Beginner's Guide: How to Start Nifty Option Trading

Beginner’s Guide to Nifty Option Trading Welcome to the beginner’s guide on how to start Nifty option trading! If you’re new to the world of options …

Read Article

When it comes to the world of investing, risk is inevitable. Whether you are a seasoned trader or a novice investor, it is important to understand the concept of hedging as a risk management strategy. One popular method of hedging is through the use of options. Options are financial instruments that give the holder the right, but not the obligation, to buy or sell an asset at a predetermined price within a specified time frame.

One way to hedge stock positions using options is through the use of a protective put. A protective put involves purchasing put options on a stock you own to protect against a potential decrease in its value. If the stock’s price drops, the put option will increase in value, offsetting the loss in the stock’s value.

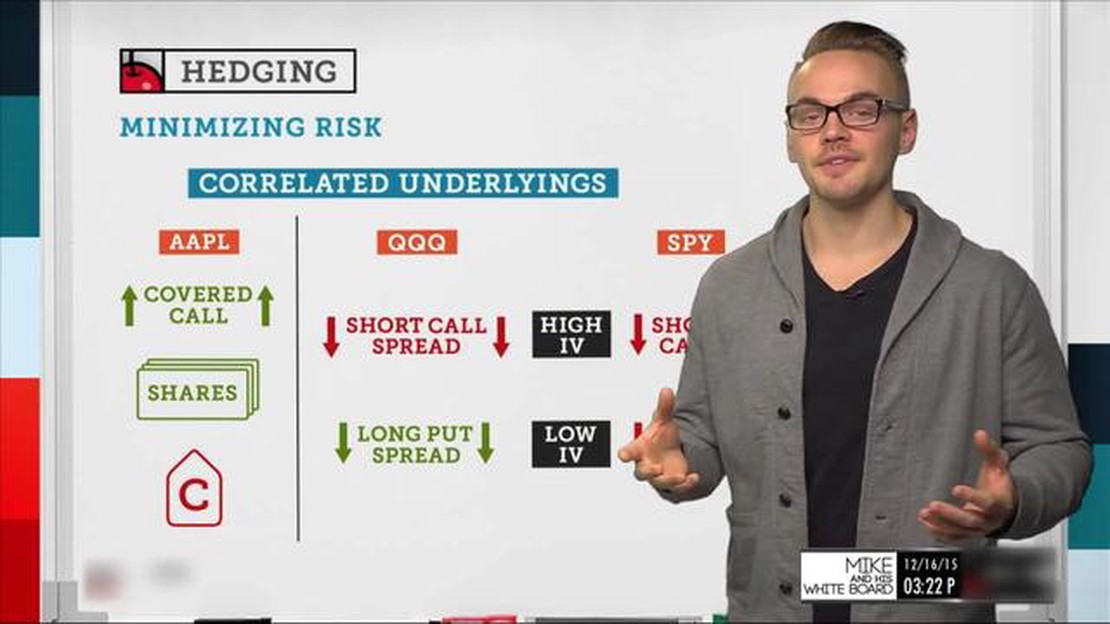

Another example of using options to hedge stock positions is through the use of a covered call. A covered call involves selling call options on a stock you own to generate income. By selling call options, you receive a premium, which can help offset potential losses in the stock’s value. However, if the stock’s price rises above the strike price of the call option, you may be obligated to sell your stock.

Options can also be used to hedge against market volatility. For example, if you anticipate increased volatility in the market, you can purchase options on an index, such as the S&P 500, to protect your portfolio. If the market experiences a significant decline, the options will increase in value, helping to offset any losses in your portfolio.

In conclusion, options provide investors with a variety of strategies to hedge their stock positions and manage risk. Whether it is through protective puts, covered calls, or hedging against market volatility, options can be a valuable tool in an investor’s toolkit. It is important to understand the risks and rewards associated with options trading and to consult with a financial advisor before implementing any hedging strategies.

When it comes to managing risk in the stock market, one popular strategy is to use options to hedge stock positions. By utilizing options contracts, investors can protect themselves against potential losses or mitigate downside risk.

Options provide investors with the right, but not the obligation, to buy or sell an asset at a predetermined price within a specified timeframe. Different option strategies can be implemented depending on an investor’s outlook and risk tolerance.

One common strategy for hedging a long stock position is to purchase put options. A put option gives the holder the right to sell a specific quantity of the underlying stock at a predetermined price, known as the strike price, within a certain timeframe. If the stock price falls below the strike price, the put option can be exercised, allowing the investor to sell the stock at a higher price and offset potential losses.

On the other hand, if an investor wants to hedge against a potential decline in stock prices without giving up the opportunity for gains, they can use a collar strategy. A collar involves purchasing a put option to protect against downside risk and simultaneously selling a call option to generate income. The call option acts as a cap on potential gains, but the premium received from selling the call option helps offset the cost of the put option.

Another strategy that can be utilized for hedging stock positions is the use of covered calls. With a covered call, an investor who owns the underlying stock can sell call options against their stock position. If the stock price remains below the strike price, the options expire worthless, and the investor keeps the premium received from selling the options. However, if the stock price rises above the strike price, the investor may be obligated to sell their stock at the predetermined price.

Options can be a valuable tool for hedging stock positions, allowing investors to manage risk and protect against potential losses. By carefully selecting the appropriate option strategy based on their investment objectives and risk tolerance, investors can effectively hedge their stock positions and potentially enhance their overall returns.

| Option Strategy | Description |

|---|---|

| Long Put | Purchase put options to protect against downside risk |

| Collar | Purchase a put option and sell a call option to cap potential gains |

| Covered Call | Sell call options against a stock position to generate income |

Read Also: 1 UN Peso to Indian Rupees: Check the Latest Exchange Rate

When it comes to hedging stock positions, options can offer several advantages compared to other hedging strategies. Here are some of the key benefits of using options for hedging:

1. Limited Risk: One of the biggest advantages of using options for hedging is that it allows the investor to limit their risk. With options, the investor knows exactly how much they can potentially lose, which provides a level of certainty and peace of mind.

Read Also: What does an FX analyst do? | The role and responsibilities of an FX analyst

2. Flexibility: Options offer flexibility in terms of choosing the desired level of protection. Investors can select different strikes and expiration dates to tailor their hedges according to their specific needs and risk appetite.

3. Cost-Effective: Compared to other hedging strategies like buying actual stocks or using futures contracts, options can be a more cost-effective method of hedging. This is because options require a smaller upfront capital outlay, allowing investors to achieve a similar level of protection at a lower cost.

4. Potential for Profits: Unlike other hedging strategies that simply aim to reduce losses, options also offer the potential for profits. If the stock price moves in the desired direction, the options can be sold for a profit, adding an additional source of income.

5. Diversification: Options provide an opportunity to diversify an investment portfolio. By including options in a hedging strategy, investors can mitigate the risk associated with their stock positions and reduce the overall volatility of their portfolio.

6. Liquidity: Options are highly liquid instruments, which means that they can be easily bought and sold in the market. This liquidity makes it convenient for investors to adjust their hedges as market conditions change.

Overall, options offer a range of advantages when it comes to hedging stock positions. While they may come with their own risks and complexities, these benefits make options a valuable tool for managing risk and protecting investments in volatile markets.

Hedging is a strategy used by investors to reduce or eliminate the risk of adverse price movements in an asset. It involves taking an offsetting position in a related security, such as an options contract, to protect against potential losses.

Options can be used to hedge stock positions by purchasing put options. A put option gives the holder the right to sell the underlying stock at a specified price (the strike price) within a certain period of time. By buying put options, investors can protect themselves against a decline in the stock’s price, limiting potential losses.

Sure! Let’s say an investor owns 100 shares of ABC Company, which is currently trading at $50 per share. The investor is concerned that the stock’s price might decline in the near future. To hedge against this potential decline, the investor purchases 1 put option contract with a strike price of $45. If the stock’s price does fall below $45 before the option expires, the investor can exercise the put option and sell the shares at $45, limiting their potential losses.

Using options to hedge stock positions has several advantages. First, it allows investors to limit their potential losses if the stock’s price declines. Second, it provides flexibility, as options can be bought or sold at any time during the option’s lifespan. Lastly, options can be a cost-effective hedging strategy, as the upfront cost of purchasing options is generally lower than selling the stock and buying it back later.

Beginner’s Guide to Nifty Option Trading Welcome to the beginner’s guide on how to start Nifty option trading! If you’re new to the world of options …

Read ArticleAre all FX options OTC? Foreign exchange (FX) options are financial derivatives that give the buyer the right, but not the obligation, to buy or sell …

Read ArticleWhat is the best strategy for stock trading? Stock trading can be a complex and sometimes unpredictable endeavor. With the ever-changing market …

Read ArticleHow to calculate correlation matrix? Correlation is a statistical measure that quantifies the relationship between two variables. It helps us …

Read ArticleUnderstanding the GMT Offset for Forex Brokers When it comes to forex trading, understanding the GMT offset is crucial. The GMT offset, also known as …

Read ArticleDoes Expert Option Accept PayPal? When it comes to online trading platforms, payment options play a crucial role. Traders always look for convenient …

Read Article