Understanding the Key Differences between Options and Common Stock

Options vs Common Stock: Understanding the Key Differences When it comes to investing in the stock market, it’s important to understand the key …

Read Article

When trading in the foreign exchange market (forex), one of the most important aspects is understanding and interpreting quotes. Forex quotes are the prices at which currencies are traded, and they provide valuable information for traders.

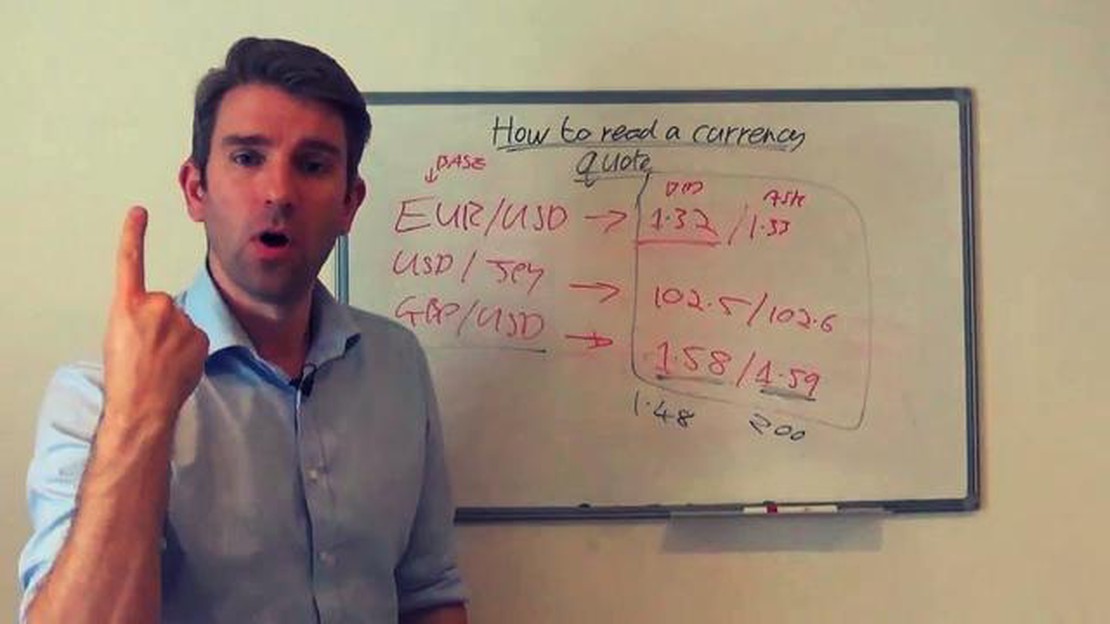

In the forex market, currencies are always traded in pairs. The first currency in the pair is called the base currency, and the second currency is called the quote currency. The quote represents the value of the base currency in terms of the quote currency. For example, in the EUR/USD pair, the euro is the base currency, and the US dollar is the quote currency.

Forex quotes are typically displayed as a bid price and an ask price. The bid price is the price at which traders are willing to buy the base currency, while the ask price is the price at which traders are willing to sell the base currency. The difference between the bid and ask price is known as the spread, and it represents the cost of trading.

When interpreting forex quotes, it’s important to pay attention to both the bid and ask prices, as well as the spread. The bid price is the price at which you can sell the base currency, and the ask price is the price at which you can buy the base currency. The spread indicates the liquidity and volatility of the currency pair, with lower spreads indicating higher liquidity and lower volatility.

In conclusion, interpreting quotes in the forex market is crucial for successful trading. By understanding the bid and ask prices, as well as the spread, traders can make informed decisions and take advantage of opportunities in the market. It’s important to stay updated with real-time quotes and regularly monitor the forex market to stay ahead of the game.

When trading in the Forex market, it is important to have a good understanding of how market quotes work. Forex market quotes are the prices at which one currency is exchanged for another currency. These quotes are constantly changing as currencies are traded in the global market.

Forex market quotes are typically given in pairs. A currency pair consists of two currencies, with the first currency being the base currency and the second currency being the quote currency. For example, in the EUR/USD currency pair, the euro (EUR) is the base currency, and the U.S. dollar (USD) is the quote currency.

There are two types of market quotes: the bid price and the ask price. The bid price is the price at which a trader can sell the base currency, and the ask price is the price at which a trader can buy the base currency. The bid price is always lower than the ask price, and the difference between these two prices is known as the spread.

Forex market quotes are typically displayed in a table format, with the bid price on the left and the ask price on the right. Traders can see both prices and decide whether to buy or sell a currency based on this information. It is important to note that the bid and ask prices are always changing, so traders need to be able to react quickly to market movements.

| Bid Price | Ask Price |

|---|---|

| 1.2345 | 1.2347 |

When interpreting market quotes, it is also important to consider the size of the trade. The size of the trade can affect the bid and ask prices, as larger trades may result in more favorable prices. Traders should also consider any fees or commissions that may be charged when buying or selling currencies.

In conclusion, understanding Forex market quotes is essential for successful trading in the Forex market. By understanding how market quotes work and how to interpret them, traders can make more informed decisions and increase their chances of making profitable trades.

Read Also: Forex Session Times in Zimbabwe: Find the Best Trading Hours

Forex market quotes, also known as exchange rates, are the prices at which one currency can be exchanged for another in the foreign exchange market. They represent the value of one currency relative to another and are expressed as a ratio or a rate.

Forex market quotes are constantly changing as the market is open 24 hours a day, five days a week. The fluctuations in exchange rates are influenced by various factors, such as economic indicators, geopolitical events, and market sentiment.

Read Also: Learn about the 2 Supertrend strategy that maximizes your trading profits

Forex market quotes typically consist of two prices: the bid price and the ask price. The bid price is the price at which traders are willing to sell a currency, while the ask price is the price at which traders are willing to buy a currency. The difference between the bid and ask prices is called the spread.

Forex market quotes are commonly displayed in currency pairs, such as EUR/USD or GBP/JPY. The first currency in the pair is called the base currency, and the second currency is called the quote currency. The exchange rate indicates how much of the quote currency is needed to buy one unit of the base currency.

Traders and investors use forex market quotes to analyze market trends, make trading decisions, and manage risk. They monitor changes in exchange rates to identify potential opportunities for profit. By interpreting forex market quotes, traders can determine whether a currency is strengthening or weakening and make informed trading strategies.

In conclusion, forex market quotes are essential for understanding the value of one currency relative to another in the foreign exchange market. They provide valuable information for traders and investors to make informed decisions and navigate the dynamic forex market.

When it comes to trading in the forex market, understanding and interpreting quotes is essential. Quotes represent the exchange rate between two currencies and are constantly changing, reflecting the supply and demand dynamics in the market. Here are some key points to keep in mind when reading and interpreting forex market quotes:

By understanding and interpreting forex market quotes, traders can make informed decisions about when to enter or exit positions, manage risk, and capitalize on trading opportunities. It is important to stay updated with real-time quotes and use technical analysis tools to analyze market trends and patterns to make informed trading decisions.

Quotes in the Forex market represent the exchange rate between two currencies. They indicate how much of one currency is required to buy one unit of another currency. These quotes are essential for traders as they provide crucial information for making trading decisions.

Forex quotes are usually displayed as a pair of currencies, with the base currency on the left and the quote currency on the right. For example, in the pair EUR/USD, the euro is the base currency and the US dollar is the quote currency. The quote shows the amount of quote currency needed to buy one unit of the base currency.

The bid price in Forex quotes is the price at which the market is willing to buy the base currency. It is the highest price that a buyer is currently willing to pay for the currency. Traders who want to sell a currency pair would receive the bid price.

The ask price in Forex quotes is the price at which the market is willing to sell the base currency. It is the lowest price that a seller is currently willing to accept for the currency. Traders who want to buy a currency pair would pay the ask price.

Traders can use Forex quotes to identify market trends by analyzing price movements over time. By comparing the bid and ask prices, traders can determine if the market is trending upwards (bullish) or downwards (bearish). Additionally, the spread between the bid and ask price can indicate the liquidity and volatility of the market.

Options vs Common Stock: Understanding the Key Differences When it comes to investing in the stock market, it’s important to understand the key …

Read ArticleWhat is the best forex price alert app for iPhone? If you’re a Forex trader and use an iPhone, having access to reliable price alerts is crucial for …

Read ArticleDo I pay tax on vested shares in Australia? Vested shares are a common form of employee remuneration in Australia. As employees work for a company, …

Read ArticleImpact of Option Trading on Index Price Option trading plays a critical role in influencing the overall price movement of stock market indices. As …

Read ArticleWhat is the 5-8-13 EMA crossover strategy? The EMA crossover strategy is a popular technical analysis tool used by traders to identify potential trend …

Read ArticleTrading forex with the stochastic indicator Are you looking to maximize your profits in the forex market? One way to do this is by utilizing the …

Read Article