Understanding the 5 Year Rule for Backdoor Roth IRAs

The 5 Year Rule for Backdoor Roth IRAs When it comes to retirement planning, maximizing your savings is essential. One strategy that many high-income …

Read Article

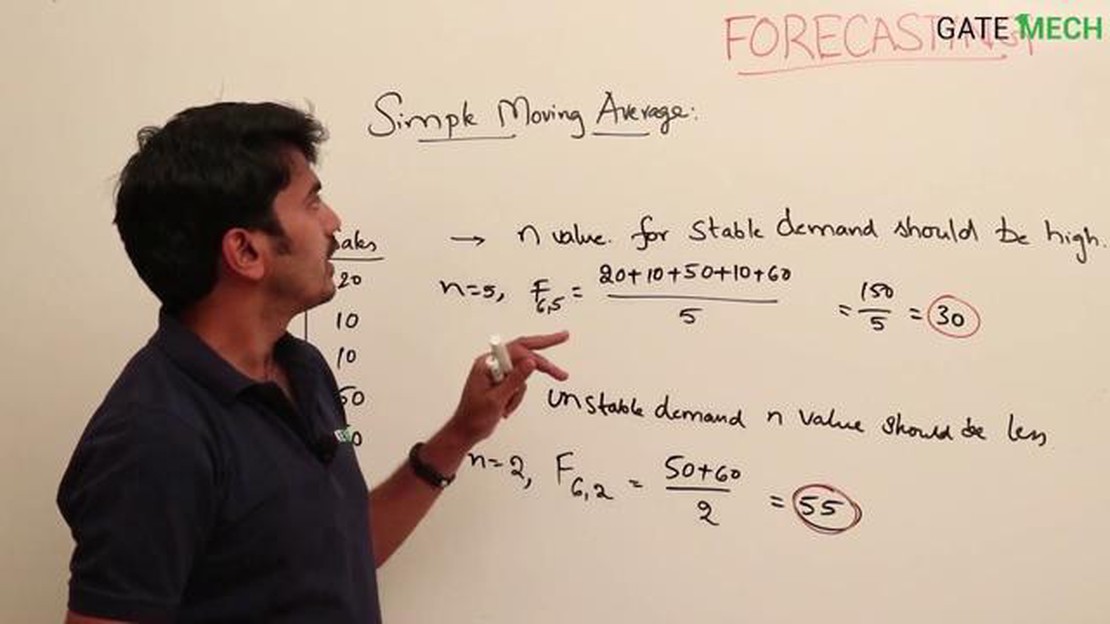

Simple moving averages are widely used in technical analysis to identify trends and make predictions in the financial markets. They are calculated by adding up a specific number of data points and dividing the sum by the number of points. However, accurately predicting simple moving averages can be a challenging task.

One approach to predicting simple moving averages is to analyze historical data and identify patterns or trends. By studying the past performance of an asset or security, traders can gain insights into how it is likely to behave in the future. This analysis can involve looking at the overall trend, as well as any smaller fluctuations or cycles.

Another method of predicting simple moving averages is to use technical indicators or mathematical formulas. These tools help traders analyze data and identify potential trends or reversals. For example, the moving average convergence divergence (MACD) indicator can be used to predict changes in the trend by comparing two moving averages with different periods.

It is important to note that predicting simple moving averages is not an exact science. The financial markets are influenced by a wide range of factors, including economic conditions, political events, and investor sentiment. As a result, there will always be a degree of uncertainty inherent in any prediction. Traders should use multiple indicators and analysis techniques to increase the accuracy of their predictions and make informed decisions.

“In the world of trading, accuracy in predicting simple moving averages is a valuable skill. While it may be challenging, with the right tools and strategies, traders can increase their chances of making successful predictions and profiting from the financial markets.”

A simple moving average (SMA) is a commonly used technical analysis tool that helps traders and investors analyze market trends and predict future price movements. It is a calculation that takes the average price of a security over a specified number of periods.

To calculate a simple moving average, you add up the closing prices of a security for a specified number of periods and divide the sum by the number of periods. For example, if you want to calculate the 10-day simple moving average of a stock, you would add up the closing prices of the stock for the past 10 days and divide the sum by 10.

Simple moving averages are used to smooth out short-term fluctuations in price and identify trends. They can be used for various timeframes, such as days, weeks, or months, depending on the trader’s or investor’s preferred timeframe.

Traders and investors use simple moving averages in different ways. One common method is to use multiple moving averages with different timeframes, such as a 50-day SMA and a 200-day SMA, to identify potential buy or sell signals. When the shorter-term SMA crosses above the longer-term SMA, it may be a bullish signal, indicating a potential upward trend. On the other hand, when the shorter-term SMA crosses below the longer-term SMA, it may be a bearish signal, indicating a potential downward trend.

Simple moving averages can also act as support or resistance levels. If the price of a security is above its SMA, it may act as a support level, indicating that the price is likely to bounce back up if it falls. If the price is below its SMA, it may act as a resistance level, indicating that the price is likely to face selling pressure if it rises.

Read Also: Is Security Bank the same as Security Bank and Trust Company?

It is important to note that simple moving averages are just one tool among many in technical analysis, and they have their limitations. They are based on historical data and may lag behind current market conditions. Traders and investors should use them in conjunction with other indicators and tools to make well-informed trading decisions.

A simple moving average (SMA) is a widely used technical analysis tool that helps traders and investors identify trends in financial markets. It is a calculation that allows analysts to smooth out price data over a specified period of time, providing a clearer picture of the underlying trend.

To calculate a simple moving average, you simply take the average of a specified number of previous closing prices. For example, a 10-day SMA would be calculated by adding up the closing prices of the past 10 days and dividing the sum by 10. Each day, a new closing price is added to the calculation, while the oldest closing price is discarded.

The SMA is often used to identify support and resistance levels, as well as to generate buy and sell signals. When the price of an asset is trading above its SMA, it is considered to be in an uptrend, while a price below the SMA indicates a downtrend. Traders may use these crossovers as entry and exit points for their trades.

While the SMA is a useful tool, it is important to note that it is a lagging indicator, meaning that it is based on historical price data. This means that it may not always accurately predict future price movements, especially in volatile markets. Traders and investors should use the SMA in conjunction with other technical analysis tools and indicators to make more informed trading decisions.

In conclusion, understanding simple moving averages is essential for any trader or investor looking to analyze trends in financial markets. By smoothing out price data over a specified period of time, the SMA allows for a clearer view of the underlying trend. However, it is important to remember that the SMA is a lagging indicator and should be used in conjunction with other tools and indicators for accurate predictions.

Predicting simple moving averages (SMA) is a valuable tool for investors and traders in analyzing market trends and making informed decisions. However, accuracy plays a crucial role in the effectiveness and reliability of these predictions.

An accurate prediction of SMAs helps investors understand the current market conditions and potential future trends. It provides them with key insights into when to buy or sell an investment, helping them maximize profits and reduce losses.

Read Also: Understanding the Distinction: Subjective vs. Objective Trading

Accuracy in predicting SMAs is essential because it allows investors to identify significant price levels and make well-timed decisions based on these levels. By accurately predicting SMAs, investors can determine support and resistance levels, which are vital in determining optimal entry and exit points for their trades.

In addition, accuracy in predicting SMAs helps investors identify trends and patterns in the market. By accurately predicting whether the SMA is increasing or decreasing over a specific time, investors can identify bullish or bearish trends and make appropriate investment decisions.

Furthermore, accuracy is essential in predicting SMAs to minimize the risks associated with false signals or noise. Inaccurate predictions may lead to false buy or sell signals, causing investors to make poor investment decisions and incur unnecessary losses.

Accurate predictions of SMAs also increase investors’ confidence in their trading strategies as they have a better understanding of the market’s behavior. It enables them to make well-informed decisions based on reliable data and analysis, increasing their chances of success in the market.

In conclusion, accuracy is crucial in predicting simple moving averages as it allows investors to make informed decisions, identify significant price levels, recognize trends, and minimize risks. By prioritizing accuracy in their predictions, investors can enhance their trading strategies and increase their chances of achieving profitable outcomes.

A simple moving average (SMA) is a calculation used to analyze data points by creating a series of averages over a specified period of time.

Accurately predicting simple moving averages can help traders and analysts make informed decisions about buying, selling, or holding assets. It provides insights into market trends and helps identify potential entry and exit points.

When predicting simple moving averages, it is important to consider the time period used for calculation, the underlying data points, and any specific patterns or trends in the data. Additionally, factors such as market conditions and the level of volatility can also affect the accuracy of the prediction.

Yes, there are several strategies and techniques that can improve the accuracy of simple moving average predictions. These include using multiple time periods for calculation, combining SMA with other technical indicators, and adjusting the calculation parameters based on historical data analysis.

The 5 Year Rule for Backdoor Roth IRAs When it comes to retirement planning, maximizing your savings is essential. One strategy that many high-income …

Read ArticleBest platform for stock trading in the Philippines Investing in the stock market is a great way to grow your wealth and secure your financial future. …

Read ArticleCompanies Affected by 9/11 Attacks The terrorist attacks on September 11, 2001, were a devastating event that shook the world. The attacks resulted in …

Read ArticleWhat is the share price of Lnkd? Welcome to our latest update on the share price of Lnkd! Lnkd is a leading social networking platform for …

Read ArticleUnderstanding the Concept of Indicators Indicators play a crucial role in our everyday lives. Whether we realize it or not, we encounter indicators in …

Read ArticleCurrent exchange rate of 1 USD in Azerbaijan If you are planning to travel to Azerbaijan or have any financial dealings with the country, it is …

Read Article