Is InstaForex Using MT5? | Everything You Need to Know

InstaForex and MT5: What You Need to Know InstaForex is a well-known online trading platform that offers various trading options to its clients. One …

Read Article

Dividend payments are an important aspect of investing in stocks and can significantly impact a trader’s overall returns. However, when it comes to trading options, the question arises: do option traders receive dividends?

The answer to this question depends on the specific type of option being traded. In general, option traders do not receive dividends. This is because options are derivatives and their value is based on the underlying stock price, rather than the dividend payments associated with the stock.

When a company pays a dividend, the stock price typically decreases by an amount equal to the dividend payment. This decrease in stock price is known as the ex-dividend drop. Since options are based on the stock price, the value of the option also decreases by the same amount.

For example, let’s say you own a call option on a stock that pays a $1 dividend. On the ex-dividend date, the stock price drops by $1. As a result, the value of your call option also decreases by $1. So, even though dividends are paid to the stockholders, option traders do not directly benefit from them.

However, it’s important to note that dividend payments can still have an indirect impact on option trading. Dividends can affect the supply and demand dynamics of the underlying stock, which in turn can influence the option prices. Additionally, dividend payments can also influence the volatility of the stock, which is a key factor in determining the price of options.

Overall, while option traders do not receive dividends, it’s crucial to consider the potential impact of dividend payments when trading options. By understanding how dividends can affect the underlying stock and option prices, traders can make more informed decisions and effectively manage their options portfolio.

One of the questions that often arises in option trading is whether option traders receive dividends. Dividends are typically paid out to shareholders of a company as a way to distribute profits. However, when it comes to options, the situation can be a bit more complex.

When an investor purchases an option, they are essentially buying the right to buy or sell an underlying asset at a specific price within a certain time frame. This means that option traders do not actually own the underlying shares of the company, and therefore do not have the right to receive dividends.

Dividends are typically paid out to shareholders on a specific date, known as the ex-dividend date. This is the date on which a stock begins trading without its dividend, and any new buyers of the stock will not receive the upcoming dividend payment. Since option traders do not actually own the shares, they are not entitled to receive the dividend payment.

Read Also: How Much is Your iPhone 4 Worth? Find Out the Resale Value

However, it’s important to note that the price of options can be influenced by the expectation of dividends. When a company announces a dividend payment, it can impact the price of the underlying stock. This, in turn, can affect the price of options on that stock.

For example, if a company announces a large dividend payment, it may cause the stock price to increase. This increase in stock price can impact the price of call options, making them more expensive. On the other hand, put options may become less expensive because the stock price is expected to rise.

Option traders can take advantage of these price changes by incorporating dividend expectations into their trading strategies. By anticipating the impact of dividends on option prices, traders can potentially profit from these moves.

In conclusion, option traders do not receive dividends as they do not own the underlying shares. However, dividends can still impact the price of options, providing opportunities for traders to profit. Understanding the relationship between dividends and option prices can be an important factor in successful option trading.

Dividends play a crucial role in option trading, as they can significantly impact the price and profitability of options contracts. Understanding the effect of dividends on options is essential for options traders to make informed investment decisions. Here are some key reasons why dividends are important in option trading:

In conclusion, dividends are an important consideration for option traders. They can significantly impact options pricing, ex-dividend dates, dividend capture strategies, and dividend risk. Traders should analyze dividend-related factors and incorporate them into their options trading strategies to make better-informed investment decisions.

Read Also: Understanding CEO Compensation: What is the Typical Salary and Benefits?

No, option traders do not receive dividends. Unlike stockholders, who are entitled to receive dividends, option traders only hold the right to buy or sell the underlying stock at a certain price.

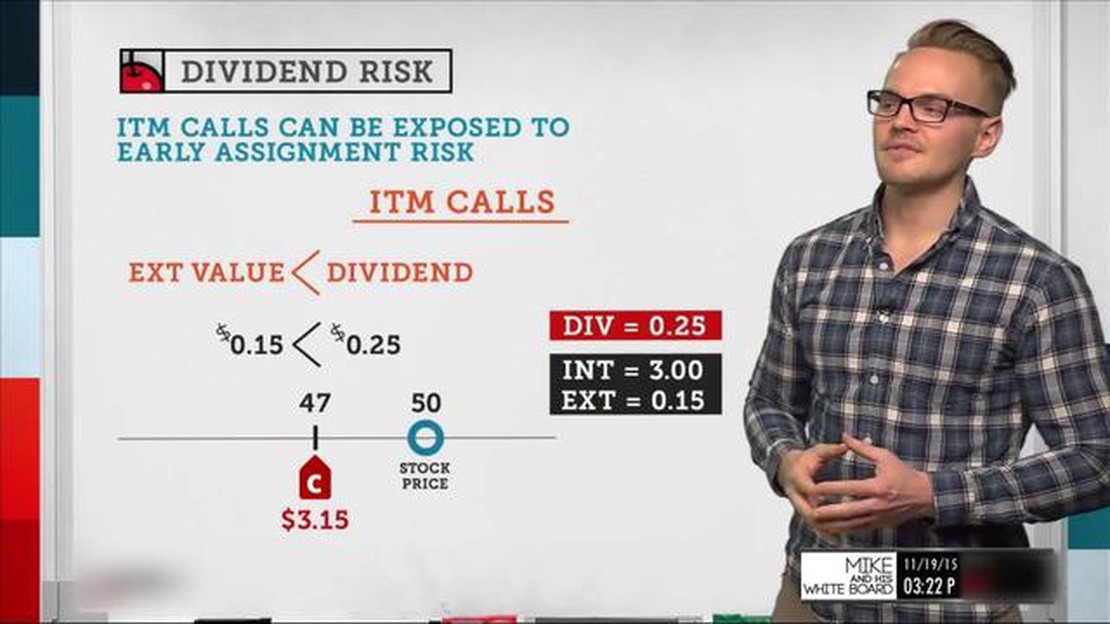

Dividends can have a significant impact on option trading. Usually, when a dividend is declared, the price of the underlying stock decreases by the amount of the dividend. This can affect the value of options that are based on that stock, as it may result in a decrease in their value.

Dividends are reflected in option prices through a reduction in the underlying stock price. This reduction is estimated by the market as the expected dividend amount. As a result, the value of options may decrease, especially if the dividend is significant.

Yes, option traders do factor in dividends when making trading decisions. They need to consider the impact of dividends on the underlying stock price, as it can affect the value of their options. Traders may also use dividend dates and amounts to strategically plan their option trades.

Yes, call and put options can be affected differently by dividends. Generally, call options tend to decrease in value when dividends are paid, as the stock price falls. On the other hand, put options may increase in value, as the decrease in stock price can make them more profitable. However, the specific impact depends on various factors such as the strike price and expiration date of the options.

Option traders do not receive dividends. Dividends are typically paid to the owners of the underlying stock, not to the holders of options contracts. However, the presence of dividends can have an impact on option prices and trading strategies.

Dividends can have a significant impact on option trading. When a stock pays a dividend, the price of the underlying stock tends to decrease by the amount of the dividend. This decrease in stock price can affect the value of options tied to that stock. For example, call options may decrease in value due to the decreased stock price, while put options may increase in value. Traders must take this into account when formulating their option trading strategies.

InstaForex and MT5: What You Need to Know InstaForex is a well-known online trading platform that offers various trading options to its clients. One …

Read ArticleUnderstanding the Difference Between a Forex Card and Global Cash Card When it comes to traveling abroad, managing finances becomes a crucial factor. …

Read ArticleIs GBP USD Going Up? As the global markets continue to face uncertainty, investors are closely monitoring the movement of GBP USD and looking for …

Read ArticleIs ABCD Pattern Effective? The ABCD pattern is a popular technical analysis tool used by traders to identify potential price reversals and …

Read ArticleBest Strategy for EMA When it comes to trading, having a reliable strategy is crucial for success. One popular strategy that many traders swear by is …

Read ArticleUnderstanding SR in Trading: A Comprehensive Guide Support and Resistance (SR) levels are key concepts in technical analysis and an essential part of …

Read Article