What is the official name of Toronto Stock Exchange? - Explained

What is the Toronto Stock Exchange called? The Toronto Stock Exchange (TSX) is Canada’s largest stock exchange and one of the world’s leading stock …

Read Article

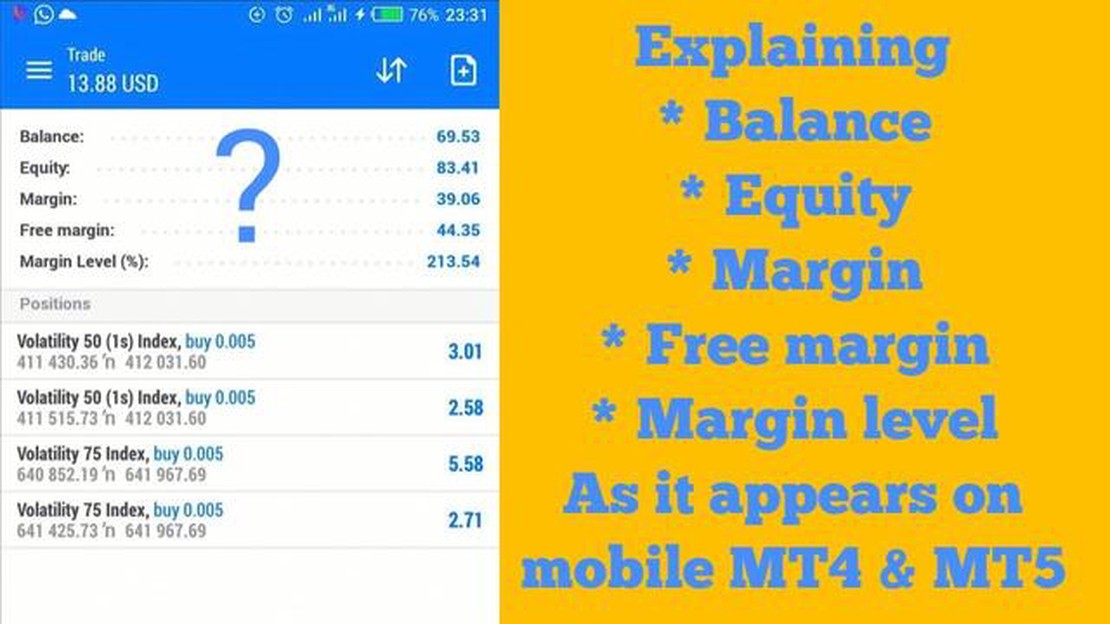

Trading in financial markets can be a lucrative venture, but it is also important to understand the concept of margin before diving into the world of trading. Margin is essentially a loan provided by your broker, allowing you to trade with more funds than you actually have in your account. It acts as a collateral for the broker, ensuring that they can cover any potential losses you might incur.

Free margin, on the other hand, refers to the amount of funds you have available to open new positions or sustain existing ones. It is calculated by deducting the margin used for open positions from your account balance. This is an important metric to monitor, as it determines your ability to take on new trades and manage risk effectively.

Calculating free margin and margin is a straightforward process. To determine the margin requirement for a specific trade, you need to know the leverage at which you are trading and the size of your trade. By multiplying the trade size by the leverage, and then converting it to the base currency of your account, you can calculate the margin required for that trade.

For example, let’s say you are trading with a leverage of 1:100 and you want to open a position of 1 lot (100,000 units) on a currency pair. If the base currency of your account is USD, and the current exchange rate for the currency pair is 1.1000, the margin required would be calculated as follows:

1 lot * 100,000 units * 1.1000 / 100 = 1,100 USD.

Once you have calculated the margin required for a trade, you can deduct it from your account balance to determine your free margin. Monitoring your free margin is crucial, as it indicates the amount of funds you have available for trading. It is important to maintain a sufficient amount of free margin to sustain your trades and avoid margin calls, which occur when your account balance falls below the required margin level.

By understanding how to calculate free margin and margin, you can better manage your trading account and make informed decisions when entering trades. Remember to always consider your risk tolerance and ensure that you have enough free margin to sustain your trades and manage potential losses.

When it comes to trading in the financial markets, it is essential to understand the concept of free margin. Free margin is the amount of money that is available in a trader’s account to open new positions or absorb potential losses.

Free margin is calculated by subtracting the used margin from the account equity. The used margin, on the other hand, refers to the amount of money that is currently being used to maintain open positions. It acts as a form of collateral for trades and protects brokers from potential losses.

Having a good understanding of free margin is crucial because it determines the level of risk a trader can take. If the free margin in an account is low, it means that the trader has used a significant portion of their available funds to maintain open positions. This leaves little room for new trades or absorbing losses.

On the other hand, if the free margin is high, it indicates that the trader has a larger portion of their funds available to open new positions or withstand potential losses. This provides more flexibility and allows traders to take advantage of market opportunities.

To calculate the free margin, one can use the formula:

Free Margin = Equity - Used Margin

Where:

It is important to monitor the free margin closely, especially during volatile market conditions. Sudden market movements can lead to increased margin requirements or even margin calls, which can result in the closure of positions if there is not enough free margin to support them.

Traders should always strive to maintain a healthy level of free margin to ensure they can handle market fluctuations and take advantage of trading opportunities.

Read Also: Is MT5 legal in the US? Exploring the legality and regulations surrounding MT5 trading in the United States

In conclusion, understanding free margin is vital for any beginner trader. It determines the risk level and flexibility in opening new positions or absorbing potential losses. By keeping a close eye on the free margin, traders can manage their accounts effectively and make informed trading decisions.

Free Margin is the amount of funds that is available in a trading account and can be used to open new positions or absorb any potential losses. It is calculated by subtracting the margin currently used for open positions from the account equity.

Equity can be defined as the current value of the account, considering both the unrealized profit or loss from open positions and any remaining cash balance.

Free Margin is an important concept in trading as it determines the amount of funds available for trading new positions. It is crucial to monitor the free margin level, as it directly affects a trader’s ability to take on additional trades or withstand potential losses.

Read Also: Is FxPro a trusted broker? Find out in our review and analysis.

If the free margin falls below a certain level, it may result in a margin call, which is a request from the broker for the trader to deposit additional funds or close some positions to maintain the required margin level.

Understanding and managing free margin is fundamental to effective risk management in trading, as it helps traders to avoid excessive leverage and potential margin calls.

Calculating the free margin in trading is an essential step in managing your investment and understanding your available funds. The free margin represents the amount of money that you have available to enter into new trades or cover any potential losses. To calculate the free margin, you need to know the following three values:

2. Used Margin: This is the portion of your account equity that is currently being used to maintain open positions.

3. Margin Level: This is the ratio of equity to used margin, expressed as a percentage. It shows how close your account is to a margin call or a stop-out level.

2. Used Margin: This is the portion of your account equity that is currently being used to maintain open positions.

3. Margin Level: This is the ratio of equity to used margin, expressed as a percentage. It shows how close your account is to a margin call or a stop-out level.

Once you have these three values, you can calculate the free margin using the following formula:

Free Margin = Account Equity - Used Margin

By subtracting the used margin from the account equity, you will get the free margin, which represents the amount of money you have available to open new positions. It is important to maintain a sufficient free margin to avoid a margin call and potential liquidation of your positions.

Monitoring your free margin is crucial for risk management and making informed trading decisions. It allows you to assess your available resources and adjust your trading strategy accordingly. Remember that free margin can fluctuate as a result of changes in your account equity or used margin.

Calculating and monitoring your free margin regularly can help you maintain control of your trading account and ensure that you have enough funds to sustain your positions and take advantage of new trading opportunities.

Free margin in trading refers to the amount of money that is available in a trading account for opening new positions. It is calculated by subtracting the used margin from the account equity.

To calculate the free margin in your trading account, you need to deduct the used margin from the account equity. The formula for calculating free margin is: Free Margin = Equity - Used Margin.

Margin in trading is the amount of money that a trader needs to deposit in their trading account in order to open and maintain a trading position. It is used as collateral to cover potential losses that may occur in trades.

Margin in trading is calculated by dividing the total value of the open positions by the leverage ratio. The formula for calculating margin is: Margin = (Total Value of Open Positions) / Leverage Ratio.

What is the Toronto Stock Exchange called? The Toronto Stock Exchange (TSX) is Canada’s largest stock exchange and one of the world’s leading stock …

Read ArticleWhat happens to options on ex-dividend date? Options are derivative financial instruments that give traders the right, but not the obligation, to buy …

Read ArticleIs Forex Trading Permissible in Islam? Forex trading has become increasingly popular in recent years, with millions of people around the world …

Read ArticleEffective Strategies for Advertising Binary Options In an increasingly competitive market, advertising binary options requires a strategic approach. …

Read ArticleNumber of Employees at Kayak Kayak, the popular travel search engine, has a substantial workforce that contributes to its success in the online travel …

Read ArticleGoldman Sachs Trading Platform: What You Need to Know Goldman Sachs, one of the world’s largest investment banks, has a powerful and sophisticated …

Read Article