Understanding Forex micro accounts: Everything you need to know

Understanding Forex Micro Accounts for Beginners In the world of foreign exchange trading, a Forex micro account has become increasingly popular among …

Read Article

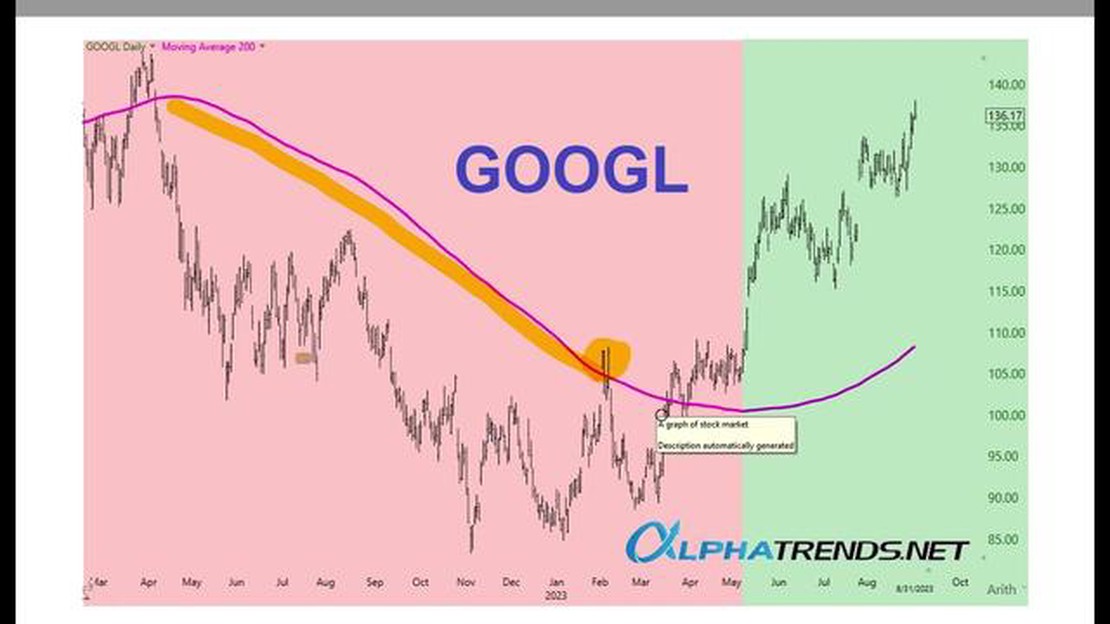

A moving average is a common technical indicator used in stock market analysis to smooth out price fluctuations and identify trends. Two commonly used moving averages are the 50-day moving average (MA50) and the 200-day moving average (MA200). When the MA50 crosses above the MA200, it is considered a bullish signal and can have several benefits for traders and investors.

Firstly, the crossing of the MA50 above the MA200 is often seen as a confirmation of an upward trend. This can provide traders with a strong buy signal, indicating that the stock price is likely to continue rising. It helps traders to confirm their analysis and make more informed decisions, increasing their chances of making profitable trades.

Secondly, the MA50 crossing above the MA200 can help to identify potential entry and exit points. When the MA50 crosses above the MA200, traders may interpret this as a signal to enter a long position or to add to an existing position. Conversely, when the MA50 crosses below the MA200, it may be seen as a signal to exit a long position or to consider shorting the stock.

Lastly, the MA50 crossing above the MA200 can act as a psychological support level for the stock price. This crossing can attract more buyers into the market, leading to increased demand and potentially driving the stock price higher. It can also provide support during pullbacks, as traders may see the MA50 as a key indicator of potential buying opportunities.

In conclusion, the crossing of the 50-day moving average above the 200-day moving average can provide several benefits for traders and investors. It can confirm an upward trend, help identify entry and exit points, and act as a psychological support level. However, it’s worth noting that no indicator or strategy is foolproof, and traders should always consider multiple factors before making trading decisions.

When a stock’s 50-day moving average crosses above its 200-day moving average, it can signal a bullish trend reversal and provide several advantages for investors.

Firstly, this technical indicator helps investors identify potential buying opportunities. When the shorter-term moving average crosses above the longer-term moving average, it suggests that the stock’s price has gained momentum and is likely to continue rising. This can be a signal for investors to enter or add to their positions, as they anticipate further price appreciation.

Secondly, the 50-day moving average crossing above the 200-day moving average confirms the start of a bullish trend. This can be particularly useful for trend-following traders who aim to ride the upward momentum and generate profits. By entering a long position when this event occurs, traders can align themselves with the prevailing trend and increase their chances of success.

Thirdly, the 50-day moving average crossing above the 200-day moving average can also provide support and act as a dynamic level of resistance. As the stock’s price continues to rise, the 50-day moving average can serve as a support level, preventing the price from falling further. This gives investors an additional level of comfort, knowing that there is a technical level supporting their investment.

Lastly, this event can attract the attention of other market participants, including institutional investors and analysts. When a stock’s moving averages cross, it often generates buzz and increases interest in the company. This can lead to increased trading volume and liquidity, providing investors with more opportunities to buy or sell shares at favorable prices.

In conclusion, the crossing of a stock’s 50-day moving average above its 200-day moving average offers several advantages for investors. It can indicate potential buying opportunities, confirm the start of a bullish trend, provide support and resistance levels, and attract market participants’ attention. By understanding and leveraging this technical indicator, investors can enhance their trading strategies and maximize potential returns.

Read Also: Discover the Optimal Time to Trade Currency Futures and Maximize Your Profits

The 50-day moving average crossing above the 200-day moving average can enhance trend identification in financial markets. This technical analysis tool helps traders and investors identify the direction of the prevailing trend.

By calculating the average price of an asset over a specific time period, the moving average smooths out short-term fluctuations and provides a clearer view of the long-term trend. The 50-day moving average and the 200-day moving average are commonly used timeframes for this purpose.

Read Also: Forex Broker Guide: How to Use a Forex Broker for Successful Trading

When the 50-day moving average crosses above the 200-day moving average, it generates a bullish signal. This indicates that the short-term trend is becoming stronger and may lead to a potential uptrend. Traders often interpret this crossover as a buy signal, as it suggests a higher probability of continued price appreciation.

On the other hand, when the 50-day moving average crosses below the 200-day moving average, it generates a bearish signal. This indicates that the short-term trend is weakening and may lead to a potential downtrend. Traders may interpret this crossover as a sell signal, as it suggests a higher probability of continued price depreciation.

By using the 50-day moving average crossing above the 200-day moving average as a trend identification tool, traders and investors can make more informed decisions. It can help them avoid entering trades against the prevailing trend and increase their chances of profitable trading opportunities.

However, it is important to note that moving averages are lagging indicators, which means they might not always capture short-term changes or reversals in the trend. It is recommended to use additional technical analysis tools and indicators to confirm signals provided by the moving average crossover.

A moving average crossing above another moving average occurs when the shorter-term moving average line moves above the longer-term moving average line in a chart. It is a bullish signal that indicates a potential upward trend in the price of a security.

The 50-day moving average crossing above the 200-day moving average is important because it is considered a strong bullish signal among technical traders. It suggests that the shorter-term trend is becoming more positive and could indicate a potential long-term upward trend in the price of a security.

The crossing of moving averages helps in making investment decisions by providing traders with a clear signal on the direction of the trend. When the 50-day moving average crosses above the 200-day moving average, it indicates that the shorter-term trend is becoming more positive, which can be a buying opportunity for traders looking to go long on a security.

Yes, there are risks and limitations associated with relying solely on moving average crossovers. Moving averages are lagging indicators and may not accurately reflect the current price action or trend. Additionally, false signals can occur, leading to potential losses if trades are executed solely based on moving average crossovers.

Yes, there are several other technical indicators that can be used in conjunction with moving average crossovers. Examples include the Relative Strength Index (RSI), the Moving Average Convergence Divergence (MACD), and the Stochastic Oscillator. These indicators can provide additional confirmation or divergence signals when used alongside moving average crossovers.

A moving average is a commonly used statistical calculation that is used to analyze data and identify trends. It is calculated by adding up a set of data points over a specific time period and then dividing that sum by the number of data points in the set.

Understanding Forex Micro Accounts for Beginners In the world of foreign exchange trading, a Forex micro account has become increasingly popular among …

Read ArticleUnderstanding the Significance of FX Costs Foreign exchange costs, also known as FX costs, play a crucial role in international financial …

Read ArticleBest Way to Trade the Dow Jones: Tips and Strategies Trading the Dow Jones is an exciting and potentially profitable endeavor. However, it can also be …

Read ArticleUnderstanding the Capital Forex Market The global foreign exchange (forex) market, also known as the Capital Forex Market, is the most liquid and …

Read ArticleWill the Canadian Dollar Strengthen in 2023? The Canadian dollar, also known as the loonie, has been a topic of interest for many investors and …

Read ArticleIs IB broker safe? When it comes to online trading, one of the most important factors to consider is the safety of your funds and personal …

Read Article