Understanding The S&P 500: What It Is and How It Works

Discover the S&P 500 and its Impact on the Stock Market The S&P 500 is a stock market index that measures the performance of the top 500 publicly …

Read Article

Doji is a popular candlestick pattern used in technical analysis to predict trend reversals. It is formed when the opening and closing prices of an asset are very close or equal, resulting in a small or no body, and a long upper and lower shadow. This pattern signifies indecision in the market, as buyers and sellers are in equilibrium, and can often lead to a reversal in the prevailing trend.

But how accurate is the Doji pattern in predicting trend reversals?

To answer this question, we need to delve deeper into the characteristics of Doji candlesticks. First, it’s important to note that Doji patterns can occur in various market conditions and timeframes, making their accuracy subject to interpretation. Traders often look for confirmation signals, such as previous trends, support and resistance levels, or other technical indicators, to validate the potential reversal indicated by a Doji.

While the Doji pattern can be a powerful tool in technical analysis, its accuracy alone may not be sufficient to base trading decisions on. It is always recommended to use other tools and indicators in conjunction with the Doji pattern to increase the probability of accurate predictions.

Overall, the Doji candlestick pattern can provide valuable insights into market sentiment and potential trend reversals. However, it is crucial for traders to analyze other factors and confirmations before making trading decisions solely based on the Doji pattern. By combining multiple indicators and patterns, traders can enhance their accuracy and make more informed trading decisions.

The Doji candlestick is a commonly used tool in technical analysis to identify potential reversals in stock price movements. It is characterized by its small real body, indicating a close price that is very close to the open price, and often signals indecision or a potential trend reversal.

Traders and analysts rely on the accuracy of Doji candlestick patterns to make informed decisions about when to buy or sell a particular security. The accuracy of a Doji candlestick can vary depending on the context in which it appears and the confirmation from other technical indicators or patterns.

While Doji candlesticks can be reliable indicators of potential reversals, they are not foolproof and should be used in conjunction with other forms of technical analysis. False signals can occur if the Doji candlestick is not confirmed by other indicators or if it appears in a trendless or choppy market.

It is important for traders to understand the limitations of Doji candlesticks and to use them as just one piece of the puzzle in their overall trading strategy. They should be used in combination with other technical tools such as trendlines, support and resistance levels, and volume indicators to increase the accuracy of their analysis.

Additionally, the accuracy of Doji candlestick patterns can be enhanced by considering the overall market conditions and the timeframe being analyzed. For example, a Doji pattern that appears on a daily chart may carry more weight than one that appears on an intraday chart. Similarly, a Doji pattern that appears after a prolonged uptrend may have more significance than one that appears in a sideways market.

Read Also: Understanding Derivatives in Forex: A Comprehensive Guide

In conclusion, the accuracy of Doji candlestick patterns in technical analysis depends on several factors, including confirmation from other indicators, the market context, and the timeframe analyzed. While they can be valuable tools in identifying potential reversals or indecision in stock price movements, they should be used in combination with other forms of analysis for maximum effectiveness.

The doji candlestick pattern is a popular tool used in technical analysis to understand market trends and potential reversals. It is known for its distinct appearance, with a small body and long shadows on both ends. The doji represents a state of indecision in the market, where the supply and demand forces are in equilibrium.

When the open and close prices of a candlestick are the same or very close, a doji is formed. The length of the shadows can vary, but they should be relatively longer compared to the body of the candlestick. This pattern indicates that buyers and sellers are equally matched, resulting in a period of market stagnation.

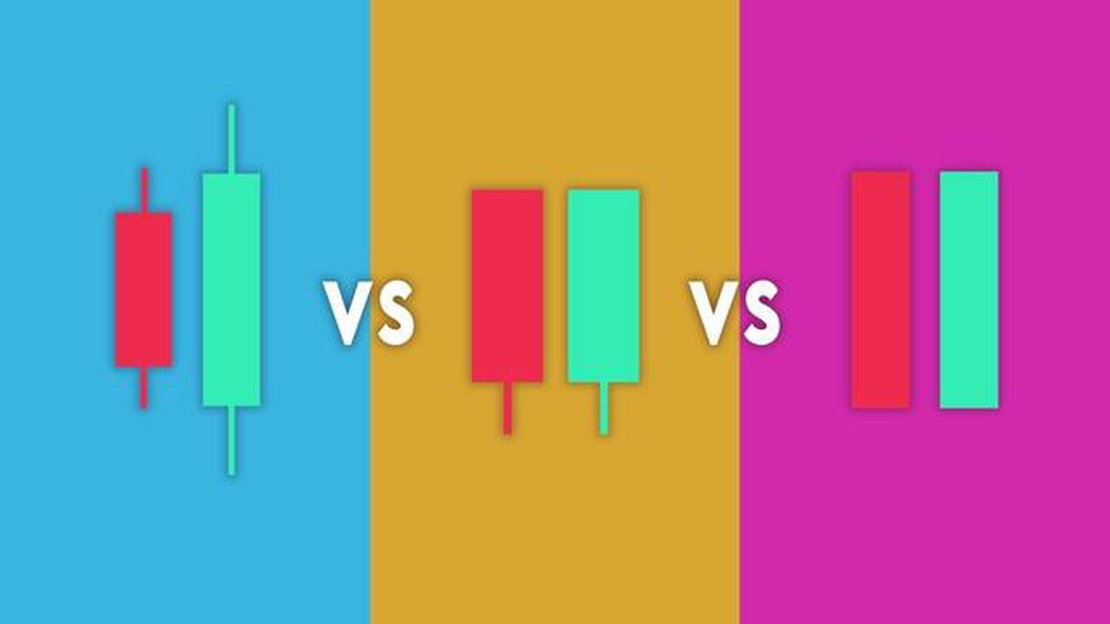

There are different types of doji candlestick patterns, including the long-legged doji, dragonfly doji, gravestone doji, and four price doji. Each type has its own characteristics and implications.

The long-legged doji has long upper and lower shadows, indicating high levels of volatility and uncertainty in the market. It suggests that neither buyers nor sellers were able to gain control during the trading session.

The dragonfly doji has a long lower shadow and no upper shadow, resembling a dragonfly. It is a bullish signal, indicating that sellers tried to push the price lower but were unable to maintain control, resulting in a potential reversal in the market.

The gravestone doji has a long upper shadow and no lower shadow, resembling a gravestone. It is a bearish signal, indicating that buyers tried to push the price higher but were unable to maintain control, signaling a potential reversal.

The four price doji has the open, close, high, and low prices at the same level. It is a rare pattern that represents extreme indecision in the market and can often precede a strong trend or reversal.

Read Also: FTSE MIB Index Country: Know the Country of FTSE MIB Index

Traders and analysts use the doji candlestick pattern in conjunction with other technical indicators and chart patterns to confirm potential reversals or trend continuations. It is important to consider the overall market context and trading volume when interpreting the doji pattern.

While the doji candlestick pattern can provide valuable insights into market sentiment, it is not always a reliable indicator on its own. It is essential to use it in combination with other tools and analysis methods to make well-informed trading decisions.

A Doji candlestick is a candlestick pattern that occurs when the opening and closing prices of an asset are very close to each other, resulting in a small or nonexistent body and long upper and lower shadows.

The accuracy of the Doji candlestick pattern in technical analysis can vary. It is considered a powerful reversal pattern when it occurs after a prolonged trend, indicating possible trend reversal. However, the accuracy of its signals relies on other factors such as volume, market context, and confirmation from other indicators.

Yes, the Doji candlestick pattern can be used for intraday trading. Traders can look for Doji patterns on different timeframes and use them as potential entry or exit points. However, it is important to consider other technical indicators and market context to increase the accuracy of the signals.

There are several types of Doji candlestick patterns, including the Classic Doji, Long-Legged Doji, Dragonfly Doji, and Gravestone Doji. Each pattern has slightly different characteristics and can provide different signals in technical analysis.

Yes, the Doji candlestick pattern can be used in combination with other indicators to increase the accuracy of signals. Traders often look for confirmation from other technical indicators such as moving averages, trendlines, or oscillators to validate the potential reversal indicated by the Doji pattern.

A Doji candlestick is a single candlestick pattern that indicates indecision in the market. It occurs when the opening and closing prices are very close to each other, resulting in a small or nonexistent real body. The length of the upper and lower shadows can vary, indicating the range of price movement during the period.

The accuracy of the Doji candlestick pattern in technical analysis depends on various factors. It is a reversal pattern that suggests a potential trend change, but it is not always reliable. Traders and analysts often use confirmation signals and additional indicators to strengthen their analysis. Overall, the accuracy of the Doji candlestick pattern can vary, and it should be considered alongside other technical analysis tools.

Discover the S&P 500 and its Impact on the Stock Market The S&P 500 is a stock market index that measures the performance of the top 500 publicly …

Read ArticleEffective Ways to Promote Your Forex Business In today’s highly competitive online forex market, effectively marketing and promoting your forex …

Read ArticleUnderstanding Google Annual Stock Compensation Google, one of the leading tech companies in the world, is famous not only for its innovative products …

Read ArticleWhy is Forex haram in Islam? In Islam, the concept of halal (permissible) and haram (prohibited) plays a significant role in guiding the daily lives …

Read ArticleIs Money Changer a Profitable Business? Money changer businesses, also known as currency exchange companies, play a crucial role in the global …

Read ArticleEmirates suspends flights to Nigeria: What’s the reason? Emirates, one of the world’s largest airlines, has recently announced the suspension of …

Read Article