How Much Do Prop Firms Pay Traders? Learn the Average Pay Rates

How much do prop firms pay traders? Proprietary trading firms, or prop firms, are companies that allow individuals to trade with the firm’s capital. …

Read Article

Options are financial derivatives that give the holder the right, but not the obligation, to buy or sell an underlying asset at a specific price, known as the strike price, on or before a certain date. One type of option that traders often focus on is the earnings report option – an option placed on a company’s stock just before the release of its earnings report.

As the earnings report date approaches, there is often increased uncertainty in the market regarding the company’s financial performance. This uncertainty can cause the price of options to increase. Traders are willing to pay a higher premium for the option as they anticipate larger price swings in the stock following the earnings report. The anticipation of potential profits or losses from these price swings drives up the demand for options.

The increase in options prices as the earnings report approaches is also influenced by other factors, such as the historical volatility of the stock and overall market conditions. If the stock has a history of large price swings around earnings announcements, options on that stock are likely to be more expensive. Additionally, if market conditions are already volatile, options prices across the board may be higher.

It is important to note that while options prices generally increase as the earnings report approaches, it does not guarantee a profitable trade. Trading options carries inherent risks, and investors should carefully consider their trading strategies and risk tolerance before engaging in options trading.

In conclusion, the price of options typically increases as the earnings report approaches due to increased uncertainty and the anticipation of potential price swings. However, it is essential to conduct thorough research and analysis before trading options and carefully manage the associated risks.

The price of options can exhibit significant movement leading up to an earnings report. Traders and investors often anticipate the release of earnings and adjust their positions accordingly, which can result in increased buying or selling pressure on options contracts.

Before the earnings report, option prices may increase as demand for these contracts rises. This is because traders expect increased volatility in the stock’s price following the earnings announcement, which in turn increases the value of options. Investors may look to purchase options as a way to potentially profit from the anticipated price movement.

Additionally, as the earnings report date approaches, implied volatility, a key component of options pricing, tends to increase. Implied volatility reflects the market’s expectations of how much the stock price will fluctuate in the future, and higher volatility generally leads to higher options prices. Traders may therefore be willing to pay a higher premium for options contracts in anticipation of larger price swings.

However, it is important to note that the relationship between option prices and earnings reports is not always straightforward. Market conditions, company information, and other factors can also influence option prices. Therefore, traders and investors should carefully assess the specific circumstances and individual stock before making any trading decisions based solely on the earnings report.

In summary, the price of options can increase as the earnings report approaches due to increased demand and higher implied volatility. However, other factors can also impact option prices, so it is important to consider a variety of factors before making trading decisions related to earnings reports.

Options can respond to earnings reports in a variety of ways. The price of options tends to increase as the earnings report approaches, especially if there is a higher level of uncertainty or volatility surrounding the stock.

Read Also: Discover the Reasons for the Zloty's Strengthening and Understand its Implications

During earnings season, there is often increased anticipation and speculation about a company’s financial performance. Traders and investors may buy options to take advantage of potential price movements following the release of the earnings report. This buying pressure can drive up the price of options.

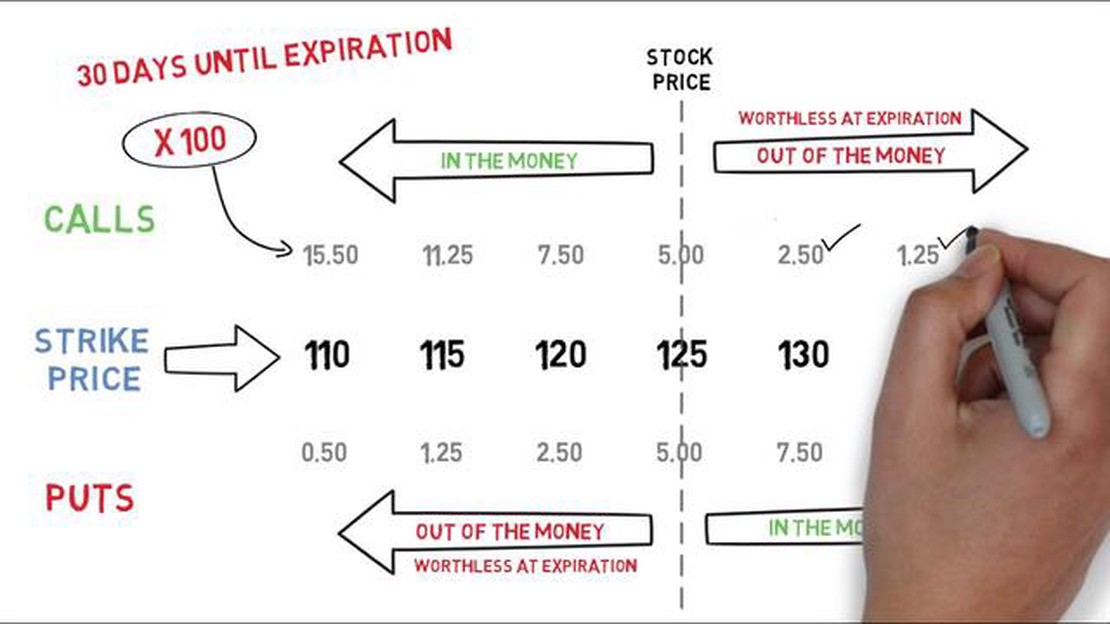

If the earnings report is positive and exceeds market expectations, the stock price may increase significantly. In this case, call options, which give the holder the right to buy the stock at a predetermined price, may become more valuable. The higher stock price increases the likelihood that the option will be exercised, leading to an increase in its price.

Read Also: Is the ZigZag Indicator Lagging? Exploring its Accuracy and Effectiveness

On the other hand, if the earnings report is negative or fails to meet market expectations, the stock price may decline. In this scenario, put options, which give the holder the right to sell the stock at a predetermined price, may become more valuable. As the stock price decreases, the likelihood of the option being exercised increases, causing its price to rise.

It’s important to note that the price of options is influenced by factors other than the earnings report itself. Factors such as the underlying stock’s volatility, time until expiration, and the strike price of the option can also impact its price. Traders and investors should take into account these factors and conduct thorough analysis before making any options trading decisions based on earnings reports.

Yes, options generally tend to increase in price as the earnings report approaches. This is because the earnings report can have a significant impact on the stock price, and as a result, on the value of the options. Traders and investors anticipate potential price movements and adjust their options positions accordingly.

Options become more expensive before the earnings report because there is an increased level of uncertainty and volatility in the market. Traders and investors are willing to pay a higher premium for options to protect themselves from large price swings that may occur as a result of the earnings report. The higher demand for options drives up their prices.

Several factors contribute to the increase in the price of options as the earnings report approaches. These include the expected volatility of the stock, the time remaining until expiration, the current price of the stock, and the strike price of the option. Additionally, market sentiment and investor expectations can also play a role in driving up the prices of options.

While it is generally expected that options will increase in price before the earnings report, there can be cases where this does not happen. If the market has already priced in the earnings expectations and there are no significant surprises, the prices of options may not experience a significant increase. Additionally, if overall market conditions are highly volatile and uncertain, options prices may not follow the usual pattern.

Traders can take advantage of the increase in options prices before the earnings report by implementing various options strategies. They can buy calls or puts to speculate on the direction of the stock price movement after the earnings report. They can also sell options to collect premium if they believe the options are overpriced. However, it is important to note that trading options involves risks and requires careful analysis and risk management.

Options are derivative financial instruments that give the holder the right, but not the obligation, to buy or sell an underlying asset at a predetermined price within a specific time frame.

The price of options can change due to various factors, such as changes in the price of the underlying asset, market volatility, time remaining until expiration, and the demand and supply dynamics in the options market.

How much do prop firms pay traders? Proprietary trading firms, or prop firms, are companies that allow individuals to trade with the firm’s capital. …

Read ArticleIs reversal trading profitable? Reversal trading, also known as countertrend trading, is a popular strategy among traders. Instead of following the …

Read ArticleInvesting 1000 rs in option trading: Is it possible and profitable? Option trading can be an exciting and potentially lucrative investment strategy. …

Read ArticleBest Trading Session for Silver: Find the Optimal Time to Trade Silver trading is a popular investment choice for many traders looking to diversify …

Read ArticleApplets: A Comprehensive Guide to Their Uses and Applications What are the common uses of applets? Guide and Examples Applets are small applications …

Read ArticleIs it possible to live on forex? Forex trading has gained popularity over the years as more and more people look for alternative ways to earn money. …

Read Article