Is C.H. Robinson a publicly traded company?

Is C.H. Robinson publicly traded? Yes, C.H. Robinson is a publicly traded company. It is listed on the NASDAQ stock exchange under the ticker symbol …

Read Article

The annual growth rate is a crucial metric for evaluating the performance of a company, investment, or economy. It measures the rate at which a value, such as revenue or GDP, increases or decreases over the course of a year. Calculating the annual growth rate over a four-year period allows for a more comprehensive assessment of trends and patterns, providing valuable insights for decision-making and planning.

To calculate the annual growth rate over a four-year period, you need to obtain the initial and final values for the variable of interest. This could be the revenue of a company, the population of a city, or any other measurable quantity. Once you have these values, the formula for calculating the annual growth rate is simple:

Annual Growth Rate = (Final Value / Initial Value)^(1/Number of Years) - 1

By raising the ratio of the final value to the initial value to the power of one divided by the number of years and then subtracting 1, you can determine the annual growth rate over the specified period. For example, if the revenue of a company increased from $1 million to $1.5 million over the course of four years, the annual growth rate would be:

Annual Growth Rate = (1.5 million / 1 million)^(1/4) - 1

Calculating the annual growth rate over a four-year period provides a longer-term perspective and helps to identify trends that may not be apparent when looking at shorter timeframes. This information is valuable for making informed decisions, whether it be for investment purposes or evaluating the success of a business strategy.

The concept of annual growth rate is an important metric that helps measure the percentage increase or decrease in a value over a specific period of time, usually one year. It is frequently used in business and finance to assess the performance and growth of companies, economies, and investments.

To calculate the annual growth rate, you need to determine the starting value and ending value of the variable you want to measure. The formula to calculate the annual growth rate is:

Annual Growth Rate = ((Ending Value / Starting Value)^(1 / Number of Years)) - 1

This formula takes into account the compounding effect by using exponents and allows for easier comparison across different time periods.

Understanding the annual growth rate is crucial for businesses and investors as it provides insights into the rate at which a particular variable such as sales, revenue, or investment returns is increasing or decreasing. It helps to evaluate the performance and make informed decisions about future investments or strategies.

The annual growth rate can be positive, indicating growth, or negative, indicating decline. For example, a positive annual growth rate of 5% means that the value has increased by 5% each year, while a negative growth rate indicates a decline.

Furthermore, the annual growth rate allows for the comparison of different variables or entities, even if their initial values are significantly different. For instance, it helps to compare the growth rate of two companies with different sizes or the performance of different investment portfolios.

Calculating the annual growth rate over a specific period, such as a 4-year period, helps to analyze trends and identify patterns. By measuring the growth rate over multiple years, it is possible to assess the consistency of growth or identify periods of rapid expansion or decline.

In conclusion, the concept of annual growth rate is an essential tool for analyzing and evaluating the performance of variables over a specific period. It provides valuable insights to businesses, investors, and economists, helping them make informed decisions and projections based on past growth patterns.

Read Also: Best Calendar Apps Compatible with Exchange: Top Choices for Improved Productivity

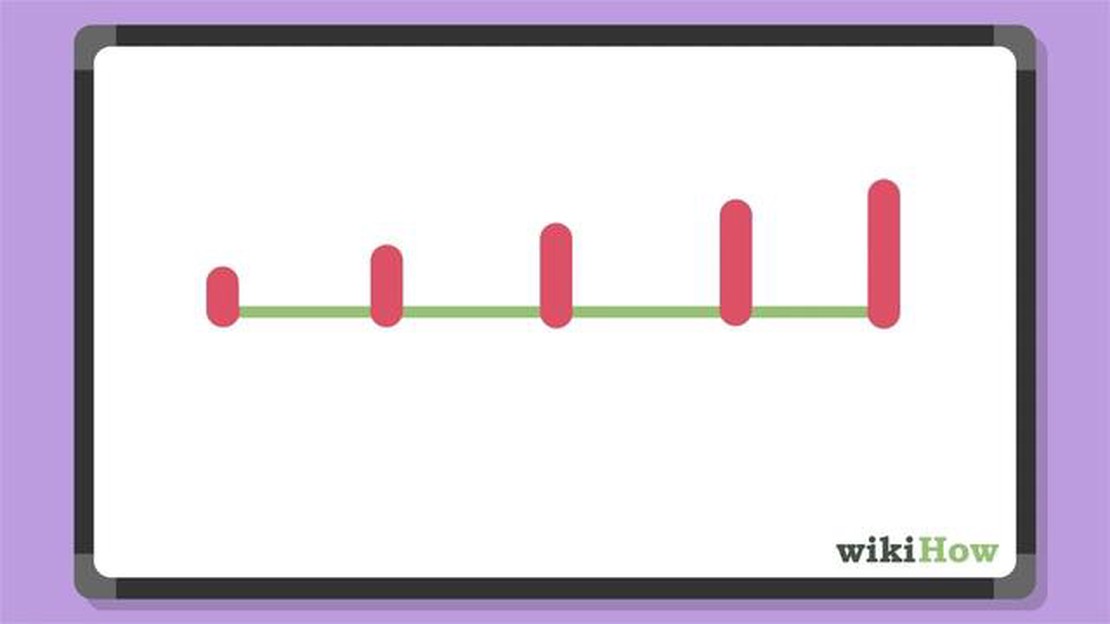

Calculating the annual growth rate is a straightforward process that involves a few simple steps. By following these steps, you can determine the growth rate of an investment or a business over a specified period.

Step 1: Determine the Initial Value

To calculate the annual growth rate, you need to know the initial value of the investment or business for the starting year. This value represents the base from which you will measure the growth.

Step 2: Determine the Final Value

Read Also: Is MT5 a Trustworthy Platform? Find Out Here!

Next, you need to determine the final value of the investment or business for the ending year. This value represents the end point from which you will measure the growth.

Step 3: Calculate the Change in Value

Once you have the initial and final values, subtract the initial value from the final value to determine the change in value. This represents the total growth over the specified period.

Step 4: Determine the Annual Growth Rate

To calculate the annual growth rate, divide the change in value by the initial value, and then multiply by 100 to express the growth rate as a percentage. This will give you the average growth rate per year over the specified period.

Step 5: Interpret the Result

Finally, interpret the result to understand the growth rate of the investment or business. If the growth rate is positive, it indicates an increase in value, while a negative growth rate indicates a decrease in value. The higher the growth rate, the faster the investment or business is growing.

By following these steps, you can easily calculate the annual growth rate and gain valuable insights into the performance of an investment or business. This information can be useful for making informed decisions and evaluating the success of your financial endeavors.

Yes, to calculate the annual growth rate over a 4-year period, you need to know the starting and ending values of the variable you are measuring. The formula to calculate the annual growth rate requires these values in order to determine the percentage change over the specified time period.

Yes, it is possible for the annual growth rate over a 4-year period to be negative. A negative growth rate indicates a decrease in the value of the variable being measured over the specified time period. It signifies a decline rather than an increase in value.

If the annual growth rate over a 4-year period is greater than 1, it indicates that the value of the variable being measured has increased over that time period. For example, an annual growth rate of 1.5 would mean that the value has grown by 50% each year on average.

Yes, you can use the annual growth rate over a 4-year period to compare different variables. By calculating the growth rate for each variable, you can determine which one has experienced a higher or lower rate of change over the specified time period. This can be useful for analyzing trends and making informed decisions.

To calculate the annual growth rate over a 4-year period, you need to consider the starting value and the ending value of the variable in question. You can use the formula: Annual growth rate = (Ending Value/Starting Value)^(1/Number of Years) - 1. In this case, you would take the ending value and divide it by the starting value, raise it to the power of 1 divided by 4 (since it’s a 4-year period) and subtract 1 from the result. This will give you the annual growth rate over the 4-year period.

Is C.H. Robinson publicly traded? Yes, C.H. Robinson is a publicly traded company. It is listed on the NASDAQ stock exchange under the ticker symbol …

Read ArticleUnderstanding the Difference between SMA and EMA Indicators When it comes to analyzing financial data and making informed trading decisions, technical …

Read ArticleWhat is intraday option? Day trading is a popular and exciting form of trading where traders buy and sell financial instruments within the same …

Read ArticleWhy is the expectation of Brownian motion 0? Brownian motion is a continuous random walk that is widely used in many areas of science, including …

Read ArticleRSI as a Momentum Indicator? The Relative Strength Index (RSI) is a popular technical indicator used in financial analysis to measure the strength and …

Read ArticleWhere can I find options outstanding? When it comes to finding the perfect option for any occasion, the choices can sometimes feel overwhelming. …

Read Article