Understanding the Impact of Vega on Options Trading

The impact of Vega in options Options trading is a complex and dynamic field, with many different factors influencing the value and profitability of …

Read Article

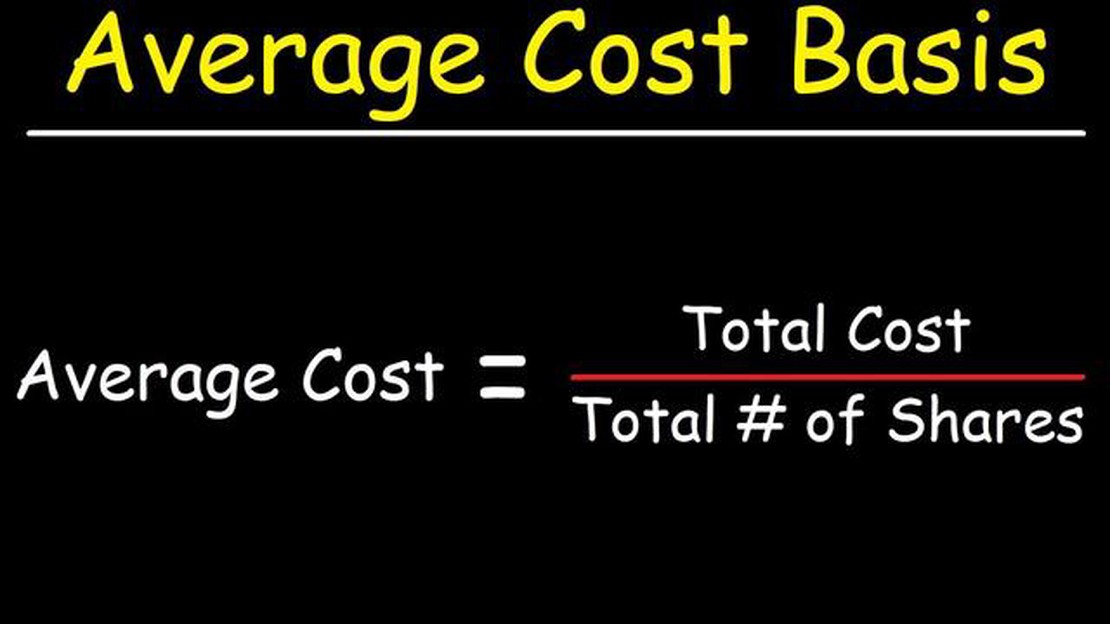

When it comes to trading stock options, understanding the cost basis is crucial. The cost basis of an option is used to determine the profit or loss when the option is sold or exercised. Knowing how to calculate the cost basis can help investors make informed decisions and maximize their returns.

Calculating the cost basis involves several factors, including the purchase price, fees and commissions, and any adjustments made throughout the life of the option. It’s important to keep track of these details to ensure accurate calculations and minimize potential tax consequences.

In this comprehensive guide, we will break down the steps to calculate the cost basis of stock options.

Step 1: Determine the Purchase Price

The purchase price is the amount paid to acquire the option. This includes any premiums, fees, and commissions associated with the purchase. It’s important to keep all receipts and documentation to accurately calculate the cost basis.

Step 2: Consider Transaction Costs

Transaction costs, such as brokerage fees and commissions, can be deducted from the cost basis. These costs can vary depending on the broker and the type of option traded. It’s essential to factor in these expenses to get an accurate cost basis.

Step 3: Account for Adjustments

Throughout the life of the option, certain adjustments may be made that can affect the cost basis. These adjustments can include dividends, stock splits, and mergers. It’s important to keep track of these adjustments and incorporate them into the cost basis calculations.

By following these steps and understanding the factors that contribute to the cost basis, investors can make more informed decisions and better manage their stock options. With accurate cost basis calculations, investors can assess the profitability of their trades and minimize tax burdens. It’s essential to stay organized and keep detailed records to ensure accurate calculations and maximize returns.

Stock options are a popular form of compensation that businesses offer to their employees. They provide employees with the right to purchase company stock at a specified price, known as the exercise price, within a certain timeframe. Understanding the cost basis of stock options is crucial for calculating the taxes owed when the options are exercised or sold.

The cost basis of a stock option is the price paid to acquire the option plus any additional costs, such as brokerage fees or commissions. It is important to track and accurately calculate the cost basis because it determines the amount of taxable income or capital gain when the options are eventually sold.

When an employee exercises a stock option, they purchase the underlying shares at the exercise price. The cost basis of these acquired shares is the exercise price plus any additional costs. This becomes the new cost basis of the shares for future tax calculations.

If the employee decides to sell the acquired shares, the cost basis is used to determine the amount of capital gain or loss. Capital gain is the difference between the selling price and the cost basis. If the selling price is higher than the cost basis, there is a capital gain. If the selling price is lower than the cost basis, there is a capital loss.

It is important to distinguish between two types of stock options: incentive stock options (ISOs) and non-qualified stock options (NSOs). The tax treatment and cost basis calculation can differ between these two types of options.

For ISOs, the cost basis is generally the exercise price plus any additional costs. However, if the employee holds the acquired shares for at least one year from the exercise date and two years from the grant date, any subsequent gain may qualify for favorable long-term capital gains tax rates.

Read Also: What is a 1% in AFL? | Understanding the Crucial Role of 1%ers in Australian Football

For NSOs, the cost basis is generally the exercise price plus any additional costs. The difference between the selling price and the cost basis is considered ordinary income and is subject to ordinary income tax rates.

In summary, understanding the cost basis of stock options is essential for calculating the taxes owed when the options are exercised or sold. It is important to accurately track and calculate the cost basis because it affects the amount of taxable income or capital gain. Different types of options, such as ISOs and NSOs, have different tax treatment and cost basis calculations, so it is crucial to understand the specifics of each type.

Read Also: Understanding the Meaning of Automated Trading: A Comprehensive Guide

| Type of Option | Cost Basis Calculation | Tax Treatment |

|---|---|---|

| ISOs | Exercise price plus additional costs | Potential for long-term capital gains tax rates |

| NSOs | Exercise price plus additional costs | Ordinary income tax rates |

Calculating the cost basis for stock options is an essential step for investors, traders, and tax professionals. The cost basis represents the original price paid for the stock options, which is crucial for determining the tax liability or gain/loss when the options are sold or exercised.

Accurate calculation of the cost basis is necessary to comply with tax regulations and properly report financial transactions. It allows individuals and businesses to accurately calculate their tax liability, avoid penalties, and demonstrate transparency in their financial dealings.

By calculating the cost basis, investors can determine the taxable income generated from the sale or exercise of stock options. This information is used to complete tax forms, such as Schedule D for individual taxpayers or Form 8949 for businesses, and properly report the taxable events to the tax authorities.

The cost basis calculation involves various factors, such as the purchase price of the options, any commissions or fees paid, and adjustments for corporate actions like stock splits or mergers. Failing to consider these factors accurately can result in incorrect reporting, potential tax audits, and financial penalties.

Additionally, calculating the cost basis provides investors with a clearer picture of their investment performance and overall financial health. By understanding the cost basis, investors can accurately determine their profit or loss from stock options transactions and evaluate the success of their investment strategies.

Overall, calculating the cost basis for stock options is essential for accurate tax reporting, compliance with regulations, and monitoring investment performance. It ensures that individuals and businesses meet their financial obligations and make informed financial decisions based on real data.

| Benefits of Calculating the Cost Basis for Stock Options |

|---|

| Compliance with tax regulations |

| Accurate tax reporting |

| Evaluation of investment performance |

| Financial transparency |

| Avoidance of penalties and audits |

The cost basis of a stock option is the original price at which the option was granted or acquired.

The cost basis of a stock option is typically calculated by taking the grant or acquisition price and adding any additional costs or fees, such as commissions. This will give you the total cost basis of the option.

Generally, the cost basis of a stock option does not change over time. It is determined at the time of grant or acquisition and remains the same throughout the life of the option.

If you sell a stock option for more than its cost basis, you will realize a capital gain. This gain will be subject to capital gains tax and should be reported on your tax return.

Yes, there are certain situations where the cost basis of a stock option can be adjusted. For example, if the option is subject to a stock split or merger, the cost basis may be adjusted to reflect the new terms of the option. Additionally, if you exercise a stock option and receive a stock dividend, the cost basis may be adjusted to account for the dividend.

The cost basis of stock options refers to the original price paid for the options, including any fees or commissions. It is used to determine the profit or loss when the options are sold or exercised.

To calculate the cost basis of stock options, you need to know the original purchase price of the options, any fees or commissions paid, and any adjustments made for stock splits or other corporate actions. You can then subtract any proceeds from the sale of the options or the cost of exercising them to determine the cost basis.

The impact of Vega in options Options trading is a complex and dynamic field, with many different factors influencing the value and profitability of …

Read ArticleExploring the Functionality of a Pulse Charger Pulse chargers are an innovative technology that has revolutionized the way we charge our devices. …

Read ArticleCan You Trade Binary Options on Forex? Forex trading and binary options are both popular methods for individuals to profit from the financial markets. …

Read ArticleBenefits of Coding for Trading In today’s digital age, technology has revolutionized the way we conduct business, and the trading industry is no …

Read ArticleWhat does a trade processing specialist do? A trade processing specialist is a vital part of the financial industry. Their role involves ensuring that …

Read Articletrading hours of XAU market If you are interested in trading gold, it is important to know the opening time for XAU trading. XAU is the symbol used to …

Read Article