Everything you need to know about a forex broker | TopForex

What is a Forex Broker? When it comes to trading on the foreign exchange market, having a reliable forex broker is crucial. One such broker that has …

Read Article

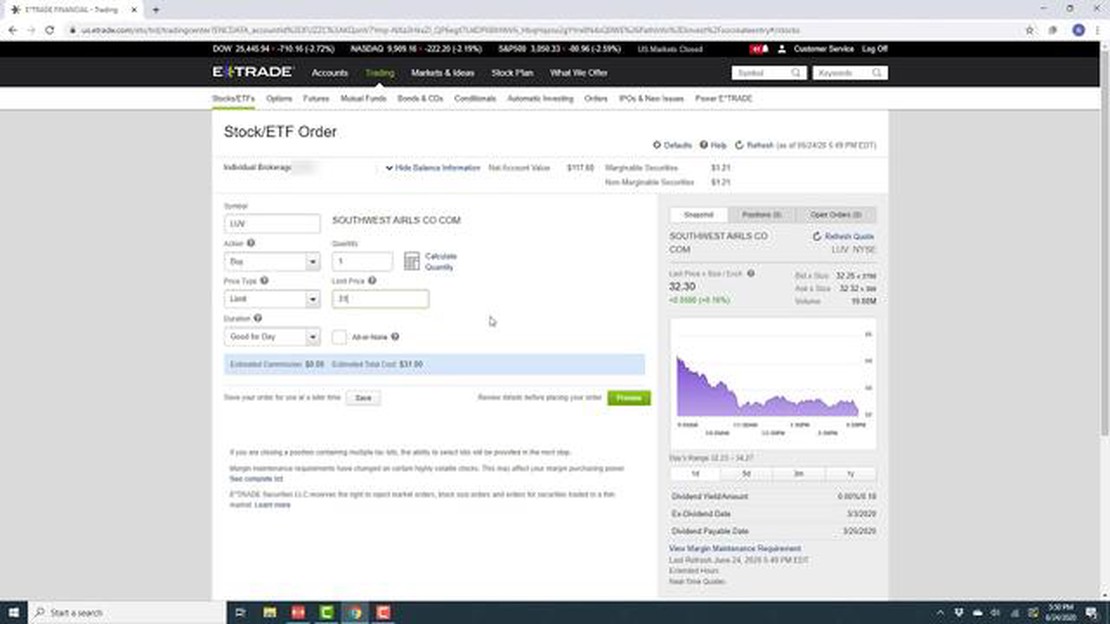

Trading in the stock market can be a lucrative endeavor, but timing is crucial. If you’re an Etrade user, you may be wondering how you can take advantage of extended trading hours to make the most of your investments. Fortunately, Etrade provides its users with the ability to trade outside of the standard market hours, allowing for increased flexibility and potential profits.

Extended trading hours, also known as after-hours trading, is the period of time before the market opens and after it closes. During this time, investors can place trades and react to news events that may affect their portfolios. By accessing extended trading hours on Etrade, you can seize opportunities that may arise outside of regular market hours, giving you a competitive edge.

To access extended trading hours on Etrade, follow these step-by-step instructions:

It’s important to note that while extended trading hours can provide more opportunities, they also come with increased risk. The volume of trades during this time is typically lower, which can result in wider bid-ask spreads and increased volatility. It’s essential to carefully research and assess the potential risks before engaging in after-hours trading on Etrade.

In conclusion, accessing extended trading hours on Etrade can be advantageous for investors looking to make the most of their trades. By following these simple steps and understanding the associated risks, you can unlock the potential of after-hours trading and take your investment strategy to the next level.

Etrade, a popular online brokerage platform, offers extended trading hours for its users. This means that you can place trades outside of the regular market hours, allowing you to take advantage of market opportunities that occur before or after the standard trading session.

Extended trading hours on Etrade typically begin at 4:00 AM Eastern Time and end at 8:00 PM Eastern Time. During this time, you will have access to pre-market and after-hours trading, where you can buy and sell securities on major exchanges such as the New York Stock Exchange and the NASDAQ.

It’s important to note that extended trading hours can be more volatile and may have lower liquidity compared to regular market hours. This is because there are fewer participants in the market during these times, which can result in larger price swings and wider bid-ask spreads.

Read Also: Can I use USD in Victoria BC? Know the Currency Accepted

To access extended trading hours on Etrade, follow these steps:

It’s important to note that not all securities may be available for trading during extended hours. Certain stocks, options, and other securities may have limitations or restrictions on trading outside of regular market hours. Additionally, be aware that Etrade may charge additional fees or commissions for extended hours trades.

Before participating in extended hours trading, it’s crucial to understand the risks involved and educate yourself on the potential impacts of trading during these hours. Consult with your financial advisor or do thorough research to ensure that extended hours trading aligns with your investment goals and risk tolerance.

Extended Trading Hours (ETH) refer to the expanded time period during which traders can buy and sell stocks on the Etrade platform. While regular trading hours typically occur between 9:30 am and 4:00 pm Eastern Time (ET), extended trading hours offer the opportunity to trade before the market opens and after it closes.

Etrade provides its customers with access to extended trading hours in order to cater to different trading strategies and accommodate individuals with busy schedules. It allows traders to react to news and events outside regular market hours, which in turn can impact stock prices.

There are two main sessions within extended trading hours on Etrade:

Read Also: Understanding Forex Liquidity Providers: How they Impact Trading and Market Stability

| Pre-Market Session | After-Hours Session |

|---|---|

| The pre-market session begins at 7:00 am and ends at 9:30 am ET. During this session, traders can place orders to buy or sell stocks before the regular market opens at 9:30 am. | The after-hours session starts from 4:00 pm and continues until 8:00 pm ET. Traders can place orders during this session to react to news or events released after the regular market closes. |

It is important to note that trading during extended hours carries certain risks. Market volatility tends to be higher, and liquidity may be lower compared to regular trading hours. Additionally, Etrade charges different commissions and fees for trading during extended hours, so it is crucial to understand the costs involved before placing trades.

Now that you have a better understanding of extended trading hours, you can proceed to the next step to learn how to access and trade during these hours on the Etrade platform.

Extended trading hours refer to the time outside of regular market hours when investors can trade stocks. It allows investors to buy or sell stocks before or after the normal session.

To access extended trading hours on Etrade, you need to have an Etrade account. Once you have an account, you can log in to the Etrade website or mobile app and place a trade during the extended hours.

Yes, there are some limitations to trading during extended hours on Etrade. Not all stocks are available for trading during these hours, and the liquidity and volatility of the market may be different from normal trading hours. It’s important to be aware of these limitations and the potential risks involved.

Trading during extended hours on Etrade can provide several benefits. It allows for more flexibility in managing your trades, and you may have an opportunity to react to news or events that occur outside of regular market hours. Additionally, there may be less competition during extended hours, which could result in better prices for your trades.

What is a Forex Broker? When it comes to trading on the foreign exchange market, having a reliable forex broker is crucial. One such broker that has …

Read ArticleUnderstanding the Fundamentals of Price Action Trading Price action trading is a popular and effective strategy used by many successful traders in the …

Read ArticleIs Forex Trading Legal in Malaysia? Foreign exchange trading, also known as forex trading, is a popular investment activity around the world. However, …

Read ArticleIs exchange rate API free? Exchange rate APIs have become an essential tool for businesses and developers looking to integrate real-time currency …

Read ArticleBest Day of the Week for Forex Trading When it comes to forex trading, timing can be crucial. Experienced traders know that different days of the week …

Read ArticleUnderstanding the Benefits of a Corporate Forex Card A corporate forex card is a type of prepaid card that is issued by a bank or financial …

Read Article