JP Morgan vs Goldman Sachs: Which Investment Bank is Superior?

JP Morgan vs Goldman Sachs: Which is the Better Investment Bank? JP Morgan and Goldman Sachs are two of the most prominent and influential investment …

Read Article

Gold options are a popular investment choice in the MCX (Multi Commodity Exchange) market. As a precious metal, gold has always been a safe haven for investors, and options allow traders to take advantage of its price movements without owning the physical metal.

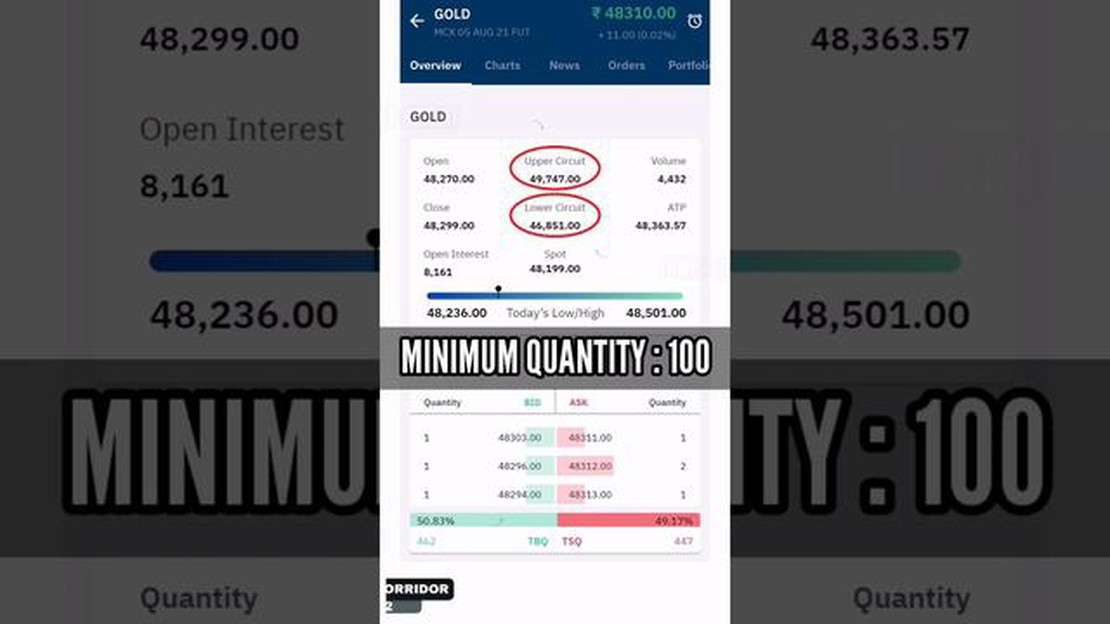

One important aspect to understand when trading gold options is the concept of lot sizes. In MCX, gold options are available for trading in multiple lots, with each lot representing a certain quantity of gold. For example, a lot size of 100 grams means that each option contract corresponds to 100 grams of gold.

When trading gold options, it is essential to understand the mechanics of the trading process. Options give traders the right, but not the obligation, to buy or sell gold at a specific price (known as the strike price) within a predetermined time frame. Traders can choose to buy a call option if they believe the price of gold will rise, or a put option if they think it will fall.

Trading gold options in MCX can be a lucrative investment opportunity, but it is crucial to have a comprehensive understanding of lot sizes and trading mechanics. By familiarizing yourself with these concepts, you can make informed decisions and maximize your potential profits in the gold options market.

Gold options are financial derivative contracts that give traders the right, but not the obligation, to buy or sell gold at a specified price within a specified timeframe. They are traded on the Multi Commodity Exchange of India (MCX) and are a popular choice among investors and speculators looking to profit from fluctuations in gold prices.

Options contracts come in two types: call options and put options. A call option gives the holder the right to buy gold at the specified price, while a put option gives the holder the right to sell gold at the specified price. Traders can choose to buy or sell options depending on their view of the future price direction of gold.

The lot size of a gold options contract on the MCX is 100 grams, which means that every options contract represents the right to buy or sell 100 grams of gold. For example, if the current price of gold is $50 per gram and a trader buys a call option with a strike price of $55, they have the right to buy 100 grams of gold at $55 per gram, regardless of whether the market price goes above or below that level.

Gold options have an expiry period of one month, meaning they can be exercised or sold at any time within that month. If the options contract is not exercised or sold before the expiry date, it becomes worthless and the trader loses the premium paid for the contract.

When trading gold options, it’s important to consider various factors such as the current price of gold, volatility in the market, and the time remaining until expiry. These factors can affect the pricing of options and the potential profit or loss that traders can make.

Disclaimer: Trading options involves risks, and traders should carefully consider their investment objectives and risk tolerance before participating in options trading.

Gold options trading offers a range of benefits for investors looking to diversify their portfolios and participate in the gold market. Here are some key advantages:

Risk management: Gold options provide an effective tool for managing risk in the gold market. With options, traders have the ability to hedge against price fluctuations and protect themselves from potential losses.

Leverage: Gold options trading allows investors to control a large amount of gold using a relatively small amount of capital. This leverage can amplify profits if gold prices move in the trader’s favor.

Flexibility: Gold options provide flexibility in terms of trading strategies. Traders can choose from a variety of options contracts, including call and put options, as well as different strike prices and expiration dates. This allows for tailoring strategies to meet specific investment objectives.

Read Also: What is an EMA Forex? Understanding Exponential Moving Average in Forex Trading

Diversification: Adding gold options to an investment portfolio can help diversify risk. Gold has historically had a negative correlation with other asset classes such as stocks and bonds. By incorporating gold options, investors can potentially reduce the overall volatility of their portfolio.

Profit potential: Gold options trading offers the potential for significant profits. If a trader accurately predicts the direction of gold prices, they can realize substantial gains. Additionally, with options, traders can profit from both rising and falling gold prices.

Liquidity: The gold options market is highly liquid, allowing for efficient entry and exit of positions. This ensures that traders can easily execute their trades at their desired prices without significant slippage.

Transparency: Gold options trading in MCX is transparent and regulated, providing investors with a level playing field. The exchange ensures fair and orderly trading, and all information related to option contracts is readily available to market participants.

Read Also: Can you short sell forex? Learn more about short selling in the forex market | Website

Hedging opportunities: Gold options allow market participants, such as gold producers and jewelers, to hedge their exposure to gold price fluctuations. This helps them manage their risk and protect their profit margins.

In conclusion, gold options trading offers numerous benefits, including risk management, leverage, flexibility, diversification, profit potential, liquidity, transparency, and hedging opportunities. By understanding and utilizing these benefits effectively, investors can enhance their trading strategies and potentially achieve their financial goals.

Lot sizes play a crucial role in gold options trading on the MCX. A lot corresponds to a specific quantity of the underlying asset, which in this case is gold.

For gold options, the lot size is 100 grams. This means that each lot represents 100 grams of gold. Traders can buy or sell multiple lots depending on their trading strategies and desired exposure to the gold market.

The lot size of 100 grams is standard for gold options on the MCX. It allows for easier calculation of margins and settles the contract in physical delivery of gold.

Understanding lot sizes is essential for effective gold options trading. Traders need to consider their risk appetite, investment capital, and market conditions before deciding on the number of lots to trade.

It’s important to note that lot sizes may vary for different commodities and exchanges. Therefore, traders should always check the specific lot size requirements before initiating any gold options trades.

In conclusion, lot sizes in gold options trading refer to the quantity of gold represented by each lot. In the MCX, the lot size for gold options is 100 grams. Traders should consider their trading strategy and market conditions when deciding on the number of lots to trade.

MCX stands for Multi Commodity Exchange of India Ltd. It is India’s largest commodity derivatives exchange where various commodities like gold, silver, crude oil, natural gas, etc are traded.

Gold options are financial derivatives that provide the option holder the right, but not the obligation, to buy or sell a specified quantity of gold at a predetermined price within a specific time period.

The lot size for gold options in MCX is 100 grams.

Trading in gold options involves buying or selling options contracts. Traders can choose to either buy call options (if they think the price of gold will rise) or buy put options (if they think the price of gold will fall). The options contracts have a specific expiry date and strike price, and traders can profit from the difference between the market price and the strike price of the options.

JP Morgan vs Goldman Sachs: Which is the Better Investment Bank? JP Morgan and Goldman Sachs are two of the most prominent and influential investment …

Read ArticleWhen will XAUUSD reopen? Gold has always been a popular investment option for both seasoned traders and beginners. XAUUSD is a widely traded currency …

Read ArticleChoosing the Best Forex Trading Robot Forex trading has become increasingly popular in recent years, with many investors turning to automated trading …

Read ArticleCorrelation of Forex Pairs: Discovering Strong Relationships Understanding the correlation between various forex pairs is crucial for any forex …

Read ArticleWho is the Best Forex Youtuber? Are you into forex trading and looking for a reliable source of information and guidance? Look no further! In this …

Read ArticleDid Bulls make a trade? As the NBA trade deadline approaches, fans and analysts are buzzing with excitement and anticipation. One team that has been …

Read Article