How Many Days is a Moving Average?

How many days is a moving average? In the world of finance and investing, the moving average is a popular tool used to analyze and predict market …

Read Article

When it comes to forecasting future trends and making predictions, two popular methods that often come to mind are exponential smoothing and weighted moving average. Both techniques are widely used in time series analysis to identify patterns and make accurate forecasts. However, there is an ongoing debate among analysts as to which method is more accurate and reliable in delivering precise predictions.

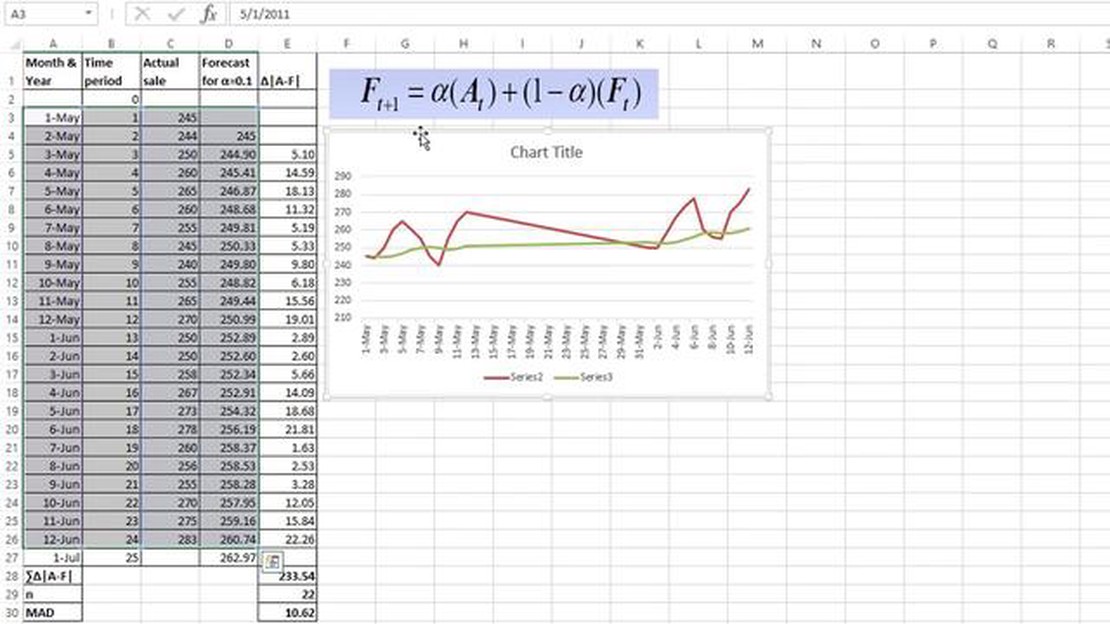

Exponential smoothing is a statistical method that places greater emphasis on recent data points while giving less importance to older observations. This technique assumes that recent trends will have a greater impact on future values, making it particularly useful in situations where there is a high level of volatility or seasonality in the data. By assigning weights to each data point based on its recency, exponential smoothing allows for a smooth forecasting curve that adapts quickly to changes in the underlying data.

On the other hand, weighted moving average assigns different weights to each data point in the time series, with the weights declining as the observations become older. This allows for a similar smoothing effect as exponential smoothing, but with a more gradual adjustment to changes in the data. The weighted moving average approach is commonly used when there is a need to give more weight to recent observations while still considering the impact of older data points.

So, which method is more accurate?

The answer to this question largely depends on the specific characteristics of the data being analyzed and the underlying patterns that exist. Exponential smoothing tends to react quickly to short-term fluctuations, which can be beneficial when there is a need to capture sudden changes or shifts in the data. However, this can also lead to a higher level of volatility in the forecasts, as the method may overreact to temporary fluctuations.

Weighted moving average, on the other hand, offers a more gradual adjustment to changes, resulting in smoother and more stable forecasts. This method may be preferred when the data exhibits a more consistent and predictable behavior over time. However, it may struggle to capture sudden shifts or spikes in the data due to the declining weight assigned to older observations.

In conclusion, the choice between exponential smoothing and weighted moving average should be made based on a careful analysis of the specific characteristics of the data and the desired level of accuracy and responsiveness in the forecasts. Both methods have their strengths and weaknesses, and it is important to consider the individual requirements of the analysis before making a decision.

Read Also: What is the value of 150000 Amex cash?

Exponential Smoothing and Weighted Moving Average are two commonly used forecasting techniques in time series analysis. Both methods aim to predict future values based on historical data. However, there are some differences in the way these methods operate and the accuracy of their predictions.

Exponential Smoothing is a technique that assigns exponentially decreasing weights to past observations, giving more importance to recent values. This method assumes that recent observations are more relevant for predicting future values, while older observations have less influence. The weightage assigned to each observation decreases exponentially over time. Exponential smoothing is useful when there is a level and trend in the data, but no seasonality.

Weighted Moving Average, on the other hand, is a technique that assigns different weights to each observation. The weights are usually inversely proportional to the age of the observation, with more recent values receiving higher weights. This method assumes that recent observations are more valuable for predicting future values, while older values have less impact. Weighted Moving Average is suitable for data with trend and seasonality.

In terms of accuracy, both Exponential Smoothing and Weighted Moving Average have their advantages and limitations. Exponential Smoothing is known for its simplicity and efficiency, making it a popular choice for forecasting. However, it may not perform well when there are sudden changes or outliers in the data. Weighted Moving Average, on the other hand, can handle sudden changes better, as it assigns higher weights to more recent observations. However, it requires more manual intervention to determine the appropriate weights.

Overall, the choice between Exponential Smoothing and Weighted Moving Average depends on the specific characteristics of the data and the forecasting goals. It is recommended to experiment with both methods and compare the accuracy of their predictions before making a final decision.

When it comes to comparing exponential smoothing and weighted moving average, the question of accuracy is of utmost importance. Businesses and researchers alike want to know which forecasting method will provide the most accurate results.

Exponential smoothing, as its name suggests, places a higher weight on more recent data points. This allows it to quickly adapt to any sudden changes in the time series and provide a forecast that reflects the most current trends. On the other hand, weighted moving average assigns different weights to different data points, with the most recent data points receiving the highest weights. This method also accounts for recent changes in the time series, but places relatively less emphasis on the very latest data points compared to exponential smoothing.

Both methods have their merits and limitations, but when it comes to accuracy, exponential smoothing tends to have an edge. The emphasis on more recent data points in exponential smoothing allows it to capture short-term fluctuations in the time series more effectively. This is particularly helpful in situations where there are sudden changes in the data or irregular patterns.

Read Also: 5 Year Forecast for GLD: What Can We Expect?

However, it’s important to note that the accuracy of any forecasting method depends on a variety of factors, such as the quality and consistency of the data, the nature of the time series, and the forecasting horizon. No method can guarantee perfect accuracy, and it’s always advisable to evaluate the performance of different methods using relevant metrics, such as mean absolute percentage error (MAPE) or root mean square error (RMSE).

In conclusion, while both exponential smoothing and weighted moving average have their strengths, when it comes to accuracy, exponential smoothing is generally considered to be more effective. However, the choice of forecasting method should ultimately be based on the specific characteristics of the time series and the desired forecasting horizon.

The two methods can be compared by analyzing their accuracy in predicting future values based on historical data.

It depends on the specific data and the underlying patterns. Generally, exponential smoothing is considered to be more accurate for predicting values with high volatility, while weighted moving average can be more accurate for predicting values with low volatility.

Exponential smoothing has advantages such as being able to adapt quickly to changing trends and adjusting the weights of past values based on their recency. This makes it suitable for predicting values with high volatility.

One limitation of weighted moving average is that it can be more sensitive to outliers in the data, as it gives more weight to recent values. Another limitation is that it requires defining the weights manually, which can be subjective and time-consuming.

How many days is a moving average? In the world of finance and investing, the moving average is a popular tool used to analyze and predict market …

Read ArticleResponsibilities and duties of an FX salesperson An FX (foreign exchange) salesperson is a professional who sells financial services and products …

Read ArticleTransferring Money from BPI Dollar to Peso: Step-by-Step Guide Transferring money from one currency to another can be a daunting task, especially when …

Read ArticleReasons why investors use the foreign exchange market The Foreign Exchange (Forex) market, also known as the currency market, is a global …

Read ArticleWhat is the bank rate for GBP to EUR? When it comes to converting one currency to another, it’s important to understand the bank rate. In the case of …

Read ArticleWhat is Bid-Ask Price in Day Trading? When it comes to day trading, understanding the bid-ask price is crucial. It is a fundamental concept that every …

Read Article