates how much of the quote currency is needed to buy one unit of the base currency.

In a forex quote, there are two types of prices: the bid price and the ask price. The bid price is the price at which buyers are willing to purchase the base currency, while the ask price is the price at which sellers are willing to sell the base currency.

The bid price is always lower than the ask price, creating a spread between the two. This spread represents the cost of trading and is usually expressed in pips, which are the smallest unit of price movement in the forex market.

Forex quotes are typically displayed in a two-sided quote format, showing both the bid and ask prices. For example, a forex quote for the EUR/USD currency pair may appear as:

Bid/Ask: 1.2150/1.2155

Here, the bid price is 1.2150, and the ask price is 1.2155. Traders can buy the base currency at the ask price and sell it at the bid price.

It is important to note that forex quotes are dynamic and constantly changing as currency prices fluctuate in the market. These changes reflect the demand and supply for each currency and are influenced by various factors such as economic indicators, geopolitical events, and market sentiment.

By understanding forex quotes and how they are presented, traders can effectively analyze market trends, identify trading opportunities, and manage their risk. It is crucial for traders to stay up to date with real-time forex quotes and use them as a fundamental tool in their trading strategies.

In conclusion, understanding the basics of forex quotes is essential for any trader in the forex market. By grasping the concept of currency pairs, exchange rates, bid/ask prices, and spreads, traders can navigate the forex market with confidence and make informed trading decisions.

Read Also: Beginner's Guide: How to Start Investing in Foreign Exchange Markets

Forex quotes, also known as currency quotes or foreign exchange rates, represent the prices at which currencies are traded in the forex market. They are expressed as a pair of currency symbols, such as EUR/USD or GBP/JPY, where the first currency is the base currency and the second currency is the quote currency.

Forex quotes are important because they provide essential information for traders and investors. They show the relative value of one currency against another, allowing participants to determine the exchange rate at which they can buy or sell a specific currency. This information is crucial for making informed trading decisions and managing currency risk.

Read Also: Step-by-Step Guide: How to Run MT4 on VPS for Enhanced Trading Performance

Forex quotes are constantly changing due to the dynamic nature of the forex market. They are influenced by various factors, including economic indicators, geopolitical events, central bank policies, and market sentiment. Traders and investors closely monitor forex quotes to identify potential trading opportunities and gauge market trends.

It is important to note that forex quotes are typically provided by financial institutions, such as banks and brokerage firms, and can vary slightly between different sources. Therefore, it is essential to use reliable and accurate sources of forex quotes to ensure the validity of the information being used for trading purposes.

In summary, forex quotes are the prices at which currencies are traded in the forex market. They play a crucial role in determining exchange rates and provide valuable information for traders and investors. By staying up-to-date with forex quotes, market participants can make informed decisions and capitalize on potential opportunities in the global currency market.

When trading forex, it is crucial to understand how to read and interpret forex quotes. Forex quotes are the prices at which currencies are bought and sold on the foreign exchange market. They typically consist of two prices: the bid price and the ask price.

The bid price is the price at which you can sell the base currency, while the ask price is the price at which you can buy the base currency. The base currency is the first currency listed in the forex pair, and the second currency is known as the quote currency.

Forex quotes are usually displayed in a format similar to this: EUR/USD 1.1800/1.1805. In this example, the base currency is the Euro (EUR), and the quote currency is the US Dollar (USD). The bid price is 1.1800, and the ask price is 1.1805.

When reading forex quotes, it is important to understand that the bid price is always lower than the ask price. The difference between the bid and ask prices is known as the spread. The spread represents the cost of trading and is how brokers make money.

It is also worth noting that forex quotes are constantly changing as currency prices fluctuate. These changes are known as pip movements. A pip is the smallest unit of measurement for currency movements, and it represents the fourth decimal place in most currency pairs.

For example, if the EUR/USD pair moves from 1.1800 to 1.1801, it has moved one pip. If it moves from 1.1800 to 1.1810, it has moved 10 pips. Traders use pip movements to determine their profit or loss on a trade.

To interpret forex quotes, it is important to pay attention to the direction of the prices and the spread. If the bid price is higher than the ask price, it may indicate a potential buying opportunity. Conversely, if the ask price is higher than the bid price, it may indicate a potential selling opportunity.

In conclusion, reading and interpreting forex quotes is essential for successful trading. Understanding the bid and ask prices, the spread, and pip movements will help you make informed trading decisions and maximize your potential profits.

Forex quoting refers to the process of displaying the current exchange rate between two currencies. It involves providing bid and ask prices for a currency pair, which shows the price at which traders can buy or sell a particular currency.

Properly quoting Forex is important because it ensures accurate and transparent pricing in the foreign exchange market. It allows traders to make informed decisions based on reliable information and helps maintain fairness and efficiency in currency trading.

Forex quotes are typically displayed as a currency pair, with the base currency on the left and the quote currency on the right. The bid price, which represents the price at which traders can sell the base currency, is usually displayed on the left, while the ask price, which represents the price at which traders can buy the base currency, is displayed on the right.

A spread in Forex quoting refers to the difference between the bid and ask price of a currency pair. It represents the cost of trading and is typically measured in pips. A narrower spread indicates a more liquid market, while a wider spread may suggest lower liquidity or higher volatility.

No, Forex quotes may vary slightly across different brokers due to factors such as liquidity providers, market conditions, and trading platforms. However, the differences are usually minimal and are not significant enough to affect trading decisions or profitability for most traders.

Beginner’s Guide: How to Start in the Forex Market Forex trading, also known as foreign exchange trading, is a decentralized market where currencies …

Read ArticleWhat is the easiest forex trading platform? Forex trading can seem overwhelming to beginners, with its complex charts, endless analysis, and frequent …

Read ArticleIs Forex Trading Available 7 Days a Week? Forex trading, also known as foreign exchange trading, is a global decentralized market where the world’s …

Read ArticleBest 5 Minute MACD Settings When it comes to successful trading, finding the right settings for technical indicators can make all the difference. One …

Read ArticleUnderstanding Future and Option Trading Welcome to our exclusive guide on future and option trading! In this article, we will delve deep into the …

Read ArticleIs it possible to trade FX in China? China, known for its booming economy and global trade influence, has a significant impact on the global foreign …

Read Article