Trading Forex with No Spread: Tips and Tricks for Zero Spread Trading

Trading forex with zero spread: ultimate guide Forex trading is a lucrative opportunity for investors to earn profits by trading currency pairs. One …

Read Article

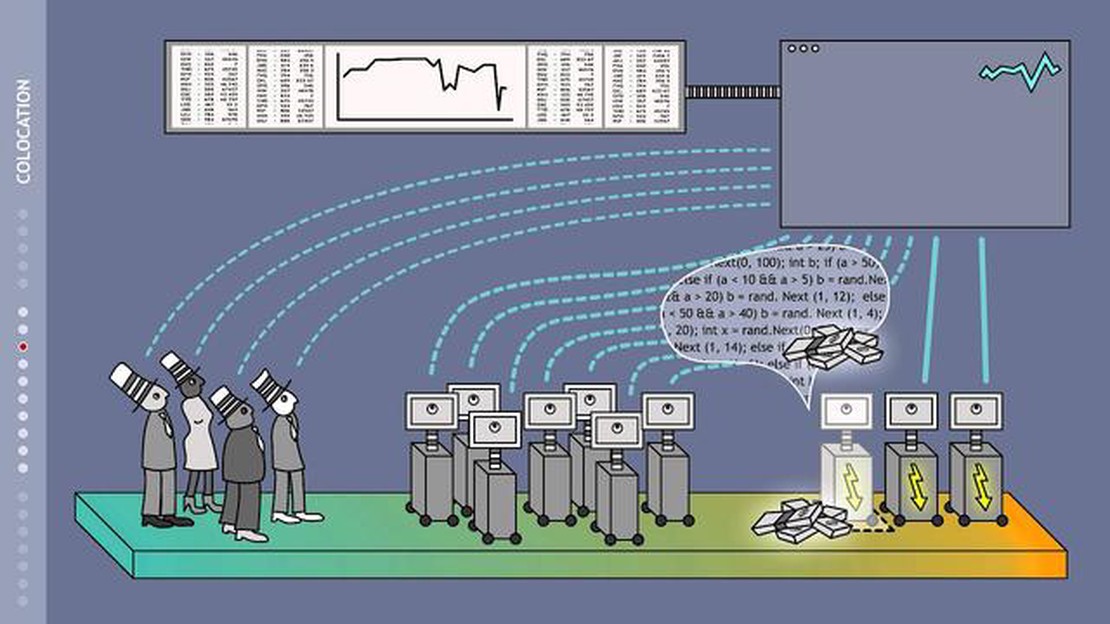

In recent years, high-frequency trading (HFT) has become a major force in the world of financial markets. HFT is a form of algorithmic trading that involves the execution of large numbers of trades in incredibly short periods of time. This rapid trading relies heavily on advanced technologies and complex algorithms to analyze market data and execute trades at lightning-fast speeds.

The rise of high-frequency trading has had a profound impact on the financial markets, but it has also raised significant concerns and risks. One of the main risks associated with HFT is the potential for market manipulation and unfair advantages. With their ability to execute trades at such high speeds, HFT firms can take advantage of tiny price discrepancies and exploit them for profit, potentially distorting market prices.

Another risk of high-frequency trading is increased volatility. The rapid-fire nature of HFT can amplify market swings and create a more unstable trading environment. This increased volatility can lead to erratic price movements and make it difficult for investors to accurately predict market trends. Additionally, the use of complex algorithms in HFT can also contribute to unexpected market reactions and exacerbate turbulence.

Furthermore, the interconnectedness of financial markets has made them more vulnerable to systemic risks posed by high-frequency trading. The speed and scale at which HFT operates can amplify the effects of market shocks and potentially lead to cascading failures across global financial systems. As a result, the risks associated with HFT extend beyond individual traders and can have far-reaching consequences for the stability of the overall financial system.

High-frequency trading (HFT) has become an increasingly prevalent practice in financial markets. This type of trading relies on the use of advanced technology and algorithms to execute trades at incredibly high speeds, often in microseconds. While HFT has been praised for its ability to improve market liquidity and reduce transaction costs, it also carries significant risks that deserve careful consideration.

One of the major risks associated with high-frequency trading is market manipulation. Because HFT algorithms can react and execute trades faster than human traders, there is a concern that certain market participants may exploit this speed advantage to manipulate prices or create artificial volatility. This can lead to market distortions and reduce overall market efficiency, ultimately harming both individual investors and the stability of financial markets as a whole.

Another risk stems from the complex nature of HFT strategies and the potential for unforeseen algorithmic errors. The reliance on algorithms and automation leaves little room for human intervention or oversight, increasing the likelihood of unintentional errors or system glitches. In extreme cases, these errors can lead to widespread market disruptions, flash crashes, or even systemic failures. The “flash crash” of 2010, where U.S. stock markets witnessed a sudden and drastic drop in prices within minutes, serves as a vivid example of the risks associated with HFT.

Moreover, there are concerns about the impact of HFT on market stability during times of stress. HFT algorithms are designed to react swiftly to changing market conditions, which can exacerbate market volatility during periods of high uncertainty or panic. The rapid withdrawal of liquidity by HFT traders may leave other market participants vulnerable, potentially amplifying the severity of market downturns or exacerbating market contagion.

Read Also: Trading Cryptocurrency in Sweden: Everything You Need to Know

Lastly, the increasing complexity and interconnectedness of financial markets have made it more difficult to effectively monitor and regulate HFT practices. Regulators face challenges in keeping up with the rapidly evolving technology and strategies employed by high-frequency traders. This poses a risk not only to individual investors but also to overall market integrity and stability if regulatory frameworks fail to adapt and keep pace with technological advancements.

In conclusion, while high-frequency trading has undoubtedly brought numerous benefits to financial markets, it is essential to recognize and address the risks it presents. Market manipulation, algorithmic errors, increased market volatility, and regulatory challenges are all significant concerns that need to be carefully managed to ensure the fair and efficient functioning of the markets.

High-frequency trading (HFT) has had a significant impact on financial markets. With its ability to execute trades at incredibly fast speeds and to react to market changes within microseconds, HFT has changed the dynamics of the trading landscape.

One of the main influences of HFT on financial markets is increased liquidity. HFT firms are constantly buying and selling securities, which helps maintain a liquid market and ensures that there is always a buyer or seller available. This liquidity has positive effects on market efficiency, as it reduces bid-ask spreads and makes it easier for traders to execute their orders.

However, there are also concerns about the impact of HFT on market stability. The speed and volume at which HFT trades can occur can lead to rapid price fluctuations and increased market volatility. This can be problematic for investors and can potentially destabilize the market, especially during times of high market stress or when there are sudden changes in market conditions.

| Positive Influences | Negative Influences |

|---|---|

| Increased liquidity | Market volatility |

| Improved market efficiency | Rapid price fluctuations |

| Easier execution of orders | Potential market destabilization |

Read Also: Understanding the Triangular Weighted Average: Definition and Application

Another influence of HFT on financial markets is the potential for market manipulation. HFT algorithms are highly complex and can be programmed to manipulate prices or execute trades based on certain market conditions. While there are regulations in place to prevent market manipulation, the speed and sophistication of HFT algorithms make it difficult for regulators to detect and prevent such activities.

Overall, the influence of HFT on financial markets is complex. While it provides benefits such as increased liquidity and improved market efficiency, it also poses risks such as market volatility and potential market manipulation. It is important for regulators and market participants to carefully monitor and manage the impact of HFT to ensure the stability and integrity of financial markets.

High-frequency trading (HFT) refers to a trading strategy that uses powerful computers and algorithms to execute a large number of trades in a very short period of time. It involves the use of complex algorithms and high-speed data connections to exploit small price differences in the market.

High-frequency trading can have both positive and negative impacts on the financial markets. On one hand, it can provide liquidity and improve market efficiency by narrowing spreads and increasing trading volumes. On the other hand, it can also increase market volatility and create instability, especially during times of market stress.

There are several risks associated with high-frequency trading. One major risk is the potential for technical glitches or system failures, which can lead to significant losses. Another risk is the possibility of market manipulation, as high-frequency traders can exploit small price differences to their advantage. Additionally, high-frequency trading can contribute to increased market volatility and make the market more susceptible to flash crashes.

Yes, there are regulations in place to control high-frequency trading. In many countries, regulators have implemented measures to monitor and regulate high-frequency trading activities. These regulations include requirements for market participants to have certain levels of risk controls and circuit breakers that can halt trading in the event of extreme price movements. However, the effectiveness of these regulations in mitigating the risks of high-frequency trading is still a subject of debate.

Trading forex with zero spread: ultimate guide Forex trading is a lucrative opportunity for investors to earn profits by trading currency pairs. One …

Read ArticleWhat is the Role of a Forex Trader? Forex trading is a profession that requires a deep understanding of the financial markets and the ability to make …

Read ArticleHow much does Interactive Brokers charge for SPX options? Interactive Brokers is a popular online brokerage firm known for its low commission rates …

Read ArticleIs there a limit to how much you can day trade? Day trading has become increasingly popular in recent years, as more and more individuals seek to …

Read ArticleWhat is the magic number in forex robot? In the world of forex trading, there is a secret to success that many traders want to know. It is called the …

Read ArticleBest Indicator for Scalping Trading Scalping is a trading strategy that aims to profit from small price changes in the market. It involves making …

Read Article