Today's India's Foreign Reserves: Current Figures and Analysis

India’s Foreign Reserves Today: What is the Current Amount? Foreign reserves play a crucial role in a country’s economic stability and its ability to …

Read Article

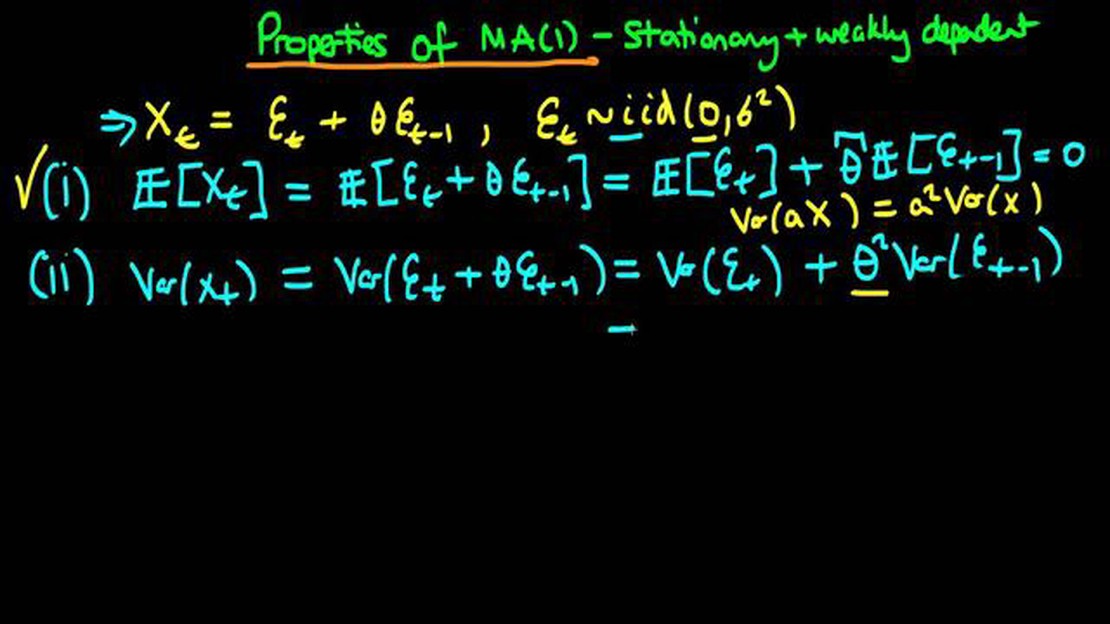

In the field of time series analysis, moving averages are widely used for smoothing data and identifying trends. However, there is a common assumption that moving averages are always stationary. Stationarity is a fundamental concept in time series analysis, which means that the statistical properties of a time series, such as its mean and variance, do not change over time. In this article, we will explore the stationarity of moving averages and investigate whether they always exhibit this property.

To understand the stationarity of moving averages, it is important to first grasp the concept of a stationary time series. A stationary time series is one where the statistical properties, such as the mean, variance, and autocorrelation, remain constant over time. In other words, a stationary time series does not exhibit any trend or seasonality.

When it comes to moving averages, the stationarity assumption is often made based on the idea that averaging out the random fluctuations in the data should result in a stationary process. This assumption holds true when the original time series is a stationary process. However, if the original time series is non-stationary, applying a moving average does not guarantee stationarity.

It is important to note that moving averages can preserve stationarity if they are applied to a stationary time series. However, if the original time series is non-stationary, moving averages may not be able to eliminate the inherent trend or seasonality. In such cases, additional techniques, such as differencing or detrending, may be required to achieve stationarity.

In conclusion, while moving averages are a useful tool for smoothing data and identifying trends, their stationarity depends on the underlying time series. It is crucial to assess the stationarity of the original time series before applying moving averages and consider additional methods if necessary. By understanding the stationarity of moving averages, researchers and analysts can make more informed decisions when utilizing this technique in their time series analysis.

Stationarity plays a crucial role in the analysis and interpretation of moving averages. Moving averages are widely used in time series analysis to smooth out fluctuations, identify trends, and forecast future values. However, the accuracy and reliability of moving averages heavily depend on the stationarity of the underlying data.

When a time series is stationary, it means that its statistical properties, such as mean, variance, and autocovariance, do not change over time. This is important because moving averages assume that the statistical properties of the data remain constant over time. If the underlying data is non-stationary, the moving average may fail to accurately represent the true behavior of the series.

Non-stationary time series exhibit trends, seasonality, or other patterns that change over time. These patterns can distort the moving average and lead to misleading results. For example, if a time series has an increasing trend, the moving average will systematically lag behind the actual values, resulting in biased forecasts that underestimate future values.

By ensuring stationarity in moving averages, we can improve the reliability of our analysis and predictions. There are various methods to achieve stationarity, such as differencing, detrending, or using logarithmic transformations. These techniques help remove trends and other non-stationary components from the data, making it suitable for accurate moving average analysis.

In conclusion, stationarity is a critical aspect to consider when using moving averages for time series analysis. It ensures the accuracy and effectiveness of the method in capturing underlying patterns and making reliable predictions. Without stationarity, moving averages may produce misleading results and hinder our ability to interpret the behavior of the series.

Stationarity is a key concept in time series analysis. It refers to the assumption that the statistical properties of a time series, such as its mean, variance, and covariance, remain constant over time. In other words, a stationary time series is one whose statistical properties are not affected by factors like trends, seasonality, or other patterns.

Read Also: How to Change the Voice Language to Japanese in Fire Emblem Awakening

A stationary time series is desirable because it allows for the application of various statistical techniques and models. These techniques assume that the underlying data follows a stationary process, enabling accurate predictions and reliable inference.

There are two main components of stationarity: strict stationarity and weak stationarity.

Strict Stationarity:

A time series is strictly stationary if its joint probability distribution does not change over time. This means that the distribution of any finite set of values within the time series remains the same, regardless of the time at which it is observed. This concept is difficult to verify in practice, as it requires knowledge of the true underlying distribution.

Weak Stationarity:

A time series is considered weakly stationary if its first two moments (mean and variance) are constant over time. This means that the mean and variance of the time series do not depend on the specific point in time at which they are calculated. In addition, the autocovariance function of a weakly stationary time series only depends on the time interval between observations, rather than the absolute time at which they occur.

Read Also: What is GJ? Everything you need to know

Stationarity is an important assumption in many time series models, such as autoregressive integrated moving average (ARIMA) models. These models are widely used in forecasting and require the time series to be stationary to generate accurate predictions.

However, it is important to note that not all time series are stationary. Many real-world time series exhibit trends, seasonality, and other patterns that violate the assumptions of stationarity. In such cases, it is necessary to apply techniques like differencing or transformations to make the time series stationary before modeling.

Understanding the concept of stationarity is crucial for analyzing and modeling time series data. It provides the foundation for selecting appropriate models and ensures the validity of statistical inferences and predictions.

The purpose of the study is to explore whether moving averages are always stationary or not.

Moving averages are statistical calculations used to analyze data points by creating a series of averages over different subsets of the full data.

It is important to determine if moving averages are stationary because stationarity is a key assumption in time series analysis, and if moving averages are not stationary, it may affect the accuracy and reliability of any analysis or predictions based on them.

A stationary time series is one where the statistical properties such as mean, variance, and autocorrelation do not change over time.

The authors of the study used both visual examination of plots and statistical tests such as the Augmented Dickey-Fuller test to test the stationarity of moving averages.

The main focus of the article is to explore the stationarity of moving averages and determine if they are always stationary.

India’s Foreign Reserves Today: What is the Current Amount? Foreign reserves play a crucial role in a country’s economic stability and its ability to …

Read ArticleRiding a Trend in Forex: Strategies and Tips to Maximize Profits+ Forex trends can be incredibly fickle, making it crucial for traders to master the …

Read ArticleDiscover how JP Morgan utilized astrology in their decision-making process As one of the most influential and successful figures in finance, JP …

Read ArticleHow to Create a Demo Account on FXCM Are you interested in forex trading, but not quite ready to risk your hard-earned money? Creating a demo account …

Read ArticleUnderstanding the Strength of the Dollar in Sweden In recent years, the strength of the dollar in Sweden has become a topic of great interest and …

Read Article5 Year Forecast for GLD: Analyzing the Future Potential of the Gold ETF Gold has always been a safe haven investment, coveted for its stability and …

Read Article