Discover the Easiest Currency Pair to Trade for Beginner Traders

Easiest Currency Pair for Trading If you’re new to forex trading, it can be overwhelming to determine which currency pair to trade. With so many …

Read Article

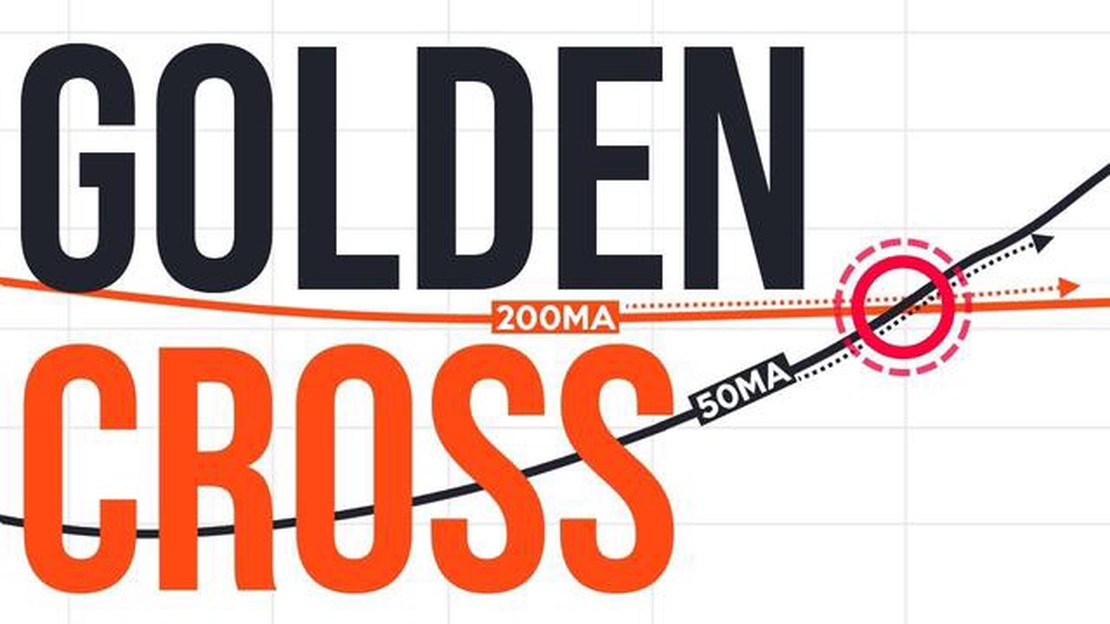

The Golden Cross is a popular technical indicator used by traders and investors to predict potential trend reversals in the stock market. It occurs when the 50-day moving average crosses above the 200-day moving average, indicating a bullish signal. Many traders rely on this signal to make investment decisions, but just how accurate is the Golden Cross?

In this article, we will examine the performance of the Golden Cross over a specific time period and analyze its accuracy in predicting stock price movements. We will delve into the historical data of various stocks and indices to determine if the Golden Cross is indeed a reliable indicator or merely a coincidence. By understanding the strengths and limitations of this indicator, traders can make more informed decisions and enhance their trading strategies.

This analysis will be carried out using statistical measures such as the success rate, the average gain/loss after a Golden Cross, and the average time to reach a certain price target. Additionally, we will compare the performance of the Golden Cross to other technical indicators to assess its relative effectiveness. By scrutinizing the data and conducting a comprehensive analysis, we aim to provide a clear picture of the Golden Cross’s accuracy and its potential implications for traders and investors.

It is important to note that while the Golden Cross has gained popularity, no single indicator can guarantee accurate predictions in the stock market. Therefore, traders and investors must approach this indicator with caution and incorporate it into a broader analysis of market trends and other essential factors. By combining technical analysis with fundamental analysis, risk management, and market sentiment, traders can make more well-rounded and informed decisions to maximize their chances of success in the stock market.

The golden cross is a widely used technical indicator in the financial markets. It occurs when the 50-day moving average of an asset’s price crosses above its 200-day moving average. Traders and investors often consider this crossover to be a bullish sign, indicating a potential upward trend in price.

While the golden cross has gained popularity among market participants, its accuracy as a predictive tool remains a topic of debate. Some traders swear by its effectiveness, while others question its reliability.

To assess the performance of the golden cross, several studies have been conducted using historical price data. These studies aim to determine if the golden cross consistently leads to profitable trades or if it is merely a coincidence.

One study compared the performance of a trading strategy based on the golden cross against a buy-and-hold approach. The results showed that the golden cross strategy outperformed the buy-and-hold strategy over a specific time period. However, the study also found that the golden cross strategy had periods of underperformance and false signals.

Another study examined the performance of the golden cross across different markets and time periods. The findings varied, with some markets and time periods showing a significant correlation between the golden cross and subsequent price increases, while others did not. This suggests that the accuracy of the golden cross can vary depending on market conditions.

It is worth noting that past performance does not guarantee future results. The accuracy of the golden cross as a predictive tool can be influenced by various factors, including market trends, investor sentiment, and fundamental factors affecting the asset’s value. Traders and investors should consider these factors and use the golden cross as one of many tools in their decision-making process.

In conclusion, while the golden cross is a popular technical indicator, its accuracy in predicting price movements is not guaranteed. Traders and investors should approach it with caution and consider it in conjunction with other indicators and fundamental analysis when making investment decisions.

Read Also: Understanding the Benefits of Rebate in Barrier Options

The Golden Cross is a popular technical indicator used in stock market analysis. It is a bullish signal that occurs when a short-term moving average crosses above a long-term moving average. Most commonly, it refers to the 50-day moving average crossing above the 200-day moving average.

When the Golden Cross occurs, it is considered a positive sign for the market or a specific stock. It suggests that the stock’s price is gaining upward momentum and that the bullish trend is likely to continue in the near future. Traders and investors often interpret the Golden Cross as a buy signal, indicating that it may be a good time to enter a long position or increase the allocation to a particular stock.

However, it is important to note that the Golden Cross is not foolproof and should not be the sole basis for investment decisions. It is a lagging indicator, meaning it is based on past price data and may not accurately predict future price movements. Market conditions can change quickly, and relying solely on the Golden Cross can lead to missed opportunities or losses.

Traders and investors should consider other technical indicators and fundamental analysis in conjunction with the Golden Cross to make more informed decisions. It is also important to assess market trends, overall market conditions, and company-specific factors before making any investment decisions based on the Golden Cross.

In conclusion, while the Golden Cross can be a useful tool in technical analysis, it should not be relied upon as the sole indicator for investment decisions. It is important to supplement it with other indicators and analysis to increase the probability of success in the markets.

The golden cross is a widely used technical indicator in financial markets that is believed to signal a bullish trend reversal. It occurs when a shorter-term moving average crosses above a longer-term moving average, typically the 50-day moving average crossing above the 200-day moving average. Traders often use this signal as a confirmation to enter long positions.

Read Also: Is BCA able to receive international transfers?

However, it is important to evaluate the accuracy of the golden cross before relying solely on it for trading decisions. While the golden cross has been historically associated with market rallies, it is not foolproof and can also generate false signals.

To evaluate the accuracy, it is essential to analyze historical data and compare the performance of the golden cross signals against actual market movements over a significant period of time. This involves backtesting the strategy by calculating the returns generated by using the golden cross as a buy signal and comparing them with the overall market returns.

It is important to note that the accuracy of the golden cross can vary depending on market conditions and the specific assets being traded. Therefore, it is recommended to perform a thorough analysis on different markets and assets to assess the reliability of the indicator in different scenarios.

Additionally, it is crucial to consider other technical indicators and fundamental analysis in conjunction with the golden cross to make more informed trading decisions. No single indicator can guarantee accurate predictions, and combining multiple indicators can help reduce the risk of false signals and improve overall trading performance.

In conclusion, while the golden cross can be a useful tool in identifying potential bullish trends, it is important to evaluate its accuracy and consider it in the context of other indicators and market conditions. By conducting thorough analysis and using it as one tool among others, traders can make more informed decisions and increase their chances of success in the financial markets.

A golden cross is a technical indicator that occurs when a shorter-term moving average crosses above a longer-term moving average. It is typically seen as a bullish signal and is used by traders to identify potential buying opportunities.

The accuracy of a golden cross in predicting stock price increases can vary. While it is considered a bullish signal, it is not a guarantee of future price increases. It is just one tool among many that traders use to make decisions, and its effectiveness can vary depending on market conditions and other factors.

When using a golden cross, it is important to consider other factors such as volume, overall market trends, and fundamental analysis. Volume can confirm the validity of the golden cross signal, while market trends and fundamental analysis can provide additional context and help assess the overall health of the stock.

Yes, there are limitations and drawbacks to using a golden cross. It is a lagging indicator, meaning that it may not provide timely signals in fast-moving markets. Additionally, false signals can occur, leading to potential losses if traders solely rely on the golden cross without considering other factors. It is important to use the golden cross in conjunction with other analysis techniques.

Easiest Currency Pair for Trading If you’re new to forex trading, it can be overwhelming to determine which currency pair to trade. With so many …

Read ArticleIs DCFX regulated? When it comes to investing in financial markets, it is crucial to understand the regulatory status of the platform or company you …

Read ArticleIs it more profitable to trade gold or silver? Gold and silver have long been considered valuable commodities and a safe haven for investors. Both …

Read ArticleOptions Trading vs Stocks: What You Need to Know When it comes to investing, understanding the difference between options trading and stocks is …

Read ArticleIs price action effective for day trading? Day trading is a popular strategy among traders who seek to make quick profits by buying and selling …

Read ArticleWhat is the Best Forex Platform for Day Traders? Forex trading has become increasingly popular among day traders, as it allows individuals to engage …

Read Article