How to obtain permission for trading options on Interactive Brokers?

How to Get Permission to Trade Options on Interactive Brokers Trading options can be a lucrative investment strategy, but before diving into the …

Read Article

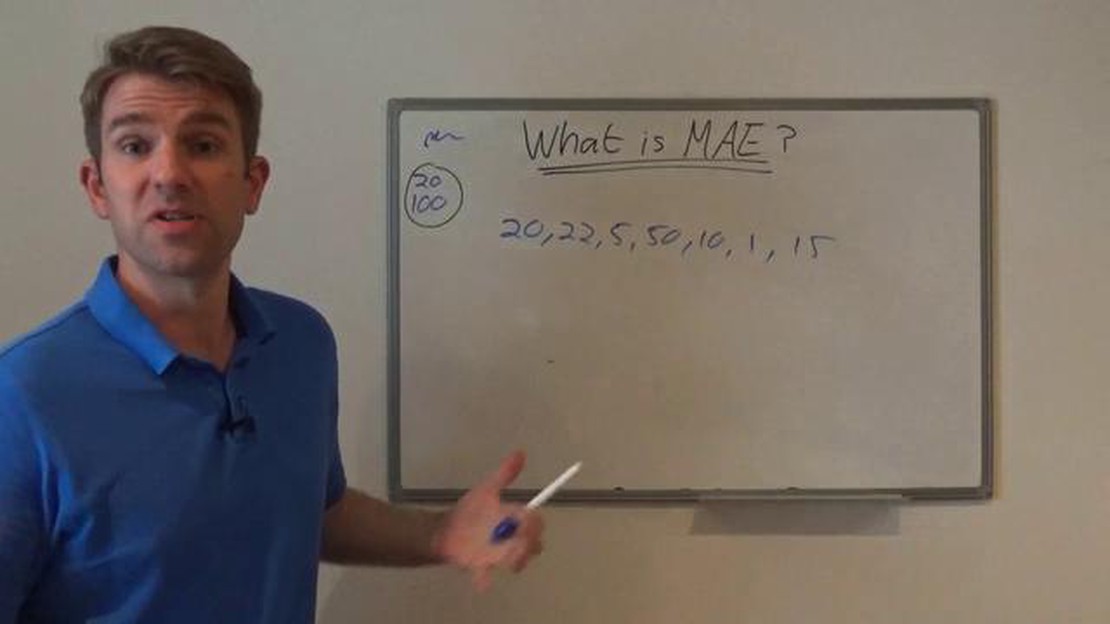

When it comes to trading, it’s crucial to have a clear understanding of your risk and potential losses. While many traders focus on calculating their potential profits, it’s just as important to determine the maximum amount you could lose on a trade. This is where the concept of Maximum Adverse Excursion (MAE) comes into play.

MAE is a metric used in trading to evaluate the maximum drawdown experienced by a trade from its entry point to its lowest point before reversing. By calculating the MAE, traders can gain valuable insights into their risk management strategies and make more informed decisions.

In this step-by-step guide, we will walk you through the process of calculating MAE. We will cover the necessary steps and provide examples to help you apply this concept to your own trading endeavors.

First, we will discuss the importance of determining your risk tolerance and how it relates to MAE. Then, we will explain how to identify the entry and exit points for a trade. We will also dive into the calculations involved in determining MAE, including measuring from the entry point to the lowest point and calculating the difference.

By the end of this guide, you will have a clear understanding of how to calculate MAE and why it plays a critical role in risk management. Armed with this knowledge, you will be better equipped to make informed trading decisions and minimize potential losses.

The concept of Maximum Adverse Excursion (MAE) is a powerful tool used in trading to measure the largest potential loss incurred between the execution of a trade and its subsequent exit. This metric helps traders evaluate the risk associated with a particular trading strategy or system.

MAE is calculated by determining the highest negative price movement in a trade from its entry point to the lowest point before it reaches its exit level. In other words, MAE represents the maximum loss a trader could have experienced if they had exited the trade at its worst possible point.

By understanding and analyzing MAE, traders can gain valuable insights into the potential risks of their trades. It allows them to assess the worst-case scenario and adjust their risk management accordingly. Traders can compare the MAE of different strategies and systems to identify which ones have higher risk levels and make more informed decisions.

MAE can also be used to optimize the size of the stop-loss orders or other risk management measures. By setting appropriate stop-loss levels based on the MAE, traders can limit their potential losses and protect their capital more effectively.

To calculate MAE, one can use historical price data and simulate trades for a given strategy or system. By analyzing a large number of simulated trades, traders can determine the average MAE and evaluate the robustness of their trading approach. This can help identify potential weaknesses in a strategy and make necessary improvements.

In conclusion, understanding Maximum Adverse Excursion is crucial for traders to assess and manage the risk associated with their trades. It provides a realistic view of potential losses and helps in making informed decisions regarding risk management. By incorporating MAE analysis into trading strategies, traders can strive for more consistent and profitable results.

Maximum Adverse Excursion (MAE) is a metric used to measure the potential downside risk in a trade. It quantifies the largest amount of money that could have been lost at any point during the trade from the entry price to the lowest price reached before the trade was closed.

MAE is an important risk management tool for traders as it helps to assess the potential loss in a trade. By calculating the MAE, traders can determine the worst-case scenario and adjust their position size or set appropriate stop-loss levels to minimize the risk.

Read Also: Understanding Currency Strength: How to Determine the Strength of a Forex Currency

MAE is often used in combination with other metrics like Maximum Favorable Excursion (MFE) to evaluate the risk-reward ratio of a trade. MFE measures the largest amount of money that could have been gained from the entry price to the highest price reached before the trade was closed.

To calculate MAE, traders need to track the price movements of a trade from the entry point to the lowest point and measure the difference between the entry price and the lowest price reached during the trade. This calculation provides a realistic measure of the potential downside risk.

Read Also: Are FX Predictions Accurate? Examining the Accuracy of Foreign Exchange Forecasts

Overall, Maximum Adverse Excursion is a valuable risk management tool for traders that allows them to evaluate the potential loss in a trade and make informed decisions to minimize risk and maximize profitability.

| Pros | Cons |

|---|---|

| Helps assess potential loss in a trade | Does not consider other factors such as execution slippage |

| Assists in adjusting position size and setting stop-loss levels | Does not account for market volatility |

| Used in conjunction with other metrics for risk evaluation | Does not provide information on potential gains |

The concept of Maximum Adverse Excursion (MAE) is crucial in the field of trading and investing. It is a measure that helps traders assess the risk associated with their trades and make informed decisions. MAE allows traders to determine the maximum loss they are willing to accept before exiting a trade, thereby managing their risk effectively.

Calculating MAE provides traders with valuable insights into their trading strategies and helps them optimize their trading system. By knowing the maximum drawdown potential of their trades, traders can set realistic and achievable profit targets. Moreover, it helps them assess the viability of their trading strategies and identify areas for improvement.

MAE is particularly significant in assessing the effectiveness of stop-loss orders. Stop-loss orders are an essential tool for managing risk in trading. By calculating MAE, traders can determine the optimal placement of stop-loss orders to minimize losses and protect their capital.

In addition, knowing the MAE can assist traders in setting appropriate position sizes. By considering the potential loss indicated by the MAE, traders can adjust their position sizes to ensure they are suitable for their risk tolerance and account balance.

Overall, calculating MAE is crucial for traders who want to be successful in the financial markets. It helps them manage risk, optimize their trading strategies, and make informed decisions. By understanding the importance of MAE and incorporating it into their trading process, traders can increase their chances of achieving consistent profitability.

Maximum Adverse Excursion (MAE) is a measure used in trading to calculate the maximum drawdown a trade experiences from its highest point to its lowest point.

MAE is calculated by finding the difference between the highest price reached by a trade and the lowest price reached during the trade, and then dividing that difference by the highest price reached.

MAE is important in trading because it allows traders to assess the potential risk of a trade. By calculating the maximum drawdown a trade can experience, traders can set appropriate stop-loss levels and manage their risk more effectively.

Yes, MAE can be used to evaluate the performance of a trading system. By calculating the maximum drawdown of a trading system’s trades, traders can assess the system’s risk and determine if it meets their risk tolerance and profitability goals.

No, MAE and MFE are not the same. While MAE calculates the maximum drawdown of a trade, MFE calculates the maximum profit a trade reaches from its lowest point to its highest point. Both measures are used to assess the risk and potential profitability of a trade.

How to Get Permission to Trade Options on Interactive Brokers Trading options can be a lucrative investment strategy, but before diving into the …

Read ArticleHow to Trade Commodity Futures in Canada Commodity futures trading in Canada offers investors an exciting opportunity to participate in the global …

Read ArticleLive Gold Trading Prices: What You Need to Know Gold has always been a popular commodity due to its intrinsic value and status as a safe haven …

Read ArticleIs MetaTrader 4 available in USA? MetaTrader 4 (MT4) is a popular trading platform used by traders all over the world. It offers a wide range of …

Read ArticleWithdrawing Swedish Money on Forex: Is It Possible? Sweden is known for its strong economy and stable currency, making it an attractive destination …

Read ArticleUnderstanding the Fundamentals in Forex Trading In the dynamic world of finance, the foreign exchange market, or forex, holds a prominent place. It is …

Read Article