What is the minimum deposit for Plus500? - Everything you need to know

Minimum Deposit for Plus500 Plus500 is a popular online trading platform that allows users to trade a variety of financial instruments, such as …

Read Article

Knowing how to calculate profit and loss is essential for any business owner or investor. Whether you are running a small startup or managing a large corporation, understanding the financial health of your venture is crucial for making informed decisions and maximizing your returns.

Profit and loss, also known as P&L, is a financial statement that shows the revenues, costs, and expenses incurred during a specified period. It is a snapshot of your business’s performance and can provide valuable insights into its profitability. By analyzing the P&L statement, you can identify areas where you are making money and areas where you are losing money.

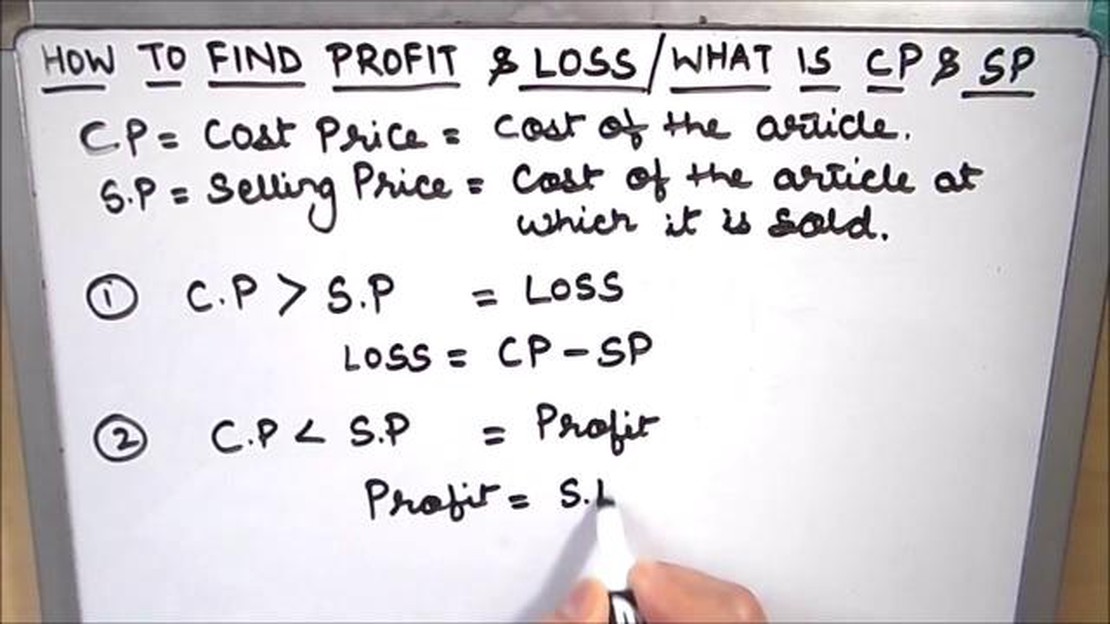

To calculate profit, you need to subtract the total expenses from the total revenue. This simple formula allows you to assess how much money you have made after accounting for all the costs associated with running your business. On the other hand, to calculate loss, you need to subtract the total revenue from the total expenses. This will give you an idea of how much money you have lost during the specified period.

Example: Let’s say you have a company that generated $500,000 in revenue last year. Your total expenses, including salaries, rent, and utilities, amounted to $400,000. By subtracting the expenses from the revenue, you can calculate that your profit for the year was $100,000.

Calculating profit and loss is essential not only for assessing your business’s financial performance but also for attracting investors and securing loans. Financial institutions and potential investors will often request your P&L statement to evaluate the viability of your venture. By being able to demonstrate a positive, growing profitability, you increase your chances of obtaining funding and expanding your business.

In conclusion, knowing how to calculate profit and loss is a fundamental skill for every business owner and investor. It allows you to assess the financial health of your venture, make informed decisions, and attract potential investors. By understanding the basics of profit and loss calculation, you can pave the way for sustainable growth and success.

Profit and loss are important concepts in business and finance. They are used to measure the success or failure of a company’s operations and to determine its financial performance.

Profit is the amount of money a company earns after deducting all of its expenses from its revenue. It is often referred to as the “bottom line” because it represents the final result of a company’s income statement. Generating a profit is essential for a business to grow and thrive.

On the other hand, loss occurs when a company’s expenses exceed its revenue. It is an indication that the company is not generating enough income to cover its costs. Losses can be problematic for a company as they can lead to financial difficulties and even bankruptcy.

Understanding profit and loss is crucial for business owners and investors as it helps them evaluate the financial health of a company. It allows them to assess profitability and make informed decisions about whether to invest in a company or not.

There are various factors that can affect a company’s profit and loss. These include revenue from sales, cost of goods sold, operating expenses, taxes, and interest expenses. By analyzing these factors, businesses can identify areas that are driving profits or causing losses.

In conclusion, profit and loss are key metrics that measure a company’s financial performance. They provide valuable insights into a company’s ability to generate income and manage expenses. By understanding profit and loss, businesses and investors can make informed decisions to ensure the success and sustainability of a company.

Calculating profit and loss for a business is important to understand its financial health. There are several factors that can affect a company’s profit and loss statement, which provides a snapshot of its earnings and expenses over a certain period of time. These factors include:

Read Also: Discover the Fastest WordPress Theme for Lightning-Fast Websites!

Understanding these factors and how they impact a company’s profit and loss is crucial for making informed business decisions and managing financial performance.

In order to calculate profit and loss, it’s essential to understand revenue and expenses. Revenue refers to the income generated from selling products or providing services. It’s the total amount of money a business earns during a specific period.

On the other hand, expenses are the costs incurred by a business in order to generate revenue. These costs can include employee salaries, rent, utilities, raw materials, marketing expenses, and any other expenses necessary to run the business.

It’s important for businesses to carefully track both their revenue and expenses to accurately calculate their profit or loss. By comparing the total revenue and total expenses, businesses can determine whether they are making a profit or operating at a loss.

Read Also: How Python is Revolutionizing Trading: Exploring its Applications and Benefits

Revenue: This includes all the income generated from sales or services. It can include income from sales of products, fees charged for services, or any other income sources related to the business.

Expenses: This includes all the costs incurred in running the business. It can include costs related to employee salaries, rent, utilities, raw materials, marketing expenses, loan interest, or any other expenses necessary for the business operations.

By calculating the difference between total revenue and total expenses, businesses can determine their profit or loss. A profit occurs when the revenue is higher than the expenses, while a loss occurs when the expenses are higher than the revenue.

Accurately tracking revenue and expenses is crucial for businesses to make informed decisions, plan for growth, and ensure financial stability. It also helps identify areas where costs can be reduced or revenue can be increased to improve the overall profitability of the business.

In conclusion, understanding revenue and expenses is essential for calculating profit and loss. By carefully tracking these components, businesses can gain valuable insights into their financial performance and make informed decisions to ensure long-term success.

Profit and loss calculation is a financial process that determines the amount of money a business has gained or lost over a specific period of time. It involves subtracting the total expenses from the total revenue to determine the net profit or loss.

To calculate profit, subtract the total expenses from the total revenue. The formula is Profit = Total Revenue - Total Expenses. This will give you the net profit earned by your business.

Calculating profit and loss is important for businesses as it helps in evaluating the financial performance and efficiency of the company. It allows business owners to make informed decisions, identify areas of improvement, and set future financial goals.

Yes, profit and loss can be negative. If the total expenses exceed the total revenue, the result will be a net loss. This indicates that the business is not generating enough revenue to cover its expenses and may need to make adjustments to improve its financial situation.

Some common expenses to consider when calculating profit and loss include employee salaries, rent, utilities, marketing expenses, raw materials costs, and taxes. These expenses play a crucial role in determining the overall profitability of a business.

Calculating profit and loss involves subtracting expenses from revenue. The result is the profit if the revenue is higher than the expenses, and the loss if the expenses are higher than the revenue.

Minimum Deposit for Plus500 Plus500 is a popular online trading platform that allows users to trade a variety of financial instruments, such as …

Read ArticleMinimum Fund Requirement for Forex Trading Forex, or foreign exchange, is a decentralized market where currencies are traded. It’s a popular …

Read ArticleUnderstanding Box 14 Codes on W-2 Forms When you receive your annual W-2 form from your employer, you may notice a section labeled “Box 14.” This …

Read ArticleWhat is the potential growth for McKesson stock? The future growth potential of McKesson stock is an intriguing topic for investors and analysts …

Read ArticleIs buying pre-IPO stocks a wise investment strategy? Investing in stocks can be a lucrative way to grow your wealth, and many investors are constantly …

Read ArticleCan AI replace human traders? Artificial intelligence (AI) is revolutionizing various industries, and the trading industry is no exception. With its …

Read Article