Yes, You Can! Discover How to Trade Futures on MetaTrader

Trading Futures on MetaTrader: Everything You Need to Know Are you interested in expanding your trading portfolio? Have you considered trading futures …

Read Article

Remittance is a popular method of transferring money globally. Whether you are sending money to your loved ones or receiving funds from abroad, knowing how to withdraw money from remittance is crucial. In this article, we will provide you with essential information about the process of withdrawing money from remittance.

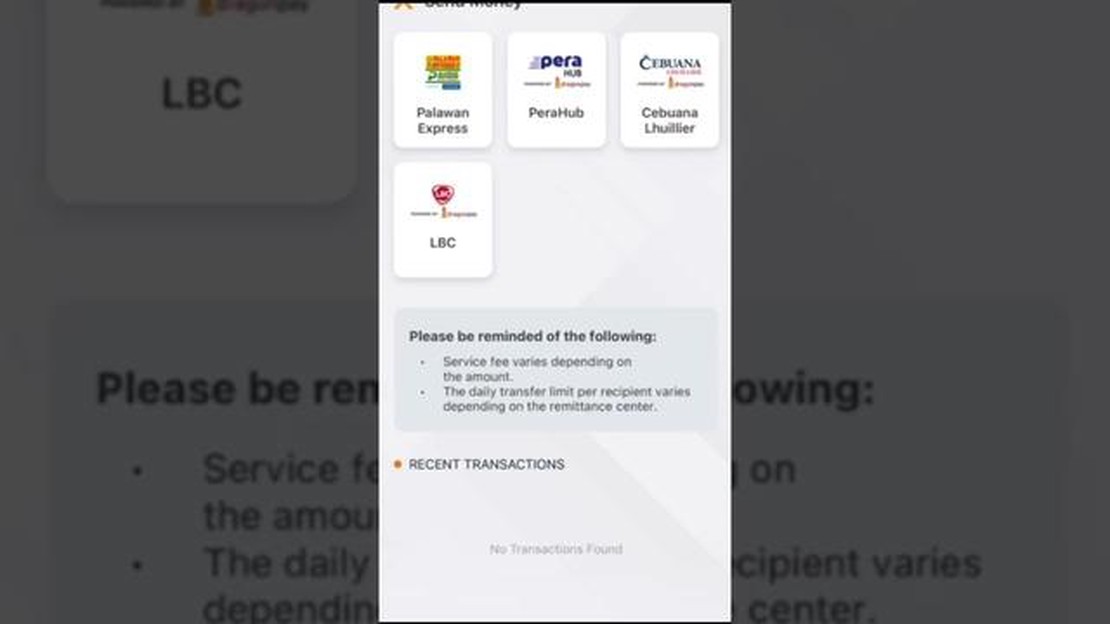

Firstly, it is important to understand that the withdrawal process may vary depending on the remittance service you are using. Some remittance providers offer multiple options for withdrawing money, such as bank transfers, cash pickup, or mobile wallets. It is recommended to familiarize yourself with the withdrawal options offered by your chosen remittance provider before initiating a transfer.

When it comes to withdrawing money from remittance, you will need to have proper identification documents. This is a necessary requirement to ensure the security and legitimacy of the transaction. Commonly accepted identification documents include a valid passport, driver’s license, or national identification card. Make sure to carry the required identification when visiting the remittance provider or the designated withdrawal location.

In certain cases, you may also need to provide additional information or documents to comply with anti-money laundering regulations and other legal requirements. This may include providing proof of the source of funds or explaining the purpose of the transaction. It is advisable to have all the necessary documents prepared in advance to avoid any delays or complications during the withdrawal process.

Overall, withdrawing money from remittance is typically a straightforward process, but it is essential to be aware of the specific requirements and options offered by your chosen remittance service. By understanding the necessary steps and having the correct identification and documents, you can ensure a smooth and secure withdrawal experience. Remember to double-check the withdrawal details and always be cautious when handling money transfers.

Remittance users need to be aware of certain essential information to ensure a smooth and hassle-free experience. Here are a few key things to keep in mind:

1. Transaction Limits: Remittance services often have maximum transaction limits. It is important to be aware of these limits before initiating a transfer to avoid any inconvenience or delays.

2. Exchange Rates: Exchange rates can impact the amount received at the destination. Users should compare the rates offered by different remittance providers to choose the most favorable one and maximize the value of their money.

3. Transfer Fees: Remittance providers may charge fees for their services. Users should inquire about the fees associated with the transfer and consider these costs when calculating the overall expense.

4. Transfer Speed: The speed of remittance transfers can vary between providers. Users should consider their urgency and select a provider that offers quick and reliable transfers, especially if the recipient needs the funds urgently.

5. Identification Requirements: Remittance services often require specific identification documents for both the sender and recipient of funds. Make sure to have the necessary documents ready to avoid any delays in the transfer process.

6. Recipient’s Bank Account: Ensure that you have accurate details of the recipient’s bank account, including the account number and the bank’s SWIFT or IBAN code. Providing incorrect information can lead to delays or even failed transfers.

Read Also: Does Morgan Stanley own Etrade? - Find out the truth

7. Fraud Prevention: Be cautious of scams and fraudulent activities when using remittance services. Only use reputable providers and double-check all information to ensure the transaction is safe and secure.

8. Customer Support: Familiarize yourself with the customer support options provided by the remittance service. In case of any issues or concerns, having access to responsive customer support can be crucial.

By keeping these essential points in mind, remittance users can make informed decisions and have a seamless experience when sending money to their loved ones or for other purposes.

When it comes to withdrawing money from a remittance service, it is important to understand the process involved. Here are the key steps to keep in mind:

| Step 1: | Choose a withdrawal method |

| Step 2: | Provide necessary information |

| Step 3: | Confirm the withdrawal |

| Step 4: | Collect the funds |

Firstly, you will need to choose a withdrawal method. Most remittance services offer multiple options such as bank transfers, cash pick-up, or mobile wallet transfers. Consider factors like convenience, cost, and availability when selecting the most suitable method for you.

Next, you will have to provide the necessary information for the withdrawal. This typically includes details such as your identification documents, bank account information, and recipient’s contact details. Ensure that all the information provided is accurate to avoid any delays or complications.

Once you have submitted the required details, you will need to confirm the withdrawal. This may involve reviewing the transaction details, verifying the recipient’s information, and authorizing the transfer. It’s important to carefully check all the information to prevent any errors or potential fraud.

Read Also: Understanding the Ins and Outs of Exchange Policy: All You Need to Know

Finally, after the withdrawal has been confirmed, you can collect the funds. The availability of the funds will depend on the chosen withdrawal method. Bank transfers may take a few business days to process, while cash pick-ups may be available for immediate collection. Follow the instructions provided by the remittance service to successfully collect your funds.

It’s important to note that the withdrawal process may vary depending on the specific remittance service you are using. Always refer to the service provider’s guidelines and instructions for accurate information on how to withdraw your money.

Withdrawing money from a remittance service can be a convenient way to access your funds in a foreign country. However, there are several factors that you should consider before making a withdrawal:

By considering these factors, you can make an informed decision when it comes to withdrawing money from a remittance service and ensure a smooth and hassle-free experience.

Remittance refers to the transfer of money or funds from one place to another, usually by an individual who is working in a foreign country and sending money back to their home country.

Yes, you can withdraw money from remittance. Once the money has been transferred to your bank account or any other designated method, you can withdraw it as per your convenience.

Yes, there are usually fees associated with withdrawing money from remittance. These fees can vary depending on the service provider and the method of withdrawal chosen. It is advisable to check with your remittance provider for specific details regarding the fees.

There are several options available for withdrawing money from remittance. You can choose to withdraw the money from your bank account, use an ATM, or visit a remittance service provider to collect the cash. Some remittance providers also offer the option of mobile wallet transfers or prepaid cards for withdrawal.

The withdrawal time for remittance can vary depending on various factors such as the remittance service provider, the method of withdrawal chosen, and the destination country. In some cases, the money can be available for withdrawal within minutes, while in other cases, it may take a few hours or even longer.

A remittance is a sum of money that is sent or transferred from one person to another, often from a foreign country to their home country.

Trading Futures on MetaTrader: Everything You Need to Know Are you interested in expanding your trading portfolio? Have you considered trading futures …

Read ArticleUnderstanding the Forex Board: A Comprehensive Guide Foreign exchange, also known as Forex or FX, is the market where currencies are traded. It is a …

Read ArticleDisadvantages of gold futures Gold futures have long been considered a popular investment choice due to their potential for high returns. However, it …

Read ArticleChoosing the Best Trading Robot: A Comprehensive Guide In today’s fast-paced and highly competitive financial markets, traders are always on the …

Read ArticleToday’s Best USD to CAD Rate Are you planning a trip to Canada? Or maybe you need to make an international payment in Canadian dollars? Whatever your …

Read ArticleBest Indicator for 1 Hour Chart When it comes to trading on the financial markets, having the right indicators can make all the difference. But with …

Read Article