Is 3D Systems Profitable? Exploring the Financial Performance of 3D Systems

Is 3D Systems profitable? 3D Systems is a leading company in the field of additive manufacturing, also known as 3D printing. With its innovative …

Read Article

Options trading can be a lucrative and exciting way to invest in the financial markets. It offers the potential for high returns while minimizing risk. This article will explore the benefits and risks of options trading, helping you decide whether it’s the right investment strategy for you.

Options are financial derivatives that give the holder the right, but not the obligation, to buy or sell an underlying asset at a predetermined price within a specified time period. Unlike traditional trading, where you buy or sell an asset directly, options trading allows you to profit from price movements without owning the asset itself.

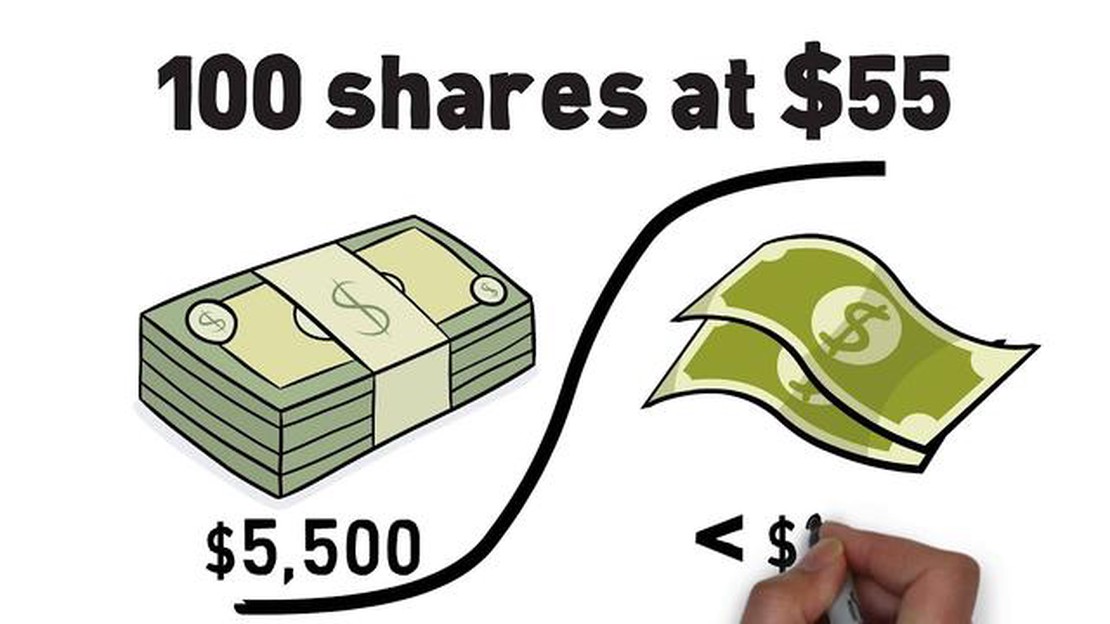

One of the key benefits of options trading is leverage. With options, you can control a large amount of the underlying asset with a relatively small investment. This means that even a small change in the price of the asset can result in a significant profit.

Another advantage of options trading is the ability to hedge your positions. By using options contracts, you can protect yourself against potential losses in your other investments. This can provide a level of security and peace of mind, especially during volatile market conditions.

When it comes to investing, there are various approaches you can take. Two popular options are options trading and traditional trading. Both methods offer potential benefits as well as risks for investors.

Ultimately, the decision between options trading and traditional trading depends on an individual’s risk tolerance, investment goals, and understanding of the market. It is important to thoroughly research and educate yourself before engaging in any type of trading activity.

Options trading is a financial strategy that involves the buying and selling of contracts that provide the right, but not the obligation, to buy or sell an underlying asset at a predetermined price within a certain time period. This type of trading can be highly complex and is typically used by experienced investors who are seeking to hedge their positions or speculate on future price movements.

Read Also: Visa Currency Conversion Fee: Everything You Need to Know

One of the key advantages of options trading is the potential for leverage. With options, investors can control a large amount of underlying assets with a relatively small investment. This allows for the potential to earn significant profits if the price of the underlying asset moves in the desired direction. However, it is important to note that leverage also increases the potential for losses, as options trading can be high-risk.

Options trading also offers flexibility and versatility. There are various types of options contracts available, including call options and put options, which allow investors to profit from both rising and falling markets. Additionally, options can be used for a variety of trading strategies, including hedging and income generation.

However, it is crucial for investors to understand the risks associated with options trading. Options contracts have expiration dates, and if the price of the underlying asset does not move in the desired direction within the specified time period, the option may expire worthless, resulting in a loss for the investor. Furthermore, options trading involves the payment of premiums, which can represent a significant cost for investors.

To be successful in options trading, it is important for investors to have a solid understanding of the market, as well as a clear trading plan. It is also advisable to consult with a financial advisor or seek professional guidance before engaging in options trading, as it requires a certain level of knowledge and expertise.

In conclusion, options trading can offer several benefits, including leverage, flexibility, and versatility. However, it also carries certain risks and requires careful consideration and planning. By understanding the basics of options trading and seeking professional advice, investors can potentially capitalize on opportunities while managing risk effectively.

Options trading is a type of investment strategy where investors buy or sell contracts that give them the right, but not the obligation, to buy or sell an asset at a predetermined price within a specific time period.

Read Also: Indian Currency Symbol in Forex: Explained and Analyzed

Options trading offers several benefits, including potential higher returns, leverage, flexibility, and risk management. It allows investors to profit from both bullish and bearish market conditions, and offers the ability to control a larger amount of stock for a smaller investment.

Options trading involves risks such as the potential loss of the entire investment, volatility, time decay, and the complexity of options strategies. It requires a good understanding of the market and the underlying asset, and can result in significant losses if not done properly.

Options trading and stock trading are two different investment strategies with their own advantages and disadvantages. Options trading offers the potential for higher returns and flexibility, but also carries more risks and complexity compared to traditional stock trading.

Options trading can be complex and risky, so it is generally not recommended for beginners. It requires a good understanding of the market, the risks involved, and the various options strategies. Beginners should first gain experience and knowledge in simpler investment strategies before venturing into options trading.

Options are financial contracts that give traders the right, but not the obligation, to buy or sell an asset at a predetermined price within a specific time period. In options trading, traders can speculate on the price movement of an underlying asset without actually owning it.

Is 3D Systems profitable? 3D Systems is a leading company in the field of additive manufacturing, also known as 3D printing. With its innovative …

Read ArticleThe Nickname for EURUSD: What Is It? The foreign exchange market, or Forex, is the largest and most liquid financial market in the world. Traders from …

Read ArticleWhat is the Currency Strength of a Trade System? When it comes to trading in the global financial markets, currency strength plays a vital role in …

Read ArticleUnderstanding the Key Intermarket Relationships In the world of finance, understanding the relationships between different markets is crucial for …

Read ArticleCapital Gains Tax Rate in Spain 2023 Capital gains tax is an important aspect of any country’s tax system. It is a tax imposed on the profits earned …

Read ArticleHow many shares can you buy with options? Options trading can be an exciting and potentially lucrative investment strategy. It allows traders to …

Read Article