Understanding Level 3 Options: Everything You Need to Know | Website Name

What is Level 3 Options? Level 3 options are a type of financial derivative that allow investors to take on more complex and sophisticated trading …

Read Article

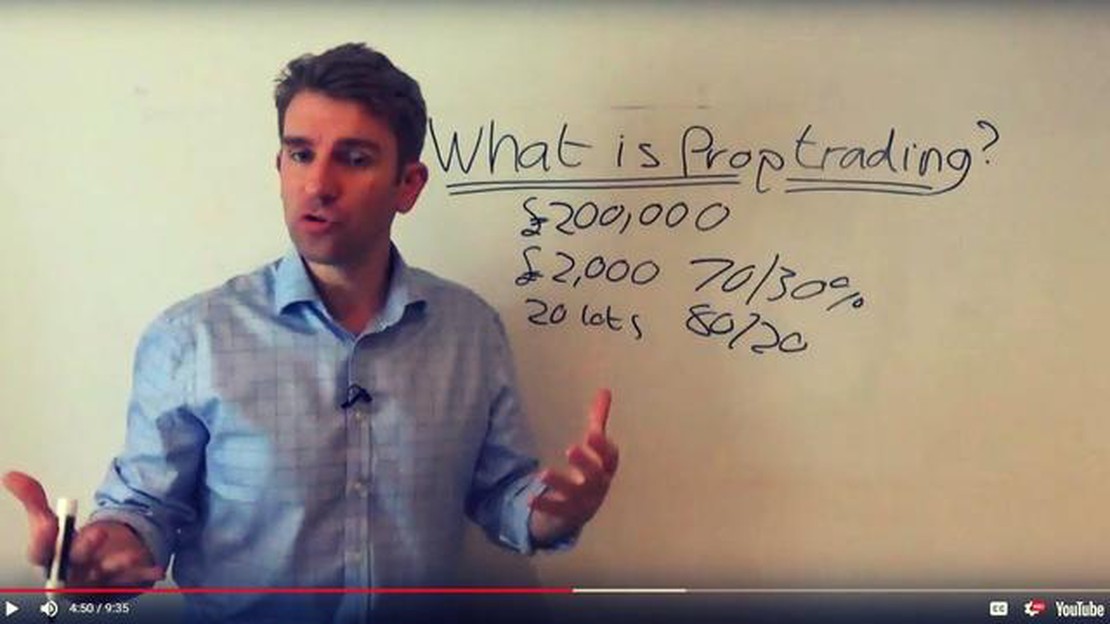

Proprietary trading, commonly referred to as prop trading, is a practice in the financial industry where trading activities are conducted by a firm using its own money and resources, rather than on behalf of clients. This type of trading allows firms to earn profits directly from the financial markets, leveraging their expertise, strategies, and trading infrastructure.

In prop trading, firms take speculative positions in various financial instruments, such as stocks, bonds, options, and derivatives, with the goal of generating profits from market movements. Unlike traditional buy-side or sell-side trading, where firms execute trades on behalf of clients, prop trading focuses on using the firm’s own capital to take risks and reap rewards.

Prop trading is typically carried out by specialized trading desks within financial institutions, such as investment banks, hedge funds, and proprietary trading firms. These desks employ experienced traders, analysts, and technologists who work together to identify trading opportunities, develop trading strategies, and execute trades in a fast-paced and competitive environment.

Prop trading strategies can vary widely depending on the firm’s expertise and risk appetite. Some firms may focus on quantitative trading, utilizing complex mathematical models and algorithms to identify market inefficiencies and exploit them. Others may employ fundamental analysis, relying on in-depth research and market insights to identify undervalued or overvalued securities. Regardless of the strategy, prop trading requires a deep understanding of financial markets, risk management, and the ability to make quick and informed trading decisions.

Proprietary trading, also commonly known as prop trading, is a practice in which financial institutions or individuals trade on their own accounts using their own capital. In other words, they use their own money to make trades, instead of executing orders on behalf of clients or customers.

This type of trading can be done by a variety of financial institutions, including banks, investment firms, and hedge funds. Proprietary traders make trades in different financial markets, such as stocks, bonds, commodities, and derivatives.

The main goal of proprietary trading is to generate profits for the trading firm or individual trader. They aim to exploit inefficiencies in the market and take advantage of short-term price fluctuations. Prop traders use various trading strategies, such as arbitrage, trend following, and market-making, to try to achieve their profit goals.

Proprietary trading can be highly lucrative, but it also carries significant risks. Traders need to have a deep understanding of the markets they trade in, as well as the ability to analyze and interpret market data. They also need to manage their risks effectively to avoid significant losses.

Regulations surrounding proprietary trading can vary by country and region. Some jurisdictions have implemented restrictions on prop trading to mitigate risks to financial stability and protect investors. For example, the Volcker Rule in the United States prohibits banks from engaging in proprietary trading with certain exceptions.

In conclusion, proprietary trading involves individuals or financial institutions trading on their own accounts using their own capital. It aims to generate profits by exploiting market inefficiencies and short-term price fluctuations. While it can be highly profitable, it also carries significant risks and is subject to regulations in many jurisdictions.

Disclaimer: This material is for educational purposes only and should not be considered investment advice. Trading in financial markets involves risk, and you should consult with a professional financial advisor before making any investment decisions.

In the world of finance, proprietary trading refers to the practice of firms or individuals trading their own capital for profit. This means that these traders are using their own money, as opposed to the funds of external investors or clients, to buy and sell various financial instruments.

Proprietary trading has become increasingly popular in recent years, as it allows traders to have more control and flexibility over their trading strategies. By using their own capital, proprietary traders can take on more risk and potentially earn higher profits.

One of the main benefits of proprietary trading is the ability to have access to confidential information. Proprietary traders often have access to information and research that is not available to the general public. This allows them to make more informed trading decisions and potentially gain an edge over other market participants.

Read Also: Is binary FX trading legitimate? Uncover the truth about binary options trading

Proprietary trading also allows traders to have full control over their trading activities. They can make quick decisions and react to market changes without having to go through a hierarchical and bureaucratic process. This flexibility can be a major advantage in fast-paced markets where timing is crucial.

Furthermore, proprietary trading can provide a lucrative career path for traders. As they are trading with their own capital, successful proprietary traders have the potential to earn substantial profits. This can be especially appealing for talented traders who want to maximize their earning potential and have a direct impact on their financial success.

However, it is important to note that proprietary trading also comes with its own risks. Since proprietary traders are using their own money, they are solely responsible for any losses that may occur. This level of risk can be both exciting and challenging, as traders must carefully manage their positions and constantly monitor the markets.

In conclusion, proprietary trading offers various benefits for traders who are willing to take on the associated risks. From increased control and flexibility to the potential for higher profits, proprietary trading can be an attractive option for those who have the skills and capital to engage in this type of trading.

Key Takeaways:

Proprietary trading plays a significant role in the functioning of financial markets. It involves firms or institutions trading financial instruments for their own account, rather than on behalf of clients or customers. This type of trading allows companies to profit from market fluctuations and generate revenue through their trading activities.

Read Also: Do Forex Robots Really Work? Exploring the Effectiveness and Efficiency

Proprietary trading provides several benefits to the financial markets. Firstly, it adds liquidity to the markets by creating additional buying and selling pressure. This can help improve the overall efficiency and functioning of the markets, as well as reduce transaction costs for other market participants.

In addition, proprietary trading can contribute to price discovery. As proprietary traders actively buy and sell securities, they help determine the fair value of these instruments. This information is important for other market participants, as it allows them to make informed investment decisions.

Furthermore, proprietary trading can serve as a risk management tool for financial institutions. By engaging in proprietary trading, firms can hedge their existing positions or manage their overall exposure to market risks. This can help to mitigate potential losses and improve the stability and resilience of the financial system.

However, it is important to note that proprietary trading can also pose risks to the financial markets. Excessive or reckless proprietary trading can result in significant losses for firms, which in turn can have systemic implications. This was highlighted during the financial crisis of 2008, when several banks suffered substantial losses due to their proprietary trading activities.

In response to these risks, many jurisdictions have implemented regulations to govern proprietary trading activities. These regulations aim to ensure the stability and integrity of the financial system, as well as protect investors and customers.

In conclusion, proprietary trading plays a crucial role in the financial markets. It provides liquidity, contributes to price discovery, and serves as a risk management tool. However, it also carries risks that need to be carefully managed and regulated. Overall, proprietary trading contributes to the efficiency and functioning of the financial markets, while requiring careful oversight and risk management.

Proprietary trading refers to when a firm or individual trades financial instruments using their own money rather than client funds. Essentially, it involves trading for the firm’s own account in order to generate profits.

Proprietary trading firms make money by taking advantage of short-term price fluctuations in the financial markets. They use various strategies, such as high-frequency trading and algorithmic trading, to identify and exploit these opportunities for profit.

There are several benefits to proprietary trading. First, it allows firms to generate additional revenue by profiting from their trading activities. Second, it helps firms to hedge their positions by taking offsetting trades. Finally, proprietary trading can help firms attract and retain top trading talent by offering the potential for high profits.

While proprietary trading can be highly profitable, it also comes with significant risks. One major risk is the potential for large losses, which can occur if a trade goes against the firm’s position. Additionally, proprietary trading firms face market risk, regulatory risk, and operational risk, among others.

Yes, proprietary trading is legal in many countries, including the United States. However, there are regulations in place to ensure that proprietary trading firms operate in a fair and transparent manner. For example, in the US, proprietary trading firms must comply with the regulations set forth by the Securities and Exchange Commission (SEC) and the Financial Industry Regulatory Authority (FINRA).

Proprietary trading is a practice where a financial institution or firm trades securities, commodities, derivatives, or other financial instruments using its own money, as opposed to using clients’ money.

What is Level 3 Options? Level 3 options are a type of financial derivative that allow investors to take on more complex and sophisticated trading …

Read ArticleAre Forex Bots Legit? Automated trading has gained significant popularity in the financial world, especially in the forex market. Forex bots, also …

Read ArticleTop Forex Reversal Indicators: Find the Best One for You When it comes to trading in the forex market, one of the key skills to master is the ability …

Read ArticleUnderstanding the 1 Hour Time Frame Strategy When it comes to trading, time is of the essence. Traders are constantly looking for strategies that can …

Read ArticleDiscovering the Heiken Ashi Ma T3 new Indicator Forex trading can be a complex and challenging endeavor. Traders are constantly seeking new tools and …

Read ArticleCardstock Paper Prices at FedEx: What to Expect If you are in need of high-quality cardstock paper for your printing needs, look no further than …

Read Article