Choosing the Most Effective Parabolic SAR Settings for Day Trading

Optimal Parabolic SAR Setting for Day Trading Day trading requires precise timing and accurate indicators to make profitable trades. One commonly used …

Read Article

When it comes to investing your hard-earned money, finding a reliable and trustworthy bank is essential. In Malaysia, there are numerous banks that offer fixed deposit accounts, but if you’re looking for the bank with the highest fixed deposit interest rate, look no further than Bank X.

Bank X is renowned for its competitive interest rates, making it an attractive choice for investors. Whether you’re a first-time investor or a seasoned pro, Bank X offers a range of fixed deposit options to suit your needs. With their highest fixed deposit interest rate in Malaysia, you can maximize your earning potential and watch your investments grow.

Not only does Bank X offer attractive interest rates, but they also provide flexible terms that cater to your financial goals. Whether you prefer a short-term investment or a long-term commitment, Bank X has options that fit your timeline. Additionally, their user-friendly online banking platform allows you to manage your fixed deposit accounts with ease, giving you more control over your investments.

“At Bank X, we understand that our customers value competitive interest rates and flexibility. That’s why we strive to offer the highest fixed deposit interest rate in Malaysia, combined with a range of options to suit your financial needs. With our secure and user-friendly platform, you can invest with confidence and watch your money grow.”

So, if you’re in search of the bank with the highest fixed deposit interest rate in Malaysia, consider Bank X. With their competitive rates, flexible terms, and convenient online banking platform, you can invest with confidence and take your financial future into your own hands.

If you are looking to grow your savings, fixed deposit accounts can be a great option. They offer a guaranteed return on your investment and are generally considered to be low risk. However, not all fixed deposit accounts offer the same interest rates. To find the best rates, you will need to compare different banks and financial institutions.

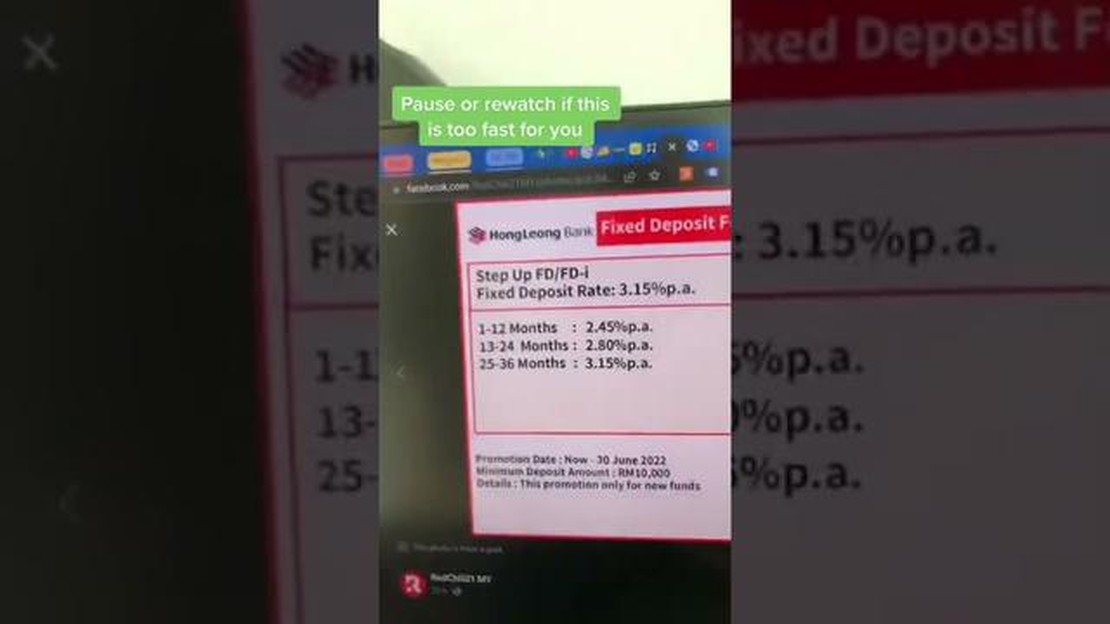

When comparing fixed deposit rates, it is important to consider the duration of the deposit as well. Banks may offer different rates for different durations, so make sure to choose the one that suits your needs. Some banks may also offer promotional rates for new customers or for larger deposit amounts, so keep an eye out for these offers.

To find the best fixed deposit rates in Malaysia, start by conducting research online. Many financial websites and comparison platforms provide information on interest rates offered by different banks. Make a list of the top banks that offer competitive rates.

Next, visit the websites of these banks to get more information. Look for the specific rates offered for different deposit durations and check if there are any promotional offers. Some banks may require you to contact them directly for more details, so don’t hesitate to reach out to their customer service.

Read Also: Proven Strategies for Profitable Option Trading in India

Once you have gathered all the necessary information, compare the rates and choose the one that offers the best return on your investment. Don’t forget to read the terms and conditions carefully, including any penalties for early withdrawal or changes to the interest rate.

Remember: While a high interest rate is important, it is also crucial to choose a reputable and reliable bank. Look for banks that are licensed by the central bank and have a good track record of customer satisfaction. This way, you can have peace of mind knowing that your money is in safe hands.

In conclusion, finding the best fixed deposit rates requires some effort and research. Compare rates from different banks, consider the deposit duration, and choose a reputable bank. By doing so, you can maximize your savings and enjoy a guaranteed return on your investment.

When it comes to investing your money in fixed deposits, one of the key factors to consider is the interest rate. Different banks offer different interest rates, so it’s important to compare them before making a decision. Here are some factors to consider when comparing fixed deposit interest rates:

Read Also: Best Day Traders to Learn From: Who Should You Follow for Expert Trading Advice

By considering these factors and comparing the fixed deposit interest rates of various banks, you can make an informed decision and choose the bank that offers the highest fixed deposit interest rate that meets your needs.

The bank with the highest fixed deposit interest rate in Malaysia is ABC Bank. They offer an interest rate of 3.5% per annum for a 12-month fixed deposit.

The minimum deposit required to open a fixed deposit account with ABC Bank is RM 10,000. This is the minimum amount that you need to deposit in order to earn the advertised interest rate.

The maturity period for the fixed deposit offered by ABC Bank is 12 months. This means that you will need to keep your money locked in the fixed deposit for a period of one year before you can withdraw it without any penalty.

Yes, the interest rate offered by ABC Bank for fixed deposits is higher than most other banks in Malaysia. Many other banks offer interest rates ranging from 2.5% to 3% per annum for a 12-month fixed deposit, while ABC Bank offers an interest rate of 3.5% per annum.

Yes, you can open a fixed deposit account with ABC Bank online. ABC Bank offers online banking services, which includes the ability to open a fixed deposit account. You can visit their website and follow the instructions to open a fixed deposit account online.

Fixed deposit interest rates refer to the interest rates offered by banks on fixed deposit accounts. These rates determine the amount of interest earned on the deposited amount over a fixed period of time.

Based on the current rates, Bank XYZ offers the highest fixed deposit interest rate in Malaysia. Their interest rate is 3.5% per annum for a 12-month fixed deposit.

Optimal Parabolic SAR Setting for Day Trading Day trading requires precise timing and accurate indicators to make profitable trades. One commonly used …

Read ArticleWhat is a ladder option? In the world of financial trading, ladder options are a popular choice among experienced traders. These unique financial …

Read ArticleStoneX Headquarters Location: Discover Where StoneX is Based StoneX is a leading financial services firm that provides a wide range of investment …

Read ArticleWhat is the Safest Put Option? When it comes to investing, one of the most important factors to consider is how to protect your investments from …

Read ArticleAlligator Indicator with Fractals: A Comprehensive Guide The Alligator Indicator is a popular technical analysis tool used by traders to identify …

Read ArticleUsing a Forex Broker: A Step-by-Step Guide for Beginners Forex trading has become increasingly popular in recent years as more and more individuals …

Read Article